Investor Presentation

1

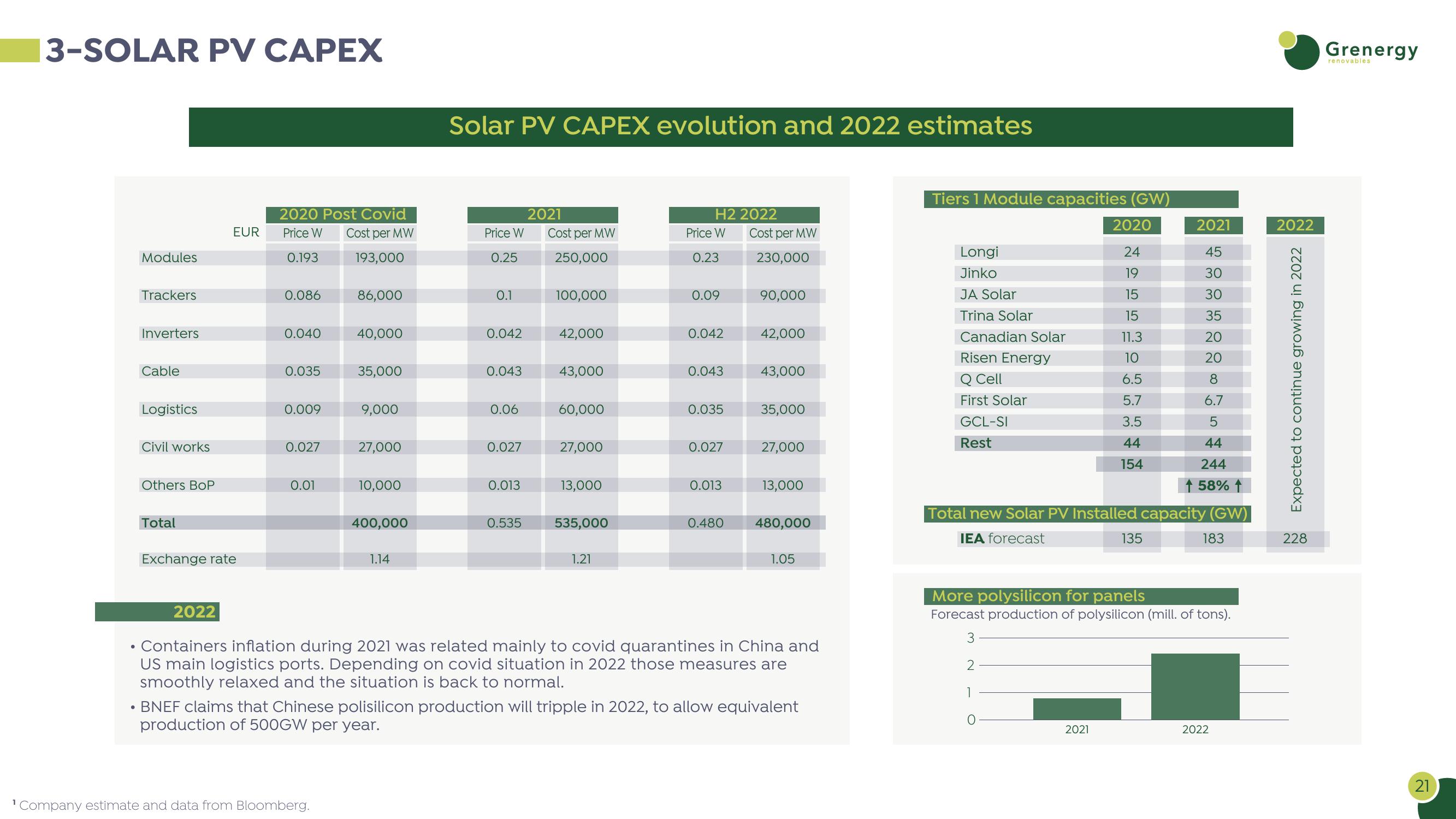

3-SOLAR PV CAPEX

Solar PV CAPEX evolution and 2022 estimates

Tiers 1 Module capacities (GW)

EUR

Modules

Trackers

2020 Post Covid

Price W

2021

Cost per MW

Price W

0.193

193,000

0.25

Cost per MW

250,000

H2 2022

Price W Cost per MW

0.23

2020

2021

2022

230,000

Longi

24

45

Jinko

19

30

0.086

86,000

0.1

100,000

0.09

90,000

JA Solar

15

30

Trina Solar

15

35

Inverters

0.040

40,000

0.042

42,000

0.042

42,000

Canadian Solar

11.3

20

Risen Energy

10

20

Cable

0.035

35,000

0.043

43,000

0.043

43,000

Q Cell

6.5

First Solar

5.7

Logistics

0.009

9,000

0.06

60,000

0.035

35,000

Civil works

0.027

27,000

0.027

27,000

0.027

27,000

GCL-SI

Rest

3.5

8 5

6.7

44

44

154

244

Others BoP

0.01

10,000

0.013

13,000

0.013

13,000

58% ↑

Total

400,000

0.535

535,000

0.480

480,000

Total new Solar PV Installed capacity (GW)

IEA forecast

Expected to continue growing in 2022

135

183

228

Exchange rate

1.14

1.21

1.05

•

2022

Containers inflation during 2021 was related mainly to covid quarantines in China and

US main logistics ports. Depending on covid situation in 2022 those measures are

smoothly relaxed and the situation is back to normal.

⚫ BNEF claims that Chinese polisilicon production will tripple in 2022, to allow equivalent

production of 500GW per year.

More polysilicon for panels

Forecast production of polysilicon (mill. of tons).

3

2

1

0

2021

2022

Company estimate and data from Bloomberg.

Grenergy

renovables

21View entire presentation