TPG Results Presentation Deck

GAAP Balance Sheet (Unaudited)

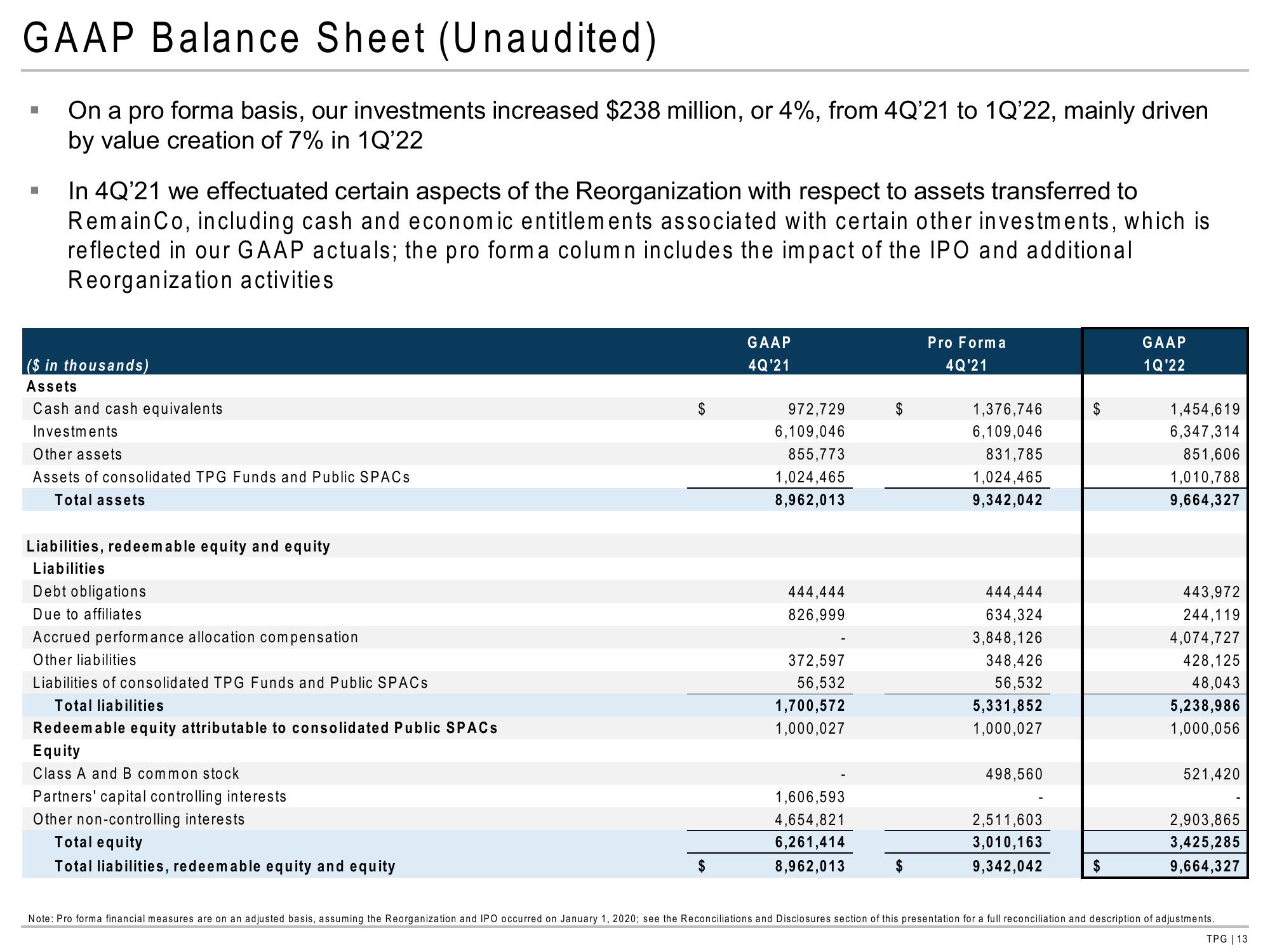

On a pro forma basis, our investments increased $238 million, or 4%, from 4Q'21 to 1Q'22, mainly driven

by value creation of 7% in 1Q'22

■

■

In 4Q'21 we effectuated certain aspects of the Reorganization with respect to assets transferred to

Remain Co, including cash and economic entitlements associated with certain other investments, which is

reflected in our GAAP actuals; the pro forma column includes the impact of the IPO and additional

Reorganization activities

($ in thousands)

Assets

Cash and cash equivalents

Investments

Other assets

Assets of consolidated TPG Funds and Public SPACs

Total assets

Liabilities, redeemable equity and equity

Liabilities

Debt obligations

Due to affiliates

Accrued performance allocation compensation

Other liabilities

Liabilities of consolidated TPG Funds and Public SPACs

Total liabilities

Redeemable equity attributable to consolidated Public SPACs

Equity

Class A and B common stock

Partners' capital controlling interests

Other non-controlling interests

Total equity

Total liabilities, redeemable equity and equity

GAAP

4Q'21

972,729

6,109,046

855,773

1,024,465

8,962,013

444,444

826,999

372,597

56,532

1,700,572

1,000,027

1,606,593

4,654,821

6,261,414

8,962,013

$

$

Pro Forma

4Q'21

1,376,746

6,109,046

831,785

1,024,465

9,342,042

444,444

634,324

3,848,126

348,426

56,532

5,331,852

1,000,027

498,560

2,511,603

3,010,163

9,342,042

$

$

GAAP

1Q'22

1,454,619

6,347,314

851,606

1,010,788

9,664,327

443,972

244,119

4,074,727

428,125

48,043

5,238,986

1,000,056

521,420

2,903,865

3,425,285

9,664,327

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

TPG | 13View entire presentation