WeWork SPAC Presentation Deck

Terms & Definitions (Cont'd)

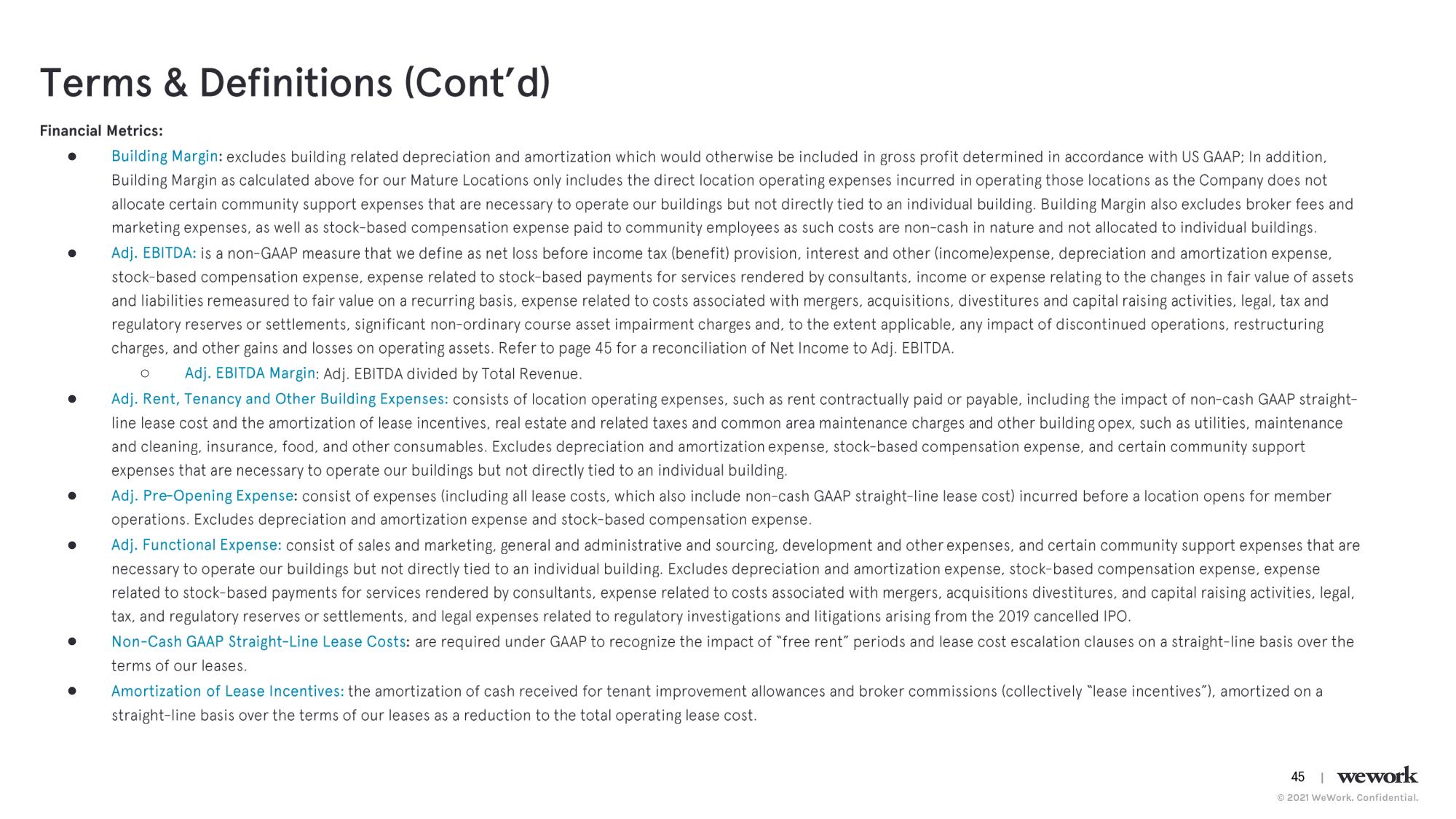

Financial Metrics:

Building Margin: excludes building related depreciation and amortization which would otherwise be included in gross profit determined in accordance with US GAAP; In addition,

Building Margin as calculated above for our Mature Locations only includes the direct location operating expenses incurred in operating those locations as the Company does not

allocate certain community support expenses that are necessary to operate our buildings but not directly tied to an individual building. Building Margin also excludes broker fees and

marketing expenses, as well as stock-based compensation expense paid to community employees as such costs are non-cash in nature and not allocated to individual buildings.

Adj. EBITDA: is a non-GAAP measure that we define as net loss before income tax (benefit) provision, interest and other (income)expense, depreciation and amortization expense,

stock-based compensation expense, expense related to stock-based payments for services rendered by consultants, income or expense relating to the changes in fair value of assets

and liabilities remeasured to fair value on a recurring basis, expense related to costs associated with mergers, acquisitions, divestitures and capital raising activities, legal, tax and

regulatory reserves or settlements, significant non-ordinary course asset impairment charges and, to the extent applicable, any impact of discontinued operations, restructuring

charges, and other gains and losses on operating assets. Refer to page 45 for a reconciliation of Net Income to Adj. EBITDA.

O Adj. EBITDA Margin: Adj. EBITDA divided by Total Revenue.

●

●

Adj. Rent, Tenancy and Other Building Expenses: consists of location operating expenses, such as rent contractually paid or payable, including the impact of non-cash GAAP straight-

line lease cost and the amortization of lease incentives, real estate and related taxes and common area maintenance charges and other building opex, such as utilities, maintenance

and cleaning, insurance, food, and other consumables. Excludes depreciation and amortization expense, stock-based compensation expense, and certain community support

expenses that are necessary to operate our buildings but not directly tied to an individual building.

Adj. Pre-Opening Expense: consist of expenses (including all lease costs, which also include non-cash GAAP straight-line lease cost) incurred before a location opens for member

operations. Excludes depreciation and amortization expense and stock-based compensation expense.

Adj. Functional Expense: consist of sales and marketing, general and administrative and sourcing, development and other expenses, and certain community support expenses that are

necessary to operate our buildings but not directly tied to an individual building. Excludes depreciation and amortization expense, stock-based compensation expense, expense

related to stock-based payments for services rendered by consultants, expense related to costs associated with mergers, acquisitions divestitures, and capital raising activities, legal,

tax, and regulatory reserves or settlements, and legal expenses related to regulatory investigations and litigations arising from the 2019 cancelled IPO.

Non-Cash GAAP Straight-Line Lease Costs: are required under GAAP to recognize the impact of "free rent" periods and lease cost escalation clauses on a straight-line basis over the

terms of our leases.

Amortization of Lease Incentives: the amortization of cash received for tenant improvement allowances and broker commissions (collectively "lease incentives"), amortized on a

straight-line basis over the terms of our leases as a reduction to the total operating lease cost.

45 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation