Ocado Results Presentation Deck

Financial Summary

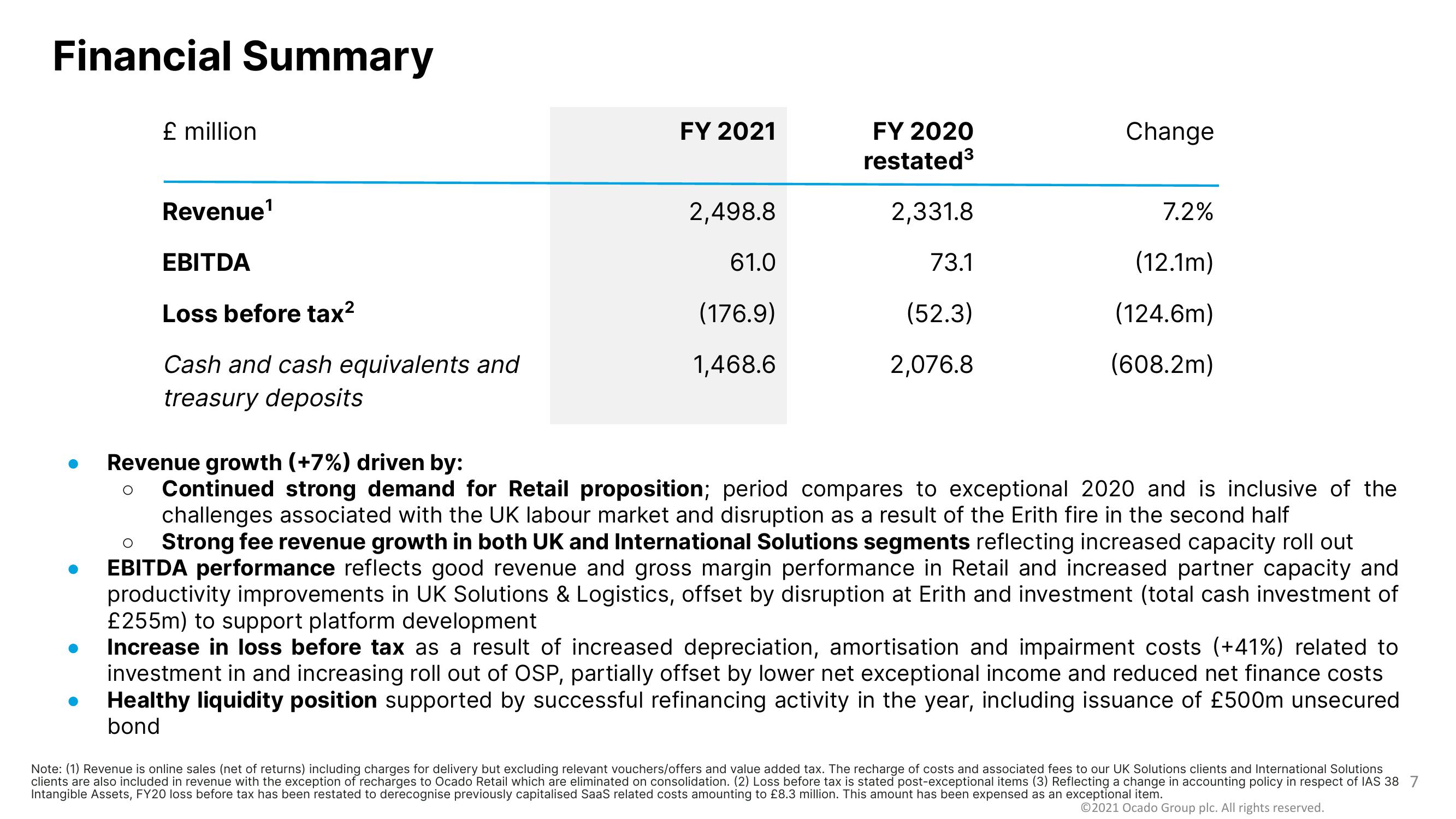

£ million

Revenue¹

EBITDA

Loss before tax²

Cash and cash equivalents and

treasury deposits

FY 2021

2,498.8

61.0

(176.9)

1,468.6

FY 2020

restated³

2,331.8

73.1

(52.3)

2,076.8

Change

7.2%

(12.1m)

(124.6m)

(608.2m)

Revenue growth (+7%) driven by:

O Continued strong demand for Retail proposition; period compares to exceptional 2020 and is inclusive of the

challenges associated with the UK labour market and disruption as a result of the Erith fire in the second half

Strong fee revenue growth in both UK and International Solutions segments reflecting increased capacity roll out

EBITDA performance reflects good revenue and gross margin performance in Retail and increased partner capacity and

productivity improvements in UK Solutions & Logistics, offset by disruption at Erith and investment (total cash investment of

£255m) to support platform development

Increase in loss before tax as a result of increased depreciation, amortisation and impairment costs (+41%) related to

investment in and increasing roll out of OSP, partially offset by lower net exceptional income and reduced net finance costs

Healthy liquidity position supported by successful refinancing activity in the year, including issuance of £500m unsecured

bond

Note: (1) Revenue is online sales (net of returns) including charges for delivery but excluding relevant vouchers/offers and value added tax. The recharge of costs and associated fees to our UK Solutions clients and International Solutions

clients are also included in revenue with the exception of recharges to Ocado Retail which are eliminated on consolidation. (2) Loss before tax is stated post-exceptional items (3) Reflecting a change in accounting policy in respect of IAS 38 7

Intangible Assets, FY20 loss before tax has been restated to derecognise previously capitalised SaaS related costs amounting to £8.3 million. This amount has been expensed as an exceptional item.

Ⓒ2021 Ocado Group plc. All rights reserved.View entire presentation