Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

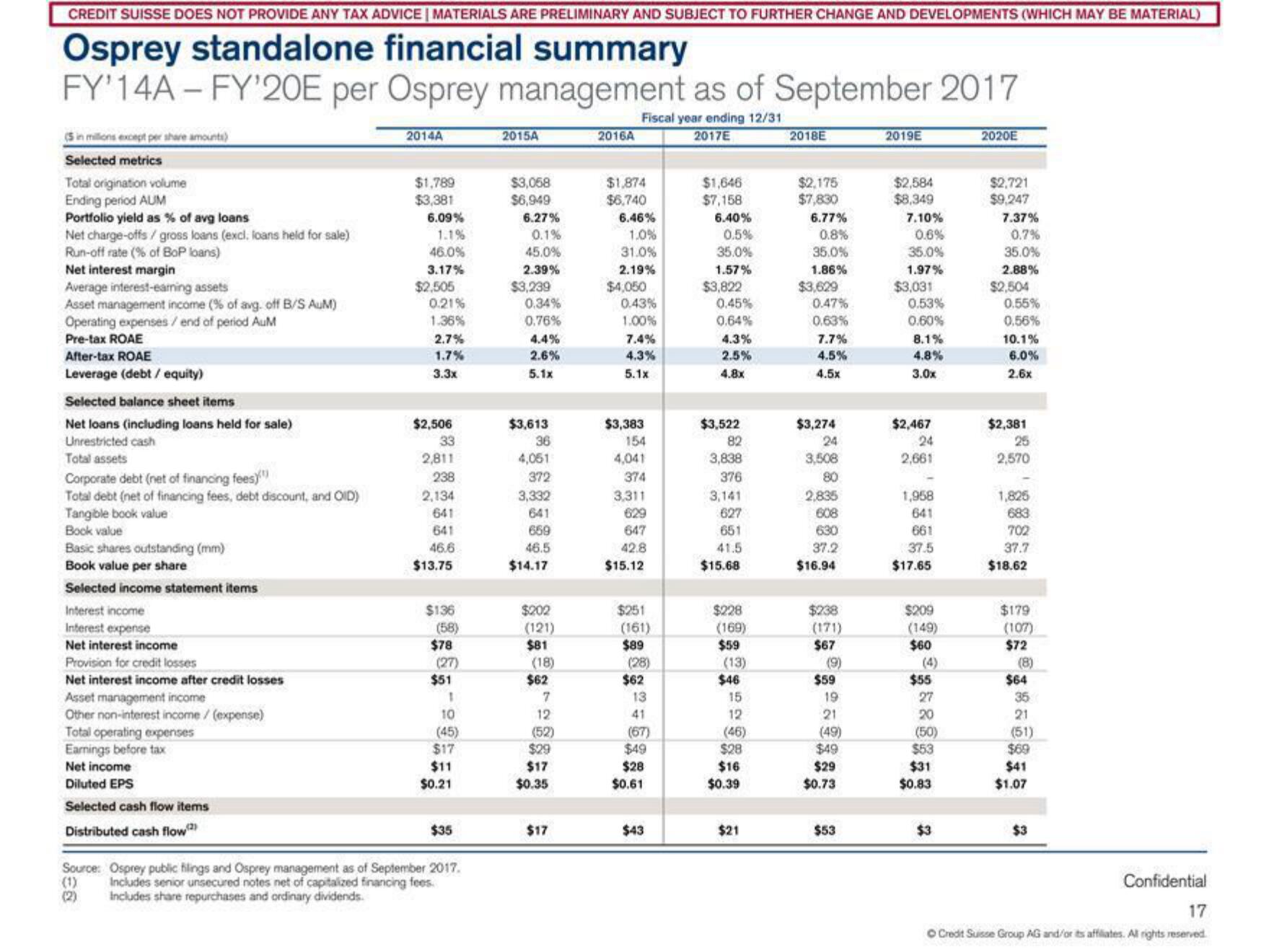

Osprey standalone financial summary

FY'14A-FY'20E per Osprey management as of September 2017

Fiscal year ending 12/31

2017E

(5 in millions except per share amounts)

Selected metrics

Total origination volume

Ending period AUM

Portfolio yield as % of avg loans

Net charge-offs / gross loans (excl. loans held for sale)

Run-off rate (% of BoP loans)

Net interest margin

Average interest-earning assets

Asset management income (% of avg. off B/S AUM)

Operating expenses/ end of period AuM

Pre-tax ROAE

After-tax ROAE

Leverage (debt / equity)

Selected balance sheet items

Net loans (including loans held for sale)

Unrestricted cash

Total assets

Corporate debt (net of financing fees)

Total debt (net of financing fees, debt discount, and OID)

Tangible book value

Book value

Basic shares outstanding (mm)

Book value per share

Selected income statement items

Interest income

Interest expense

Net interest income

Provision for credit losses

Net interest income after credit losses

Asset management income

Other non-interest income / (expense)

Total operating expenses

Earnings before tax

Net income

Diluted EPS

Selected cash flow items

Distributed cash flow)

2014A

$1,789

$3,381

6.09%

1.1%

46.0%

3.17%

$2,505

0.21%

1.36%

2.7%

1.7%

3.3x

$2,506

33

2,811

238

2,134

641

641

46.6

$13.75

$136

(58)

$78

(27)

$51

1

10

(45)

$17

$11

$0.21

$35

Source: Osprey public filings and Osprey management as of September 2017.

(1)

Includes senior unsecured notes net of capitalized financing fees.

Includes share repurchases and ordinary dividends.

(2)

2015A

$3,058

$6,949

6.27%

0.1%

45.0%

2.39%

$3,239

0.34%

0.76%

4.4%

2.6%

5.1x

$3,613

36

4,061

372

3,332

641

659

46.5

$14.17

$202

(121)

$81

(18)

$62

7

12

(52)

$29

$17

$0.35

$17

2016A

$1,874

$6,740

6.46%

1.0%

31.0%

2.19%

$4,050

0.43%

1.00%

7.4%

4.3%

5.1x

$3,383

154

4,041

374

3,311

629

647

42.8

$15.12

$251

(161)

$89

(28)

$62

13

41

(67)

$49

$28

$0.61

$43

$1,646

$7,158

6.40%

0.5%

35.0%

1.57%

$3,822

0.45%

0.64%

4.3%

2.5%

4.8x

$3,522

82

3,838

376

3,141

627

651

41.5

$15.68

$228

(169)

$59

(13)

$46

15

12

(46)

$28

$16

$0.39

$21

2018E

$2,175

$7,830

6.77%

0.8%

35.0%

1.86%

$3,629

0.47%

0.63%

7.7%

4.5%

4.5x

$3,274

24

3,508

80

2,835

608

630

37.2

$16.94

$238

(171)

$67

(9)

$59

19

21

(49)

$49

$29

$0.73

$53

2019E

$2,584

$8,349

7.10%

0.6%

35.0%

1.97%

$3,031

0.53%

0.60%

8.1%

4.8%

3.0x

$2,467

24

2,661

1,958

641

661

37.5

$17.65

$209

(149)

$60

$55

27

20

(50)

$53

$31

$0.83

$3

2020E

$2,721

$9,247

7.37%

0.7%

35.0%

2.88%

$2,504

0.55%

0.56%

10.1%

6.0%

2.6x

$2,381

25

2,570

1,825

683

702

37.7

$18.62

$179

(107)

$72

(8)

$64

35

21

(51)

$69

$41

$1.07

$3

Confidential

17

● Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation