KKR Real Estate Finance Trust Investor Presentation Deck

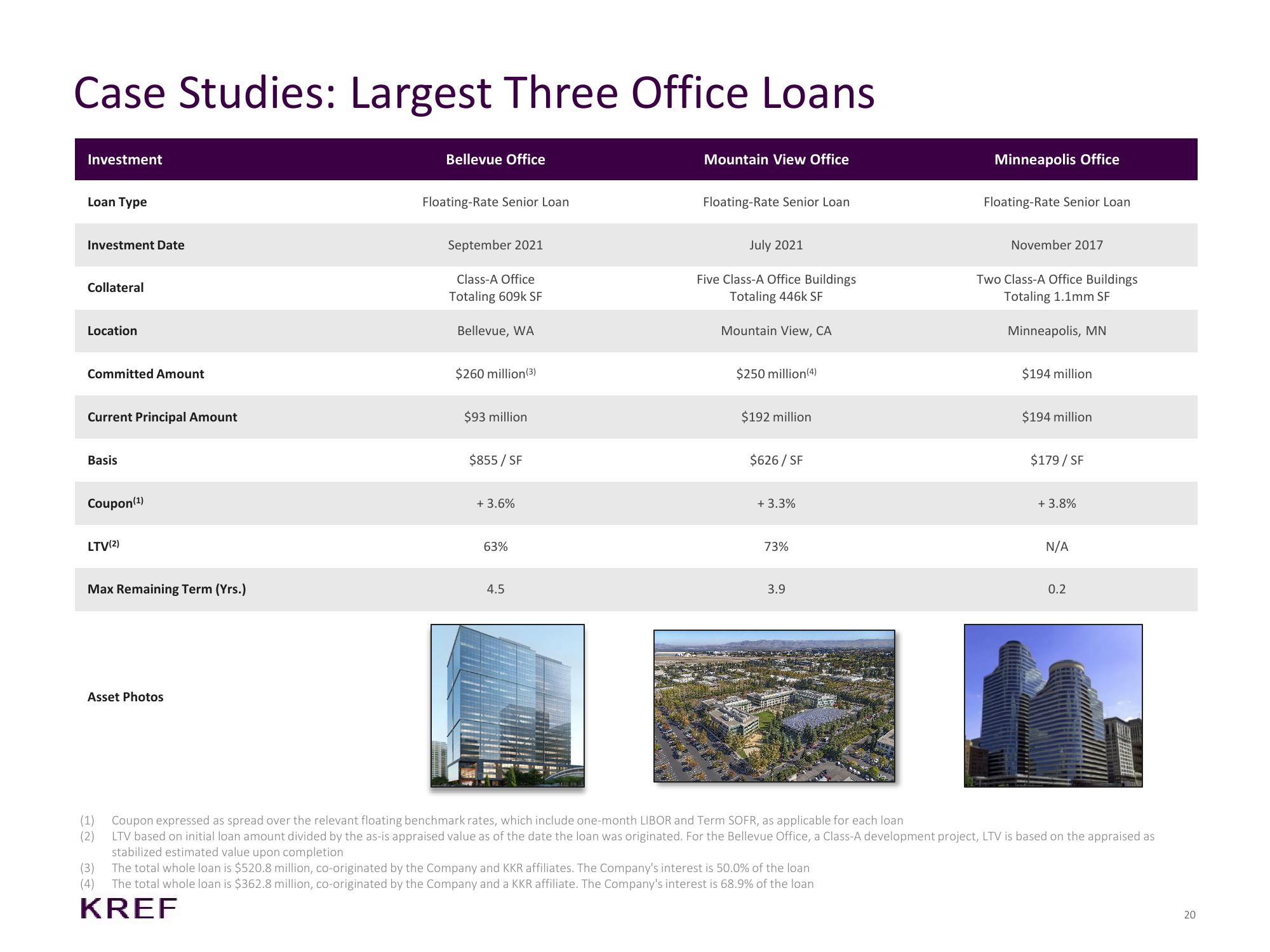

Case Studies: Largest Three Office Loans

Investment

Loan Type

Investment Date

Collateral

Location

Committed Amount

Current Principal Amount

Basis

Coupon (¹)

LTV(2)

Max Remaining Term (Yrs.)

Asset Photos

Bellevue Office

Floating-Rate Senior Loan

September 2021

Class-A Office

Totaling 609k SF

Bellevue, WA

$260 million (3)

$93 million

$855/SF

+ 3.6%

63%

4.5

Mountain View Office

Floating-Rate Senior Loan

July 2021

Five Class-A Office Buildings

Totaling 446k SF

Mountain View, CA

$250 million (4)

$192 million

$626/SF

+3.3%

73%

3.9

Minneapolis Office

(3)

The total whole loan is $520.8 million, co-originated by the Company and KKR affiliates. The Company's interest is 50.0% of the loan

(4) The total whole loan is $362.8 million, co-originated by the Company and a KKR affiliate. The Company's interest is 68.9% of the loan

KREF

Floating-Rate Senior Loan

November 2017

Two Class-A Office Buildings

Totaling 1.1mm SF

Minneapolis, MN

$194 million

$194 million

$179 / SF

+ 3.8%

N/A

0.2

(1) Coupon expressed as spread over the relevant floating benchmark rates, which include one-month LIBOR and Term SOFR, as applicable for each loan

(2)

LTV based on initial loan amount divided by the as-is appraised value as of the date the loan was originated. For the Bellevue Office, a Class-A development project, LTV is based on the appraised as

stabilized estimated value upon completion

20View entire presentation