J.P.Morgan 4Q23 Earnings Results

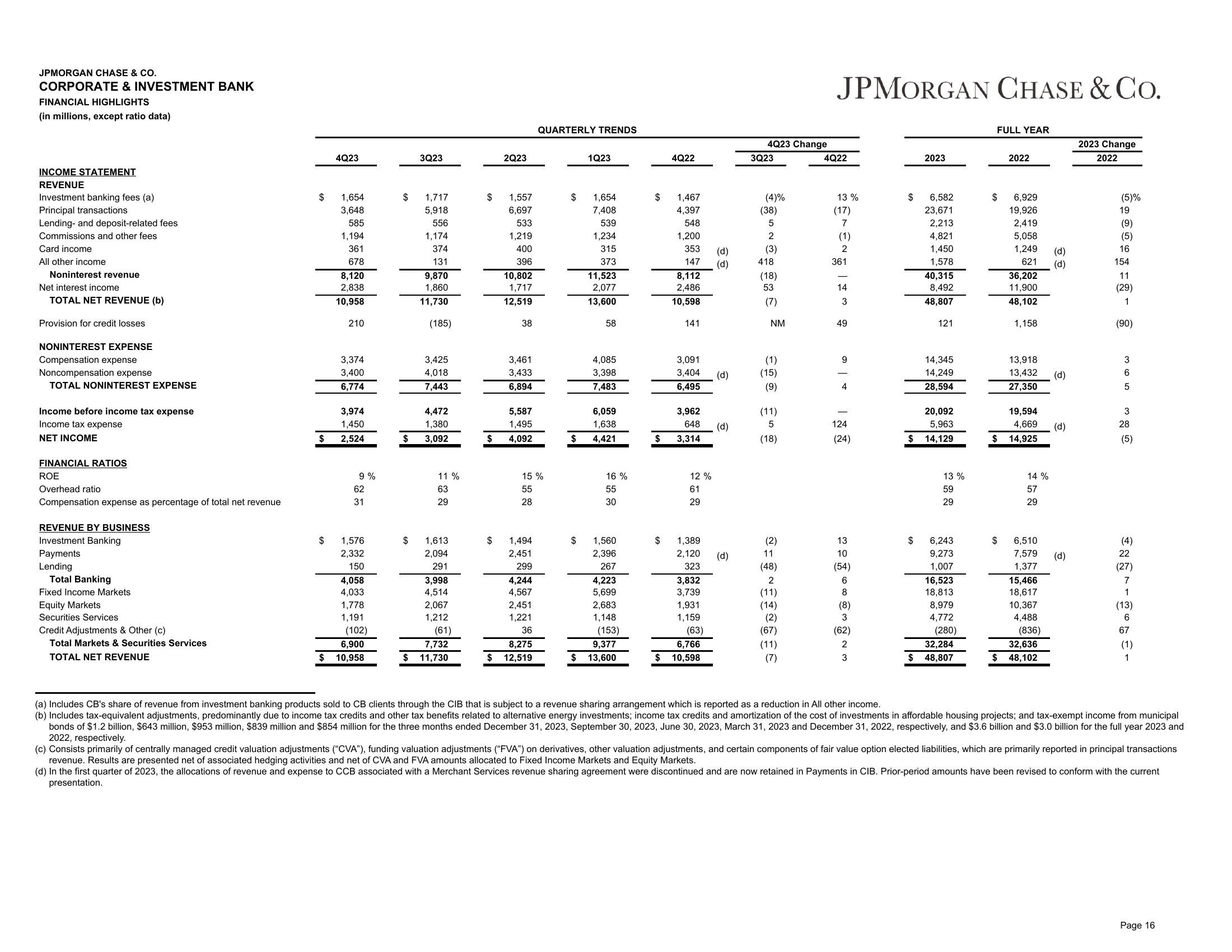

JPMORGAN CHASE & CO.

CORPORATE & INVESTMENT BANK

FINANCIAL HIGHLIGHTS

(in millions, except ratio data)

INCOME STATEMENT

REVENUE

Investment banking fees (a)

Principal transactions

Lending- and deposit-related fees

Commissions and other fees

Card income

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE (b)

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense

NET INCOME

FINANCIAL RATIOS

ROE

Overhead ratio

Compensation expense as percentage of total net revenue

REVENUE BY BUSINESS

Investment Banking

Payments

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services

Credit Adjustments & Other (c)

Total Markets & Securities Services

TOTAL NET REVENUE

$

$

$

4Q23

1,654

3,648

585

1,194

361

678

8,120

2,838

10,958

210

3,374

3,400

6,774

3,974

1,450

2,524

9%

62

31

1,576

2,332

150

4,058

4,033

1,778

1,191

(102)

6,900

10,958

$

3Q23

$

1,717

5,918

556

1,174

374

131

9,870

1,860

11,730

(185)

3,425

4,018

7,443

4,472

1,380

$ 3,092

11 %

63

29

1,613

2,094

291

3,998

4,514

2,067

1,212

(61)

7,732

$ 11,730

$

2Q23

$

1,557

6,697

533

1,219

400

396

10,802

1,717

12,519

38

3,461

3,433

6,894

5,587

1,495

$ 4,092

15 %

55

28

1,494

2,451

299

4,244

4,567

2,451

1,221

36

QUARTERLY TRENDS

8,275

$ 12,519

$

1Q23

$

1,654

7,408

539

1,234

315

373

11,523

2,077

13,600

58

4,085

3,398

7,483

6,059

1,638

$ 4,421

16 %

55

30

1,560

2,396

267

4,223

5,699

2,683

1,148

(153)

9,377

$ 13,600

$

4Q22

$

1,467

4,397

548

1,200

353

147

8,112

2,486

10,598

141

3,962

648

$ 3,314

3,091

3,404 (d)

6,495

12 %

61

29

1,389

2,120

323

3,832

3,739

1,931

1,159

(63)

(d)

(d)

6,766

$ 10,598

(d)

(d)

4Q23 Change

3Q23

(4)%

(38)

5

2

(3)

418

(18)

53

(7)

NM

(1)

(15)

(9)

(11)

5

(18)

(2)

11

(48)

2

(11)

(14)

(2)

(67)

(11)

(7)

JPMORGAN CHASE & CO.

4Q22

13%

(17)

7

(1)

2

361

WE |

14

3

49

。 | + |

9

4

124

(24)

13

10

(54)

6

8

(8)

3

(62)

2

3

$

$

2023

$

6,582

23,671

2,213

4,821

1,450

1,578

40,315

8,492

48,807

121

20,092

5,963

$ 14,129

14,345

14,249

28,594

13 %

59

29

6,243

9,273

1,007

16,523

18,813

8,979

4,772

(280)

32,284

48,807

FULL YEAR

$

$

2022

6,929

19,926

2,419

5,058

1,249

621

36,202

11,900

48,102

1,158

13,918

13,432 (d)

27,350

19,594

4,669

14,925

14%

57

29

6,510

7,579

1,377

15,466

18,617

10,367

4,488

(836)

(d)

(d)

32,636

$ 48,102

(d)

(d)

2023 Change

2022

(5)%

19

(9)

(5)

16

154

11

(29)

1

(90)

3

6

5

3

28

(5)

(4)

22

(27)

7

1

(13)

6

67

(1)

1

(a) Includes CB's share of revenue from investment banking products sold to CB clients through the CIB that is subject to a revenue sharing arrangement which is reported as a reduction in All other income.

(b) Includes tax-equivalent adjustments, predominantly due to income tax credits and other tax benefits related to alternative energy investments; income tax credits and amortization of the cost of investments in affordable housing projects; and tax-exempt income from municipal

bonds of $1.2 billion, $643 million, $953 million, $839 million and $854 million for the three months ended December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, respectively, and $3.6 billion and $3.0 billion for the full year 2023 and

2022, respectively.

(c) Consists primarily of centrally managed credit valuation adjustments ("CVA"), funding valuation adjustments ("FVA") on derivatives, other valuation adjustments, and certain components of fair value option elected liabilities, which are primarily reported in principal transactions

revenue. Results are presented net of associated hedging activities and net of CVA and FVA amounts allocated to Fixed Income Markets and Equity Markets.

(d) In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current

presentation.

Page 16View entire presentation