Tempo SPAC Presentation Deck

Detailed Transaction Overview

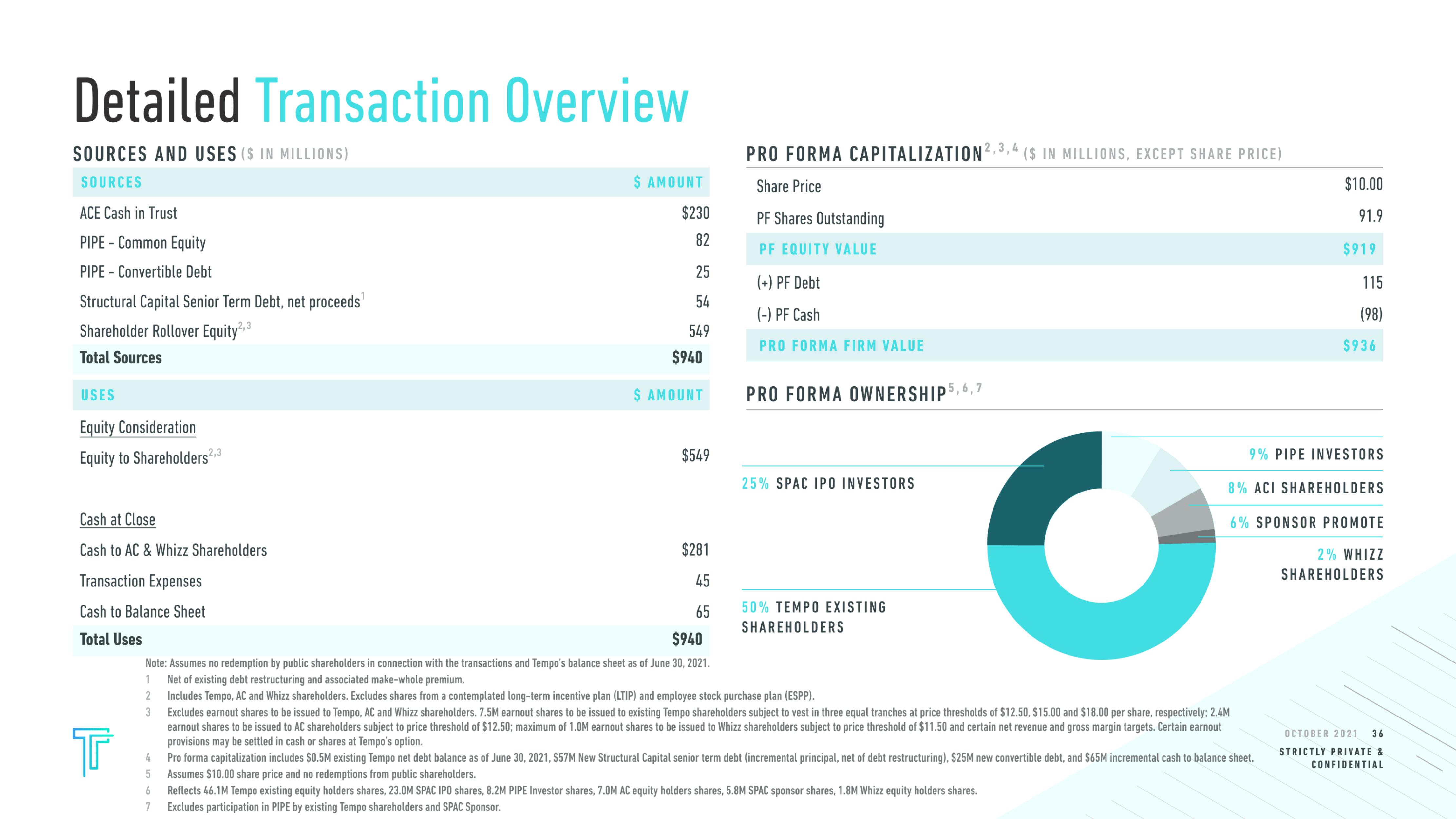

SOURCES AND USES ($ IN MILLIONS)

SOURCES

ACE Cash in Trust

PIPE-Common Equity

PIPE Convertible Debt

Structural Capital Senior Term Debt, net proceeds¹

Shareholder Rollover Equity2,3

Total Sources

USES

Equity Consideration

Equity to Shareholders2,3

Cash at Close

Cash to AC & Whizz Shareholders

Transaction Expenses

Cash to Balance Sheet

Total Uses

$ AMOUNT

$230

82

25

54

549

$940

$ AMOUNT

$549

$281

45

65

$940

Note: Assumes no redemption by public shareholders in connection with the transactions and Tempo's balance sheet as of June 30, 2021.

1 Net of existing debt restructuring and associated make-whole premium.

PRO FORMA CAPITALIZATION 2,3,4 ($ IN MILLIONS, EXCEPT SHARE PRICE)

Share Price

PF Shares Outstanding

PF EQUITY VALUE

(+) PF Debt

(-) PF Cash

PRO FORMA FIRM VALUE

PRO FORMA OWNERSHIP 5,6,7

25% SPAC IPO INVESTORS

50% TEMPO EXISTING

SHAREHOLDERS

•

6 Reflects 46.1M Tempo existing equity holders shares, 23.0M SPAC IPO shares, 8.2M PIPE Investor shares, 7.0M AC equity holders shares, 5.8M SPAC sponsor shares, 1.8M Whizz equity holders shares.

7

Excludes participation in PIPE by existing Tempo shareholders and SPAC Sponsor.

$10.00

91.9

2 Includes Tempo, AC and Whizz shareholders. Excludes shares from a contemplated long-term incentive plan (LTIP) and employee stock purchase plan (ESPP).

3

Excludes earnout shares to be issued to Tempo, AC and Whizz shareholders. 7.5M earnout shares to be issued to existing Tempo shareholders subject to vest in three equal tranches at price thresholds of $12.50, $15.00 and $18.00 per share, respectively; 2.4M

earnout shares to be issued to AC shareholders subject to price threshold of $12.50; maximum of 1.0M earnout shares to be issued to Whizz shareholders subject to price threshold of $11.50 and certain net revenue and gross margin targets. Certain earnout

provisions may be settled in cash or shares at Tempo's option.

4

Pro forma capitalization includes $0.5M existing Tempo net debt balance as of June 30, 2021, $57M New Structural Capital senior term debt (incremental principal, net of debt restructuring), $25M new convertible debt, and $65M incremental cash to balance sheet.

5 Assumes $10.00 share price and no redemptions from public shareholders.

$919

115

(98)

$936

9% PIPE INVESTORS

8% ACI SHAREHOLDERS

6% SPONSOR PROMOTE

2% WHIZZ

SHAREHOLDERS

OCTOBER 2021 36

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation