Liberty Global Results Presentation Deck

RECONCILIATIONS

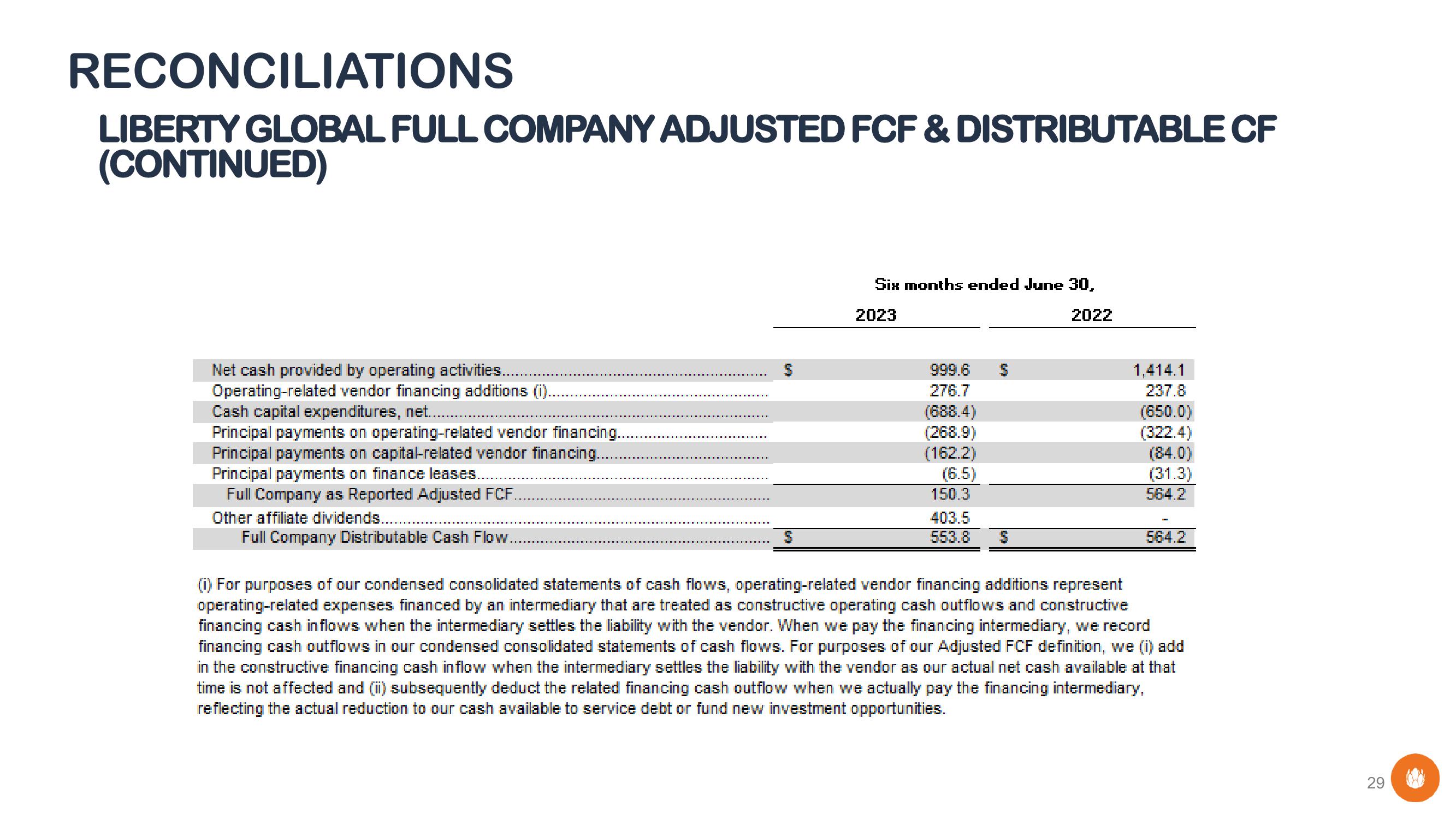

LIBERTY GLOBAL FULL COMPANY ADJUSTED FCF & DISTRIBUTABLE CF

(CONTINUED)

Net cash provided by operating activities...

Operating-related vendor financing additions (i).

Cash capital expenditures, net...

Principal payments on operating-related vendor financing.

Principal payments on capital-related vendor financing...

Principal payments on finance leases....

Full Company as Reported Adjusted FCF.

Other affiliate dividends......

Full Company Distributable Cash Flow.

Six months ended June 30,

2023

2022

999.6

276.7

(688.4)

(268.9)

(162.2)

(6.5)

150.3

403.5

553.8

1,414.1

237.8

(650.0)

(322.4)

(84.0)

(31.3)

564.2

564.2

(1) For purposes of our condensed consolidated statements of cash flows, operating-related vendor financing additions represent

operating-related expenses financed by an intermediary that are treated as constructive operating cash outflows and constructive

financing cash in flows when the intermediary settles the liability with the vendor. When we pay the financing intermediary, we record

financing cash outflows in our condensed consolidated statements of cash flows. For purposes of our Adjusted FCF definition, we (i) add

in the constructive financing cash inflow when the intermediary settles the liability with the vendor as our actual net cash available at that

time is not affected and (ii) subsequently deduct the related financing cash outflow when we actually pay the financing intermediary,

reflecting the actual reduction to our cash available to service debt or fund new investment opportunities.

29View entire presentation