Financial Results Second Quarter 2022

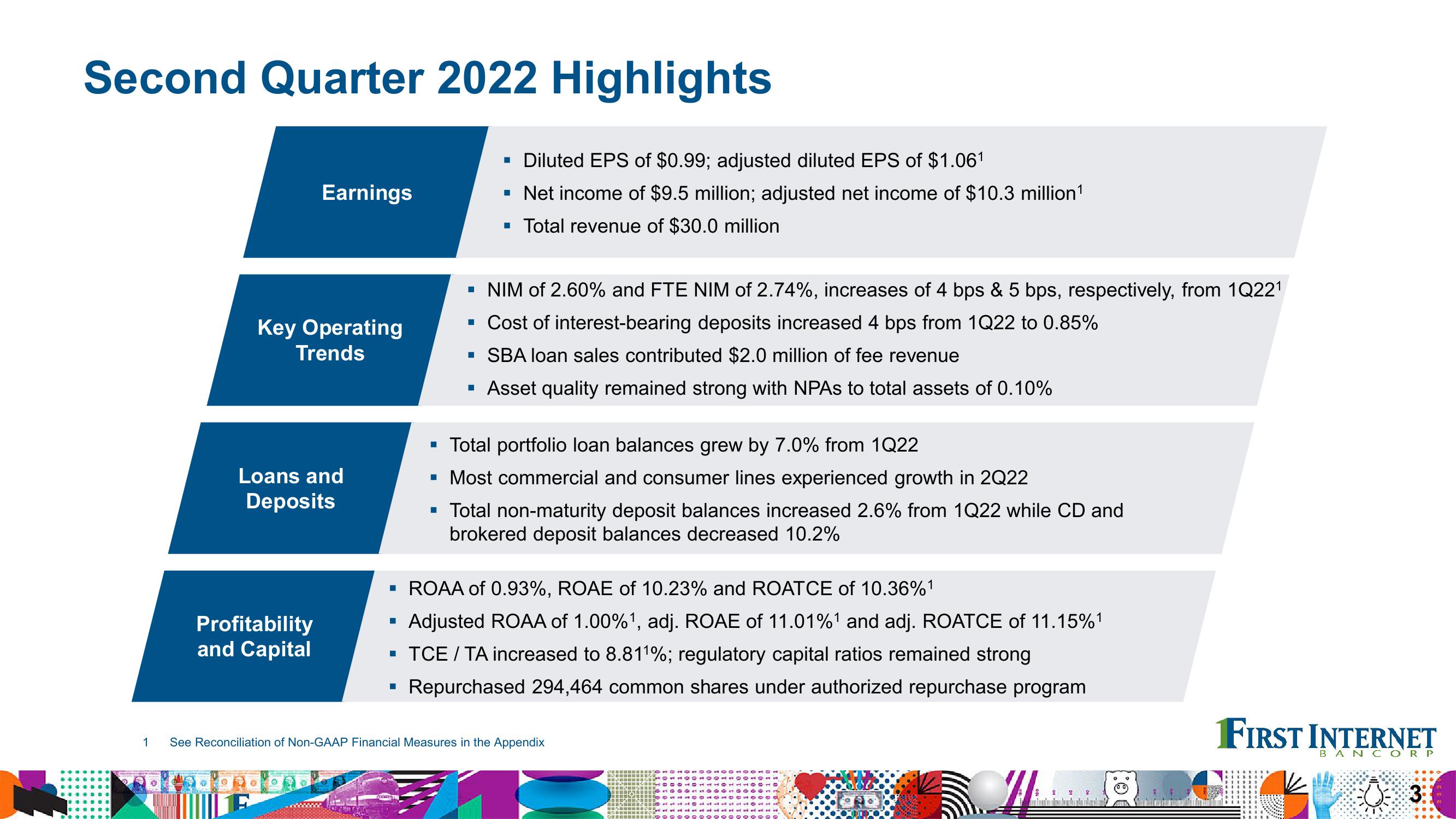

Second Quarter 2022 Highlights

1

Earnings

Key Operating

Trends

Loans and

Deposits

Profitability

and Capital

■

▪ Diluted EPS of $0.99; adjusted diluted EPS of $1.06¹

▪ Net income of $9.5 million; adjusted net income of $10.3 million ¹

▪ Total revenue of $30.0 million

■

▪ NIM of 2.60% and FTE NIM of 2.74%, increases of 4 bps & 5 bps, respectively, from 1Q22¹

■ Cost of interest-bearing deposits increased 4 bps from 1Q22 to 0.85%

▪ SBA loan sales contributed $2.0 million of fee revenue

▪ Asset quality remained strong with NPAs to total assets of 0.10%

▪ ROAA of 0.93%, ROAE of 10.23% and ROATCE of 10.36%¹

Adjusted ROAA of 1.00%¹, adj. ROAE of 11.01%¹ and adj. ROATCE of 11.15%1

▪ TCE / TA increased to 8.81¹%; regulatory capital ratios remained strong

Repurchased 294,464 common shares under authorized repurchase program

▪ Total portfolio loan balances grew by 7.0% from 1Q22

Most commercial and consumer lines experienced growth in 2Q22

▪ Total non-maturity deposit balances increased 2.6% from 1Q22 while CD and

brokered deposit balances decreased 10.2%

See Reconciliation of Non-GAAP Financial Measures in the Appendix

22 2

FIRST INTERNET

BANCOR P

V

3View entire presentation