Silicon Valley Bank Results Presentation Deck

Focus Area: Leveraging client liquidity

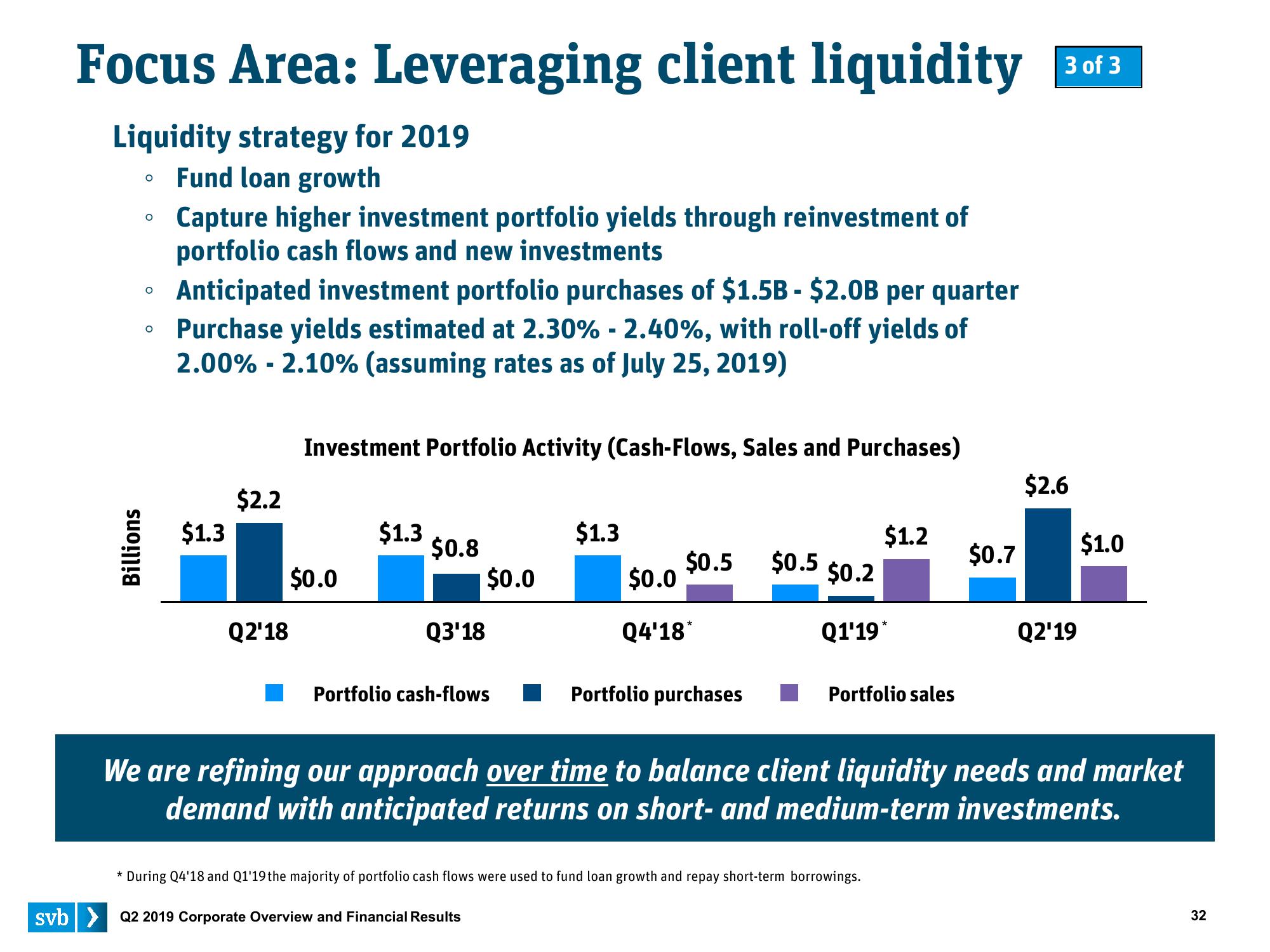

Liquidity strategy for 2019

• Fund loan growth

O

Billions

O

O

O

Capture higher investment portfolio yields through reinvestment of

portfolio cash flows and new investments

Anticipated investment portfolio purchases of $1.5B- $2.0B per quarter

Purchase yields estimated at 2.30% - 2.40%, with roll-off yields of

2.00% - 2.10% (assuming rates as of July 25, 2019)

$1.3

$2.2

Q2'18

Investment Portfolio Activity (Cash-Flows, Sales and Purchases)

$0.0

$1.3

$0.8

Q3'18

$0.0

Portfolio cash-flows

$1.3

svb> Q2 2019 Corporate Overview and Financial Results

$0.5

$0.0

Q4'18*

Portfolio purchases

$0.5

$0.2

$1.2

Q1'19*

Portfolio sales

* During Q4'18 and Q1'19 the majority of portfolio cash flows were used to fund loan growth and repay short-term borrowings.

$0.7

3 of 3

$2.6

Q2'19

We are refining our approach over time to balance client liquidity needs and market

demand with anticipated returns on short- and medium-term investments.

$1.0

32View entire presentation