Summer 2023 Solar Industry Update

Advanced Energy Project Credit (48C) Newest Guidance

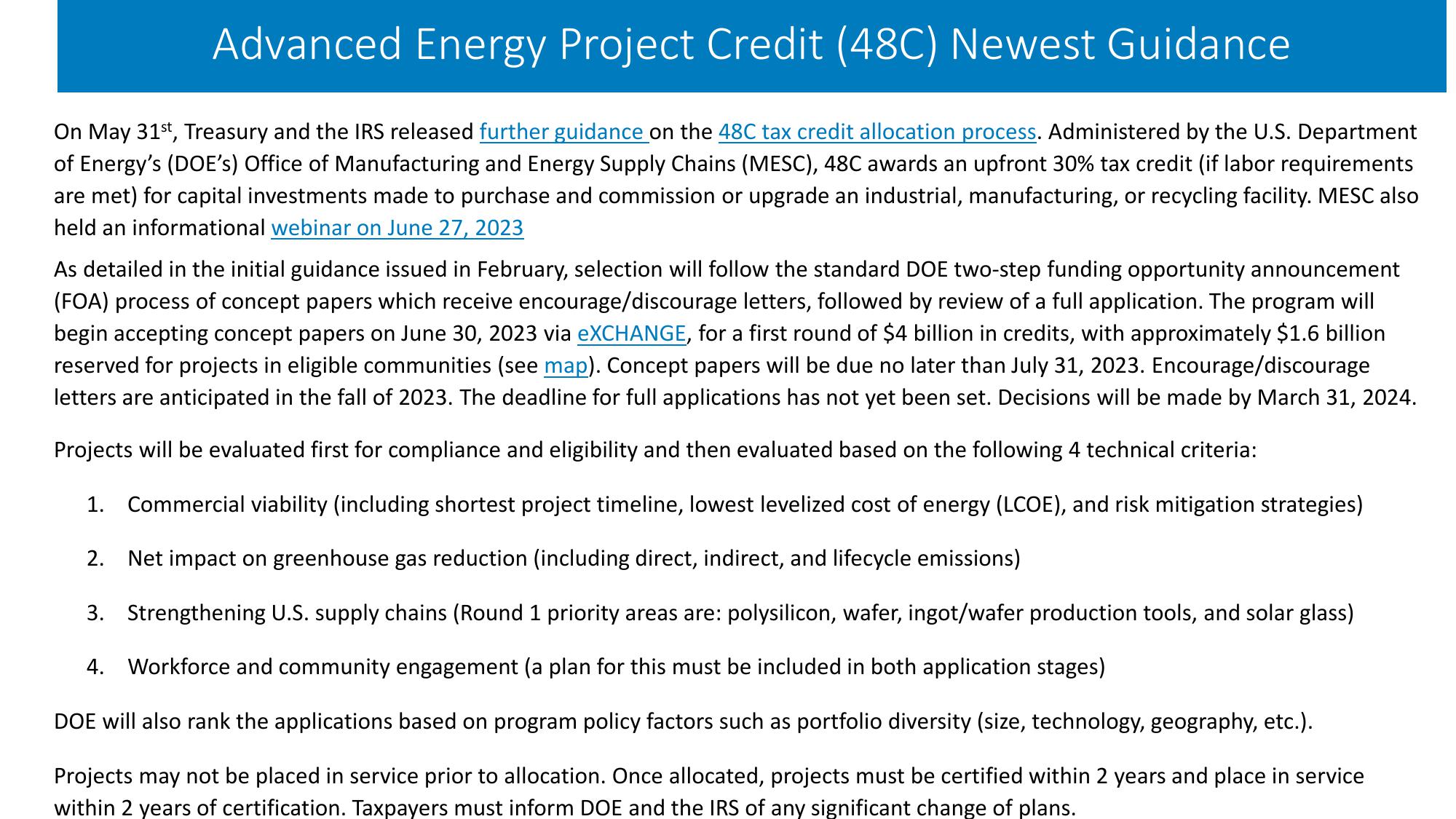

On May 31st, Treasury and the IRS released further guidance on the 48C tax credit allocation process. Administered by the U.S. Department

of Energy's (DOE's) Office of Manufacturing and Energy Supply Chains (MESC), 48C awards an upfront 30% tax credit (if labor requirements

are met) for capital investments made to purchase and commission or upgrade an industrial, manufacturing, or recycling facility. MESC also

held an informational webinar on June 27, 2023

As detailed in the initial guidance issued in February, selection will follow the standard DOE two-step funding opportunity announcement

(FOA) process of concept papers which receive encourage/discourage letters, followed by review of a full application. The program will

begin accepting concept papers on June 30, 2023 via eXCHANGE, for a first round of $4 billion in credits, with approximately $1.6 billion

reserved for projects in eligible communities (see map). Concept papers will be due no later than July 31, 2023. Encourage/discourage

letters are anticipated in the fall of 2023. The deadline for full applications has not yet been set. Decisions will be made by March 31, 2024.

Projects will be evaluated first for compliance and eligibility and then evaluated based on the following 4 technical criteria:

1. Commercial viability (including shortest project timeline, lowest levelized cost of energy (LCOE), and risk mitigation strategies)

2. Net impact on greenhouse gas reduction (including direct, indirect, and lifecycle emissions)

3. Strengthening U.S. supply chains (Round 1 priority areas are: polysilicon, wafer, ingot/wafer production tools, and solar glass)

4. Workforce and community engagement (a plan for this must be included in both application stages)

DOE will also rank the applications based on program policy factors such as portfolio diversity (size, technology, geography, etc.).

Projects may not be placed in service prior to allocation. Once allocated, projects must be certified within 2 years and place in service

within 2 years of certification. Taxpayers must inform DOE and the IRS of any significant change of plans.View entire presentation