Bridge Investment Group Results Presentation Deck

ΤΗ

4

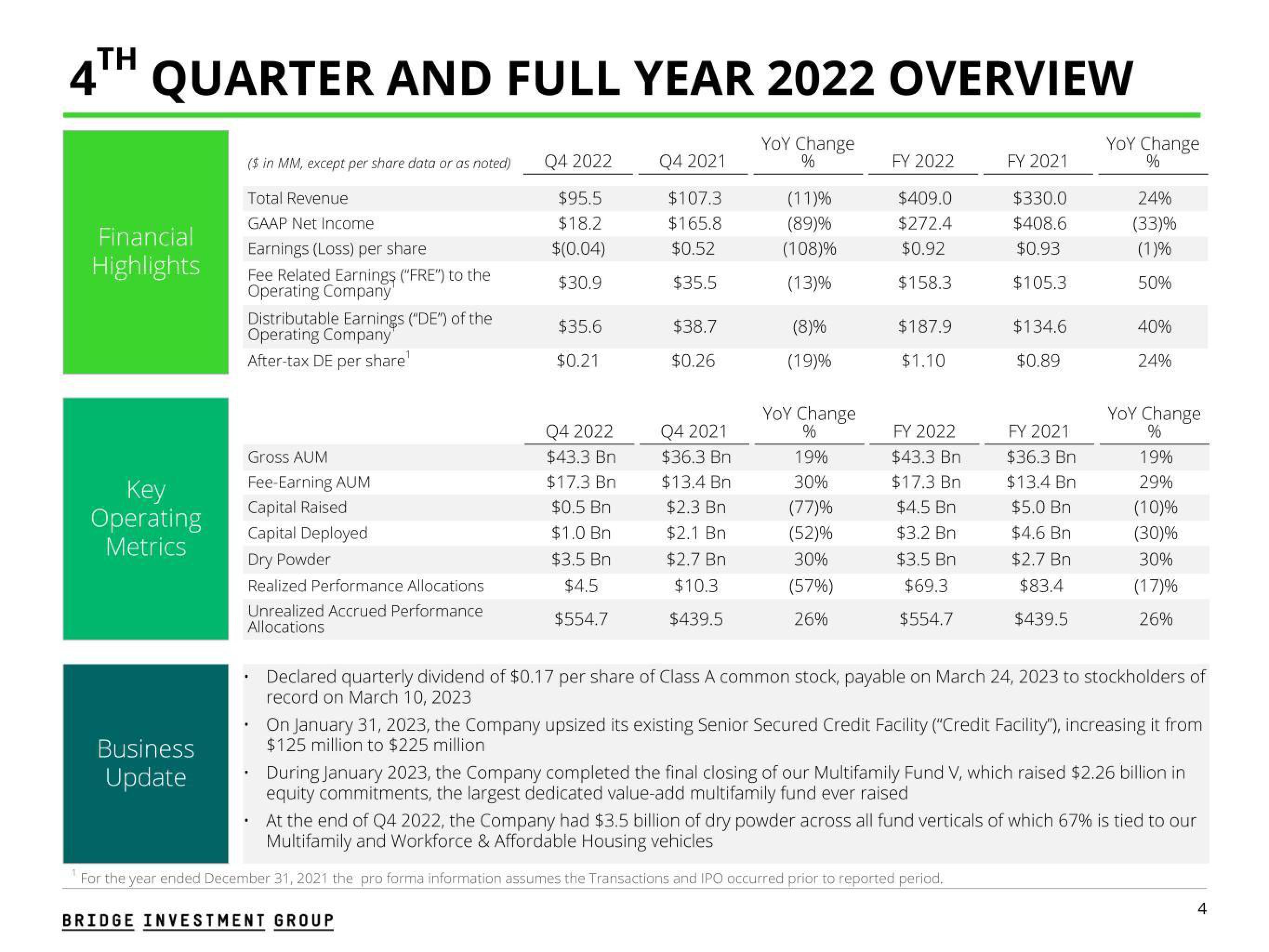

QUARTER AND FULL YEAR 2022 OVERVIEW

YOY Change

%

Financial

Highlights

Key

Operating

Metrics

Business

Update

($ in MM, except per share data or as noted)

Total Revenue

GAAP Net Income

Earnings (Loss) per share

Fee Related Earnings ("FRE") to the

Operating Company'

Distributable Earnings ("DE") of the

Operating Company"

After-tax DE per share¹

Gross AUM

Fee-Earning AUM

Capital Raised

Capital Deployed

Dry Powder

Realized Performance Allocations

Unrealized Accrued Performance

Allocations

.

Q4 2022

$95.5

$18.2

$(0.04)

$30.9

$35.6

$0.21

Q4 2022

$43.3 Bn

$17.3 Bn

$0.5 Bn

$1.0 Bn

$3.5 Bn

$4.5

$554.7

Q4 2021

$107.3

$165.8

$0.52

$35.5

$38.7

$0.26

BRIDGE INVESTMENT GROUP

Q4 2021

$36.3 Bn

$13.4 Bn

$2.3 Bn

$2.1 Bn

$2.7 Bn

$10.3

$439.5

(11)%

(89)%

(108)%

(13)%

(8)%

(19)%

YOY Change

%

19%

30%

(77)%

(52)%

30%

(57%)

26%

FY 2022

$409.0

$272.4

$0.92

$158.3

$187.9

$1.10

FY 2022

$43.3 Bn

$17.3 Bn

$4.5 Bn

$3.2 Bn

$3.5 Bn

$69.3

$554.7

FY 2021

$330.0

$408.6

$0.93

$105.3

$134.6

$0.89

FY 2021

$36.3 Bn

$13.4 Bn

$5.0 Bn

$4.6 Bn

$2.7 Bn

$83.4

$439.5

For the year ended December 31, 2021 the pro forma information assumes the Transactions and IPO occurred prior to reported period.

YOY Change

%

24%

(33)%

(1)%

50%

40%

24%

Declared quarterly dividend of $0.17 per share of Class A common stock, payable on March 24, 2023 to stockholders of

record on March 10, 2023

YOY Change

%

19%

29%

(10)%

(30)%

30%

(17)%

26%

On January 31, 2023, the Company upsized its existing Senior Secured Credit Facility ("Credit Facility"), increasing it from

$125 million to $225 million

During January 2023, the Company completed the final closing of our Multifamily Fund V, which raised $2.26 billion in

equity commitments, the largest dedicated value-add multifamily fund ever raised

At the end of Q4 2022, the Company had $3.5 billion of dry powder across all fund verticals of which 67% is tied to our

Multifamily and Workforce & Affordable Housing vehicles

4View entire presentation