PropertyGuru SPAC Presentation Deck

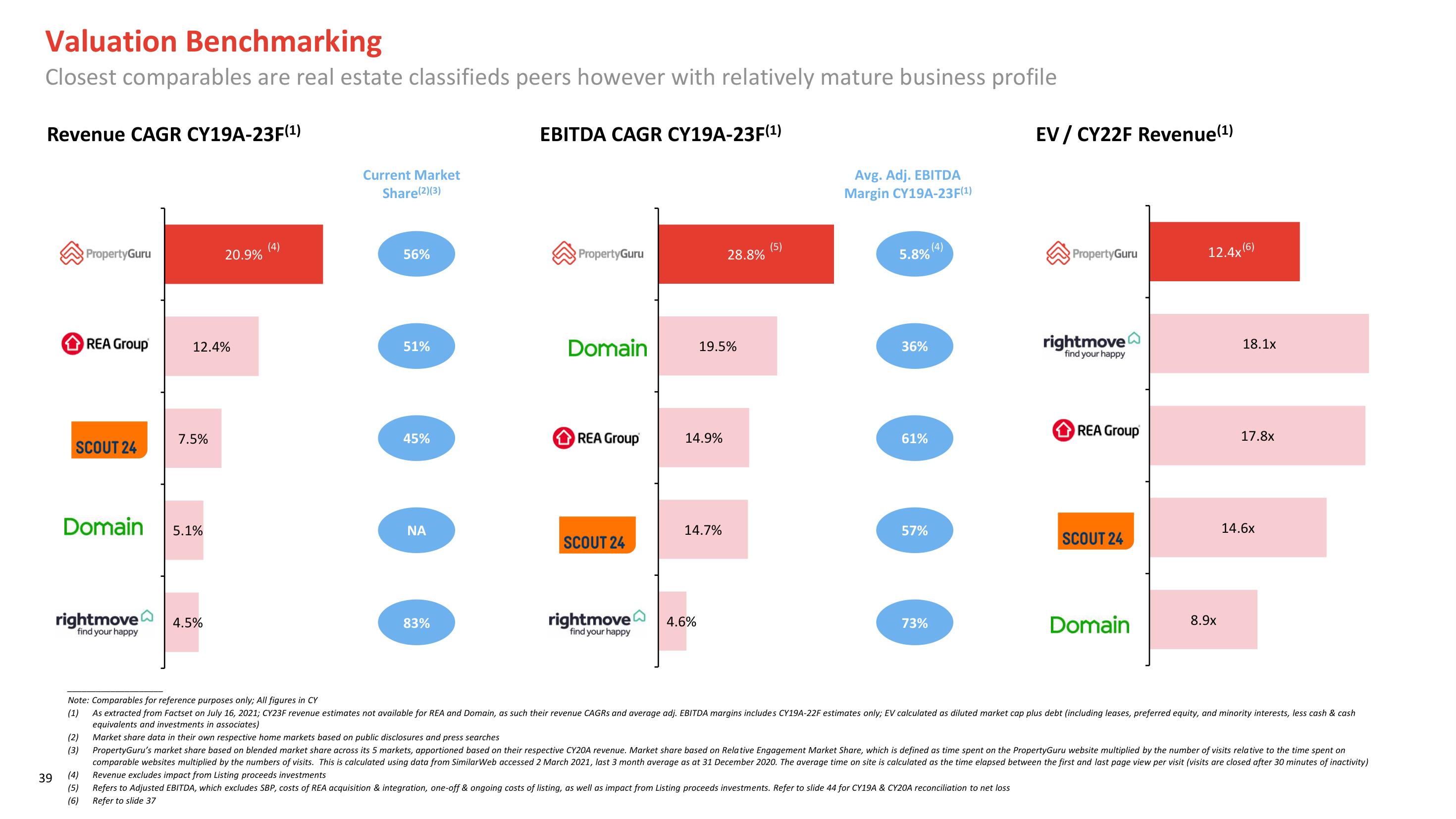

Valuation Benchmarking

Closest comparables are real estate classifieds peers however with relatively mature business profile

Revenue CAGR CY19A-23F(¹)

39

PropertyGuru

REA Group

SCOUT 24

rightmove

find your happy

(4)

(5)

(6)

Domain 5.1%

12.4%

7.5%

20.9%

4.5%

(4)

Current Market

Share(2)(3)

56%

51%

45%

ΝΑ

83%

EBITDA CAGR CY19A-23F(¹)

PropertyGuru

Domain

REA Group

SCOUT 24

rightmove

find your happy

14.9%

19.5%

14.7%

4.6%

28.8%

(5)

Avg. Adj. EBITDA

Margin CY19A-23F(¹)

5.8% (4)

36%

61%

57%

73%

EV / CY22F Revenue (¹)

PropertyGuru

rightmove

find your happy

REA Group

SCOUT 24

Domain

12.4x(6)

8.9x

18.1x

17.8x

14.6x

Note: Comparables for reference purposes only; All figures in CY

(1) As extracted from Factset on July 16, 2021; CY23F revenue estimates not available for REA and Domain, as such their revenue CAGRS and average adj. EBITDA margins includes CY19A-22F estimates only; EV calculated as diluted market cap plus debt (including leases, preferred equity, and minority interests, less cash & cash

equivalents and investments in associates)

(2) Market share data in their own respective home markets based on public disclosures and press searches

(3) PropertyGuru's market share based on blended market share across its 5 markets, apportioned based on their respective CY20A revenue. Market share based on Relative Engagement Market Share, which is defined as time spent on the PropertyGuru website multiplied by the number of visits relative to the time spent on

comparable websites multiplied by the numbers of visits. This is calculated using data from SimilarWeb accessed 2 March 2021, last 3 month average as at 31 December 2020. The average time on site is calculated as the time elapsed between the first and last page view per visit (visits are closed after 30 minutes of inactivity)

Revenue excludes impact from Listing proceeds investments

Refers to Adjusted EBITDA, which excludes SBP, costs of REA acquisition & integration, one-off & ongoing costs of listing, as well as impact from Listing proceeds investments. Refer to slide 44 for CY19A & CY20A reconciliation to net loss

Refer to slide 37View entire presentation