SoftBank Results Presentation Deck

LTV Calculation:

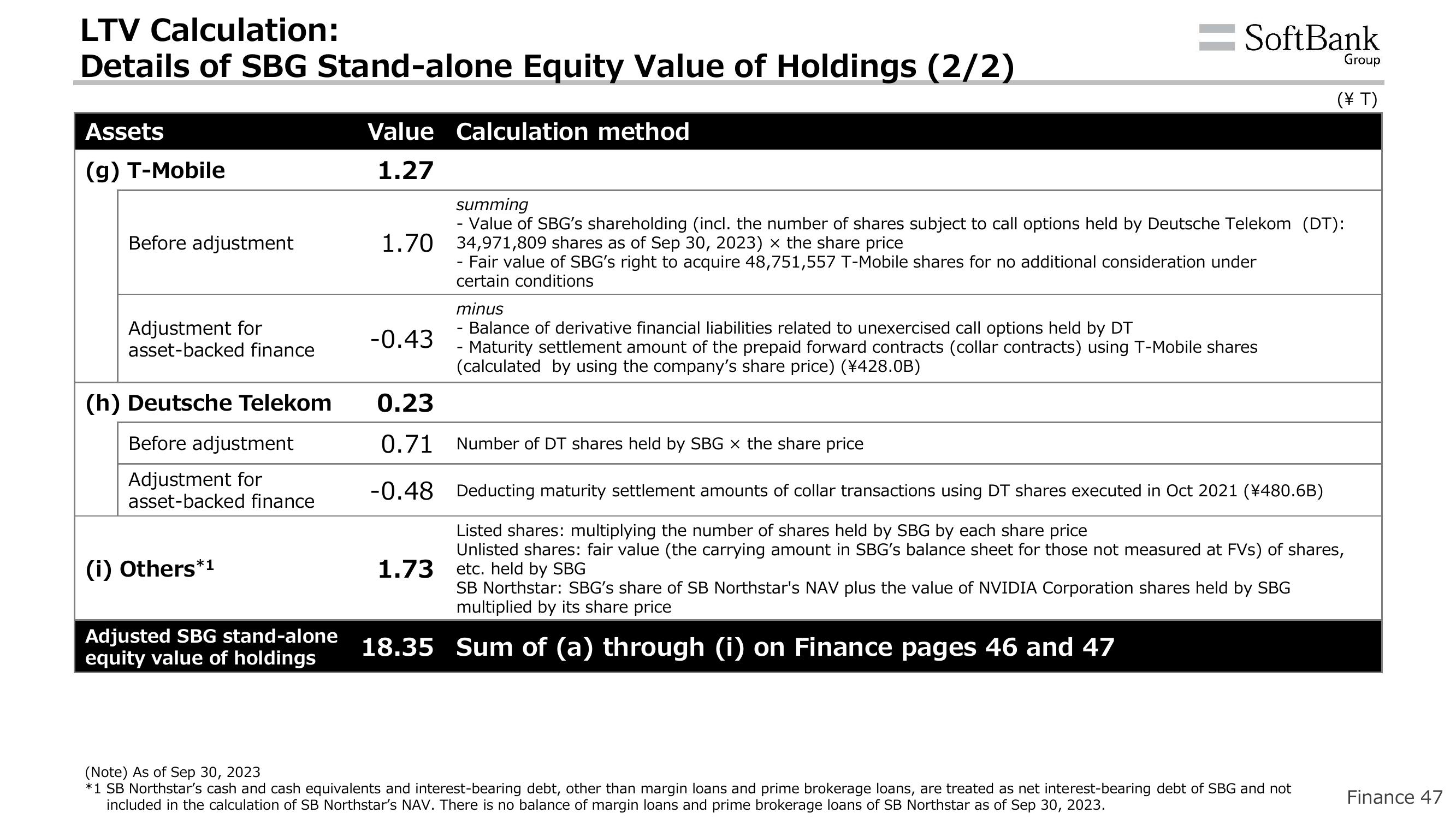

Details of SBG Stand-alone Equity Value of Holdings (2/2)

Assets

(g) T-Mobile

Before adjustment

Adjustment for

asset-backed finance

(h) Deutsche Telekom

Before adjustment

Adjustment for

asset-backed finance

(i) Others*1

Adjusted SBG stand-alone

equity value of holdings

Value Calculation method

1.27

-0.43

0.23

0.71

-0.48

summing

- Value of SBG's shareholding (incl. the number of shares subject to call options held by Deutsche Telekom (DT):

1.70 34,971,809 shares as of Sep 30, 2023) × the share price

- Fair value of SBG's right to acquire 48,751,557 T-Mobile shares for no additional consideration under

certain conditions

minus

- Balance of derivative financial liabilities related to unexercised call options held by DT

- Maturity settlement amount of the prepaid forward contracts (collar contracts) using T-Mobile shares

(calculated by using the company's share price) (¥428.0B)

1.73

SoftBank

18.35 Sum of (a) through (i) on Finance pages 46 and 47

Number of DT shares held by SBG x the share price

Deducting maturity settlement amounts of collar transactions using DT shares executed in Oct 2021 (¥480.6B)

Listed shares: multiplying the number of shares held by SBG by each share price

Unlisted shares: fair value (the carrying amount in SBG's balance sheet for those not measured at FVs) of shares,

etc. held by SBG

SB Northstar: SBG's share of SB Northstar's NAV plus the value of NVIDIA Corporation shares held by SBG

multiplied by its share price

Group

(¥ T)

(Note) As of Sep 30, 2023

*1 SB Northstar's cash and cash equivalents and interest-bearing debt, other than margin loans and prime brokerage loans, are treated as net interest-bearing debt of SBG and not

included in the calculation of SB Northstar's NAV. There is no balance of margin loans and prime brokerage loans of SB Northstar as of Sep 30, 2023.

Finance 47View entire presentation