Paysafe Results Presentation Deck

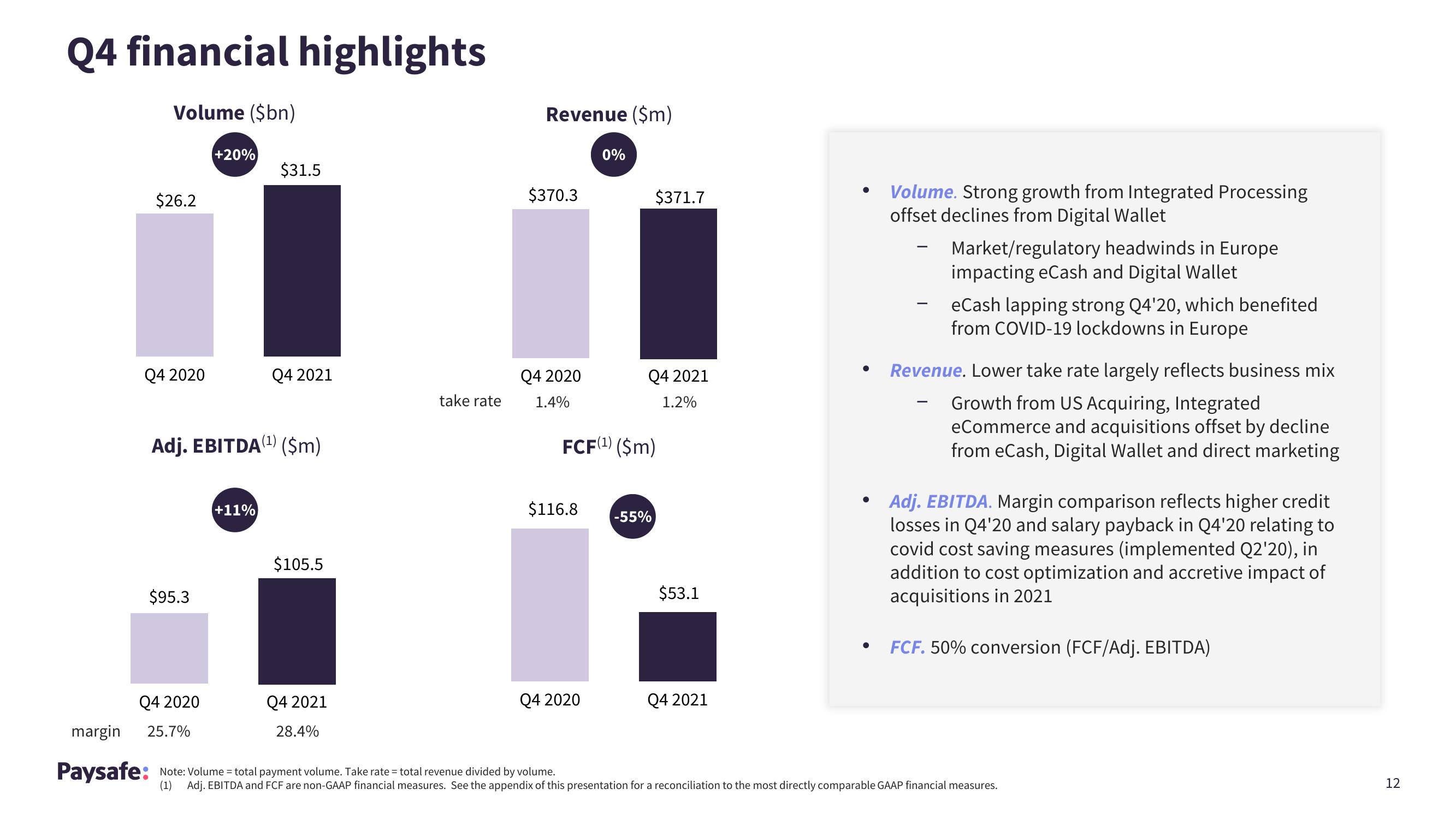

Q4 financial highlights

Volume ($bn)

$26.2

Q4 2020

$95.3

Q4 2020

+20%

Adj. EBITDA (¹) ($m)

margin 25.7%

$31.5

+11%

Q4 2021

$105.5

Q4 2021

28.4%

take rate

Revenue ($m)

$370.3

Q4 2020

1.4%

$116.8

Q4 2020

Paysafe: Note: Volume = total payment volume. Take rate = total revenue divided by volume.

0%

FCF(¹) ($m)

$371.7

Q4 2021

1.2%

-55%

$53.1

Q4 2021

●

●

●

Volume. Strong growth from Integrated Processing

offset declines from Digital Wallet

Market/regulatory headwinds in Europe

impacting eCash and Digital Wallet

eCash lapping strong Q4'20, which benefited

from COVID-19 lockdowns in Europe

Revenue. Lower take rate largely reflects business mix

Growth from US Acquiring, Integrated

eCommerce and acquisitions offset by decline

from eCash, Digital Wallet and direct marketing

Adj. EBITDA. Margin comparison reflects higher credit

losses in Q4'20 and salary payback in Q4'20 relating to

covid cost saving measures (implemented Q2'20), in

addition to cost optimization and accretive impact of

acquisitions in 2021

FCF. 50% conversion (FCF/Adj. EBITDA)

(1) Adj. EBITDA and FCF are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measures.

12View entire presentation