Q3 2018 Financial Results

Q3 2018 Highlights

■

■

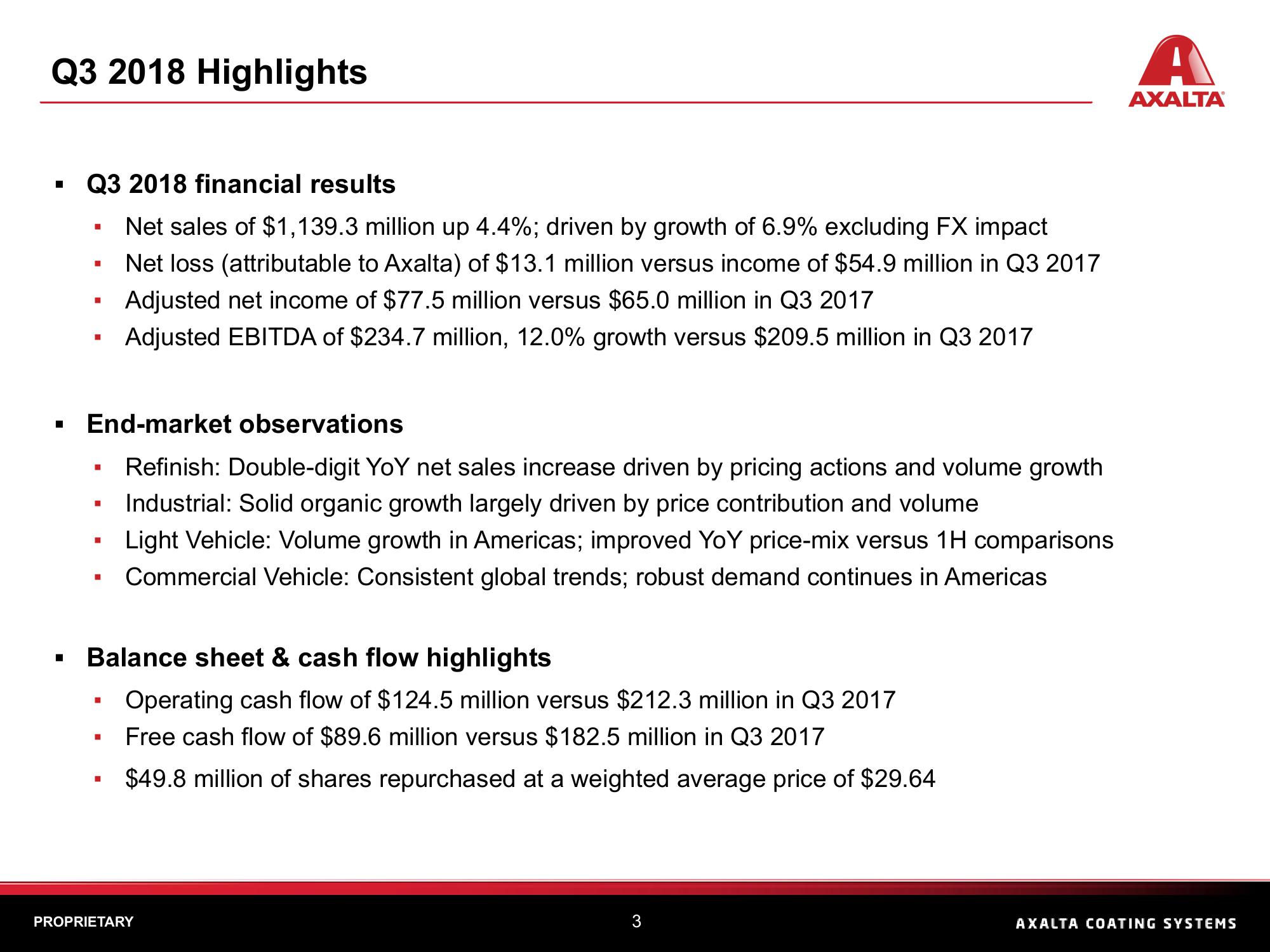

Q3 2018 financial results

Net sales of $1,139.3 million up 4.4%; driven by growth of 6.9% excluding FX impact

Net loss (attributable to Axalta) of $13.1 million versus income of $54.9 million in Q3 2017

Adjusted net income of $77.5 million versus $65.0 million in Q3 2017

Adjusted EBITDA of $234.7 million, 12.0% growth versus $209.5 million in Q3 2017

■

H

■

■

End-market observations

Refinish: Double-digit YoY net sales increase driven by pricing actions and volume growth

Industrial: Solid organic growth largely driven by price contribution and volume

Light Vehicle: Volume growth in Americas; improved YoY price-mix versus 1H comparisons

Commercial Vehicle: Consistent global trends; robust demand continues in Americas

■

I

■

■

Balance sheet & cash flow highlights

Operating cash flow of $124.5 million versus $212.3 million in Q3 2017

Free cash flow of $89.6 million versus $182.5 million in Q3 2017

$49.8 million of shares repurchased at a weighted average price of $29.64

H

PROPRIETARY

3

A

AXALTAⓇ

AXALTA COATING SYSTEMSView entire presentation