Oaktree Real Estate Opportunities Fund Viii, L.P. Presentation for Fresno County Employees’ Retirement Association

OAKTREE REAL ESTATE OPPORTUNITIES STRATEGY

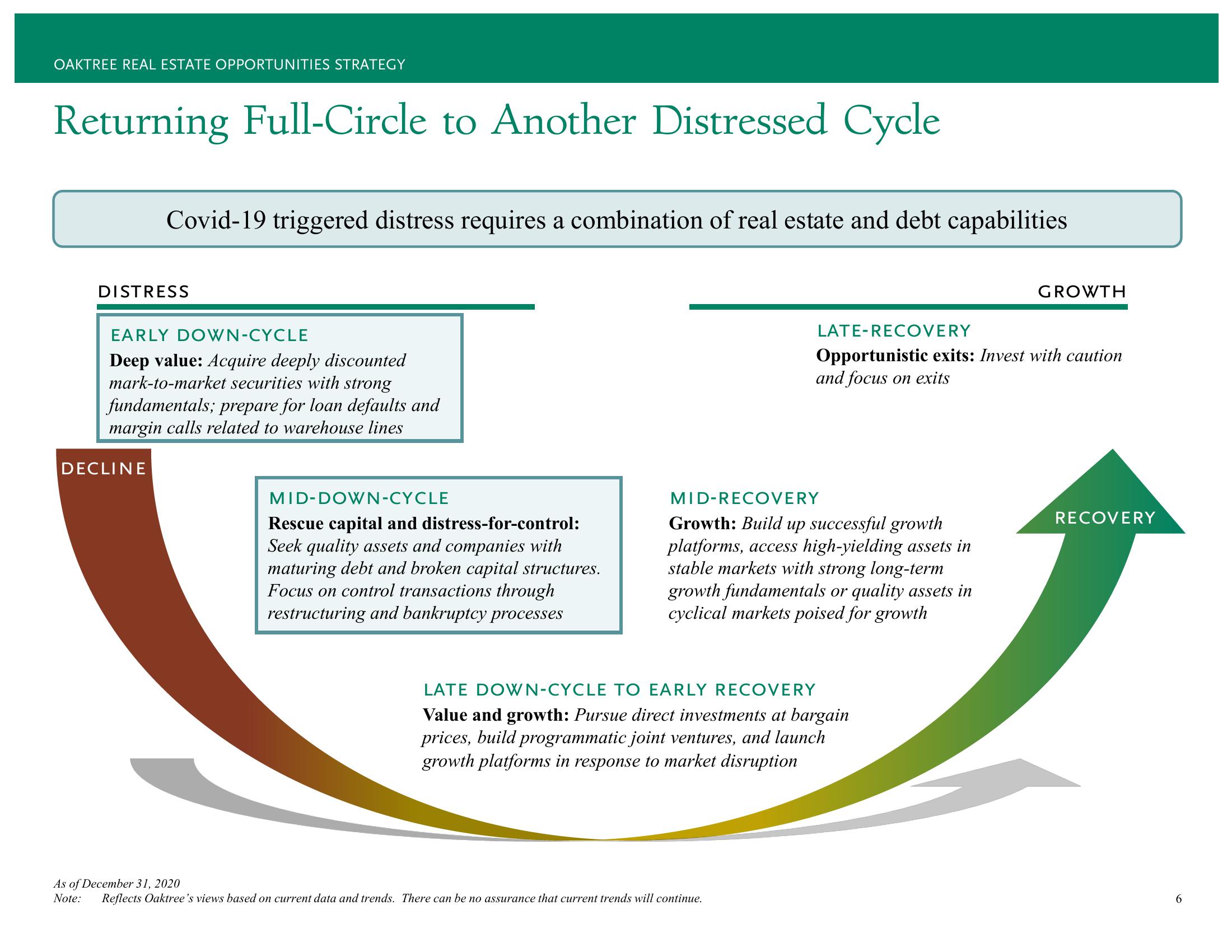

Returning Full-Circle to Another Distressed Cycle

Covid-19 triggered distress requires a combination of real estate and debt capabilities

DISTRESS

EARLY DOWN-CYCLE

Deep value: Acquire deeply discounted

mark-to-market securities with strong

fundamentals; prepare for loan defaults and

margin calls related to warehouse lines

DECLINE

MID-DOWN-CYCLE

Rescue capital and distress-for-control:

Seek quality assets and companies with

maturing debt and broken capital structures.

Focus on control transactions through

restructuring and bankruptcy processes

MID-RECOVERY

Growth: Build up successful growth

platforms, access high-yielding assets in

stable markets with strong long-term

growth fundamentals or quality assets in

cyclical markets poised for growth

LATE-RECOVERY

Opportunistic exits: Invest with caution

and focus on exits

LATE DOWN-CYCLE TO EARLY RECOVERY

Value and growth: Pursue direct investments at bargain

prices, build programmatic joint ventures, and launch

growth platforms in response to market disruption

As of December 31, 2020

Note:

Reflects Oaktree's views based on current data and trends. There can be no assurance that current trends will continue.

GROWTH

RECOVERY

6View entire presentation