Sezzle Results Presentation Deck

YEAR-OVER-YEAR PROGRESSION

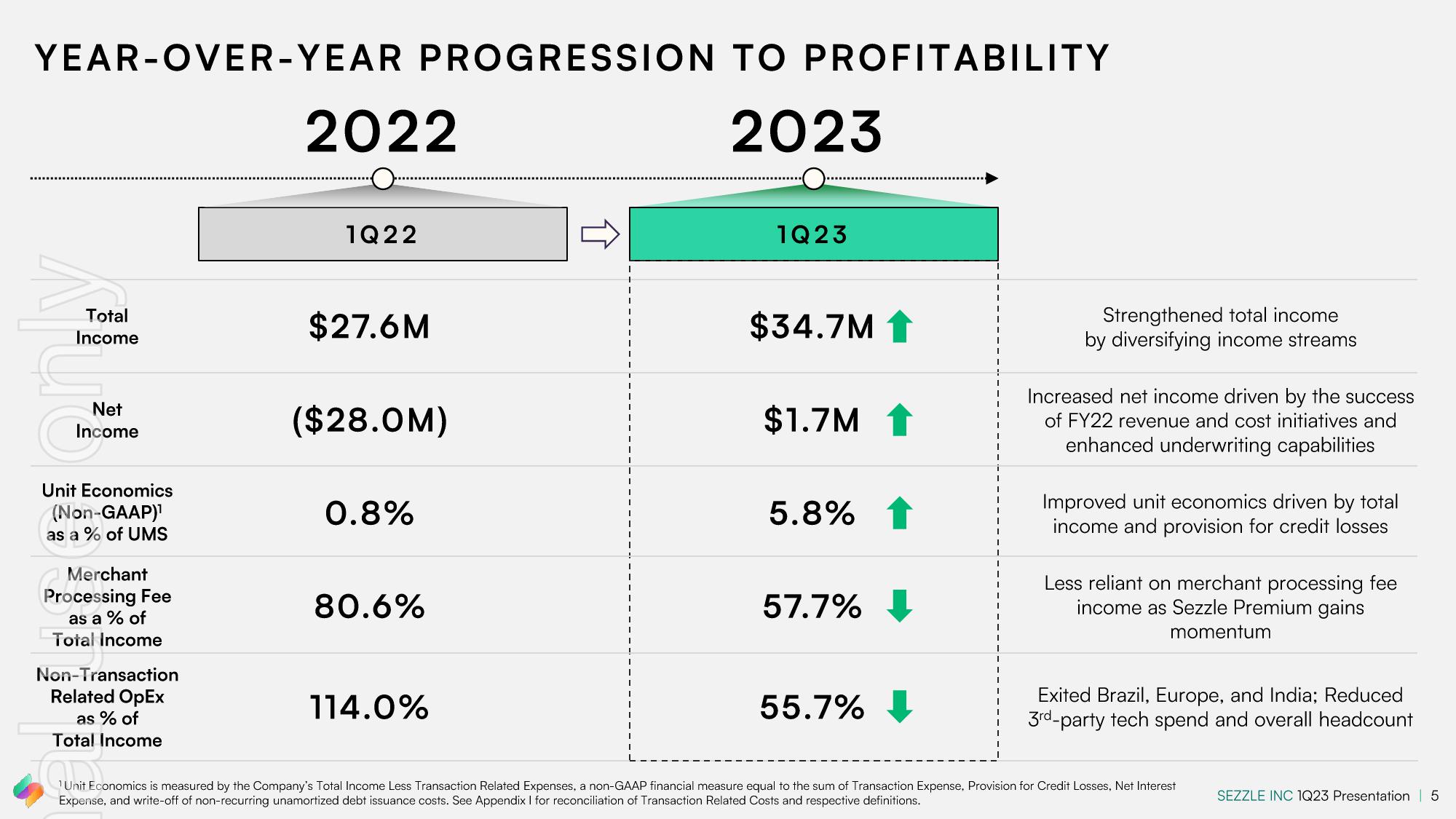

Total

Income

Net

Income

Unit Economics

(Non-GAAP)¹

as a % of UMS

Merchant

Processing Fee

as a % of

Total Income

Non-Transaction

Related OpEx

as % of

Total Income

2022

1Q22

$27.6M

($28.0M)

0.8%

80.6%

114.0%

介

T

TO PROFITABILITY

2023

1Q23

$34.7M 1

$1.7M 1

5.8% 1

57.7%

55.7%

Strengthened total income

by diversifying income streams

Increased net income driven by the success

of FY22 revenue and cost initiatives and

enhanced underwriting capabilities

Improved unit economics driven by total

income and provision for credit losses

Less reliant on merchant processing fee

income as Sezzle Premium gains

momentum

Exited Brazil, Europe, and India; Reduced

3rd-party tech spend and overall headcount

Cum

Unit Economics is measured by the Company's Total Income Less Transaction Related Expenses, a non-GAAP financial measure equal to the sum of Transaction Expense, Provision for Credit Losses, Net Interest

Expense, and write-off of non-recurring unamortized debt issuance costs. See Appendix I for reconciliation of Transaction Related Costs and respective definitions.

SEZZLE INC 1Q23 Presentation | 5View entire presentation