Main Street Capital Investor Day Presentation Deck

Follow-on Investment Case Studies

GRT

Company Description

■

Initial Transaction

Manufacturer of engineered rubber products for a

variety of end markets

GRT manufactures rubber belting, wear and

impact liners, sheet rubber products, screen

media and other molded products

■

Acquisition Strategy / Rationale

GRT management sought to:

■

Management buyout / corporate carve out

Previously a "corporate orphan" whose

management team sought a financial partner that

would invest in the future growth of the business

■

Diversify end market exposure

Diversify sales channels

Vertically integrate

Successfully completed two highly strategic

acquisitions

Valley

RUBBER

Gorilla Tough for Mining & Aggregato

Biltrite

Ripley

Operations

Representative Acquisitions

▪ Manufacturer of custom rubber solutions

and molded products

Provided additional manufacturing

capabilities, end market exposure, sales

channel diversification, and geographic

diversification

■

Vertically integrated industrial sheet rubber

and rubber products manufacturer

▪ Provided vertical integration through the

addition of in-house rubber mixing

capabilities.

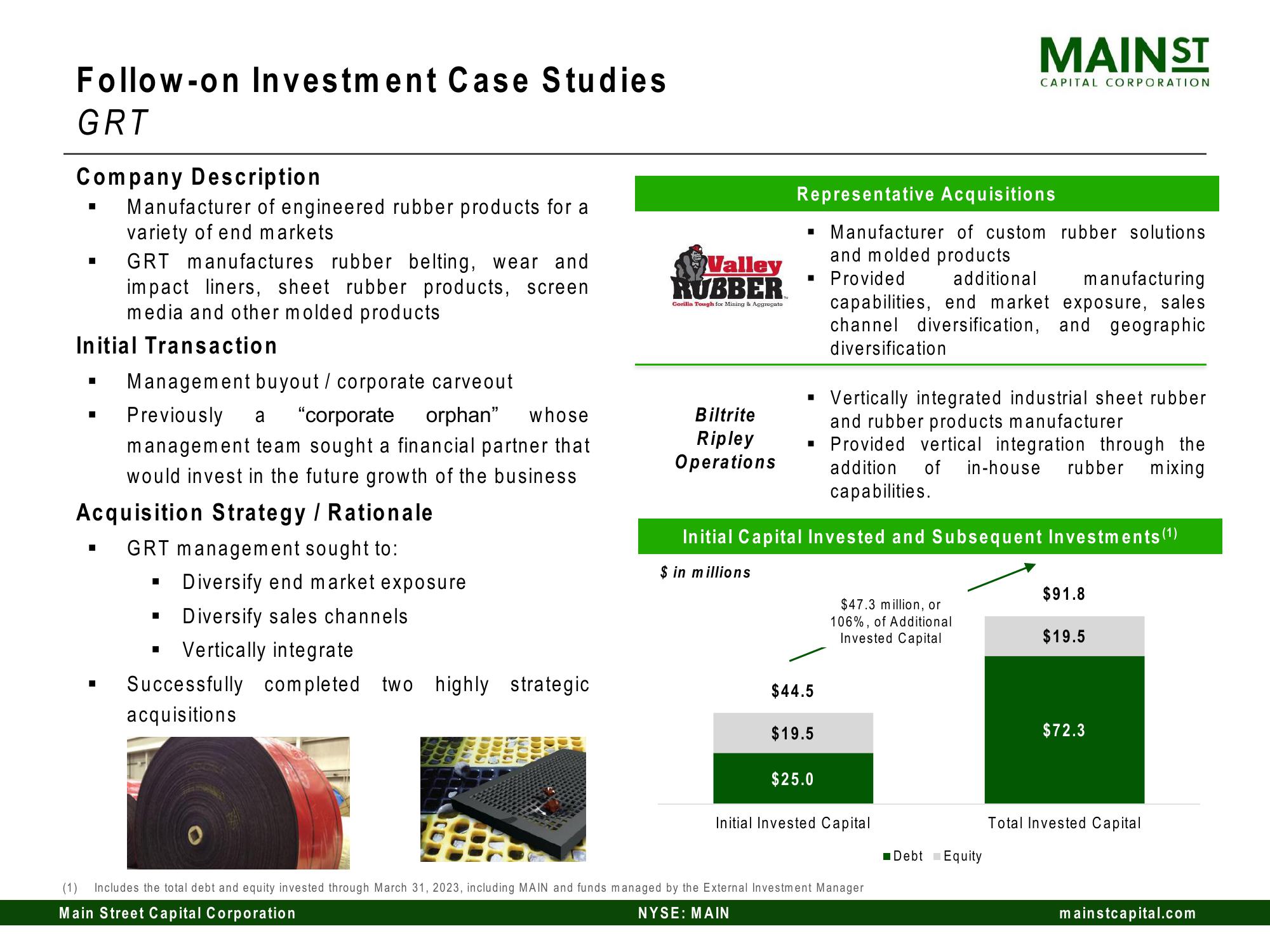

$44.5

Initial Capital Invested and Subsequent Investments (¹)

$ in millions

$19.5

$25.0

$47.3 million, or

106%, of Additional

Invested Capital

MAIN ST

Initial Invested Capital

CAPITAL CORPORATION

(1) Includes the total debt and equity invested through March 31, 2023, including MAIN and funds managed by the External Investment Manager

Main Street Capital Corporation

NYSE: MAIN

Debt Equity

$91.8

$19.5

$72.3

Total Invested Capital

mainstcapital.comView entire presentation