Crocs Investor Presentation Deck

Cr

CS

cr

OCS

CI

OC!

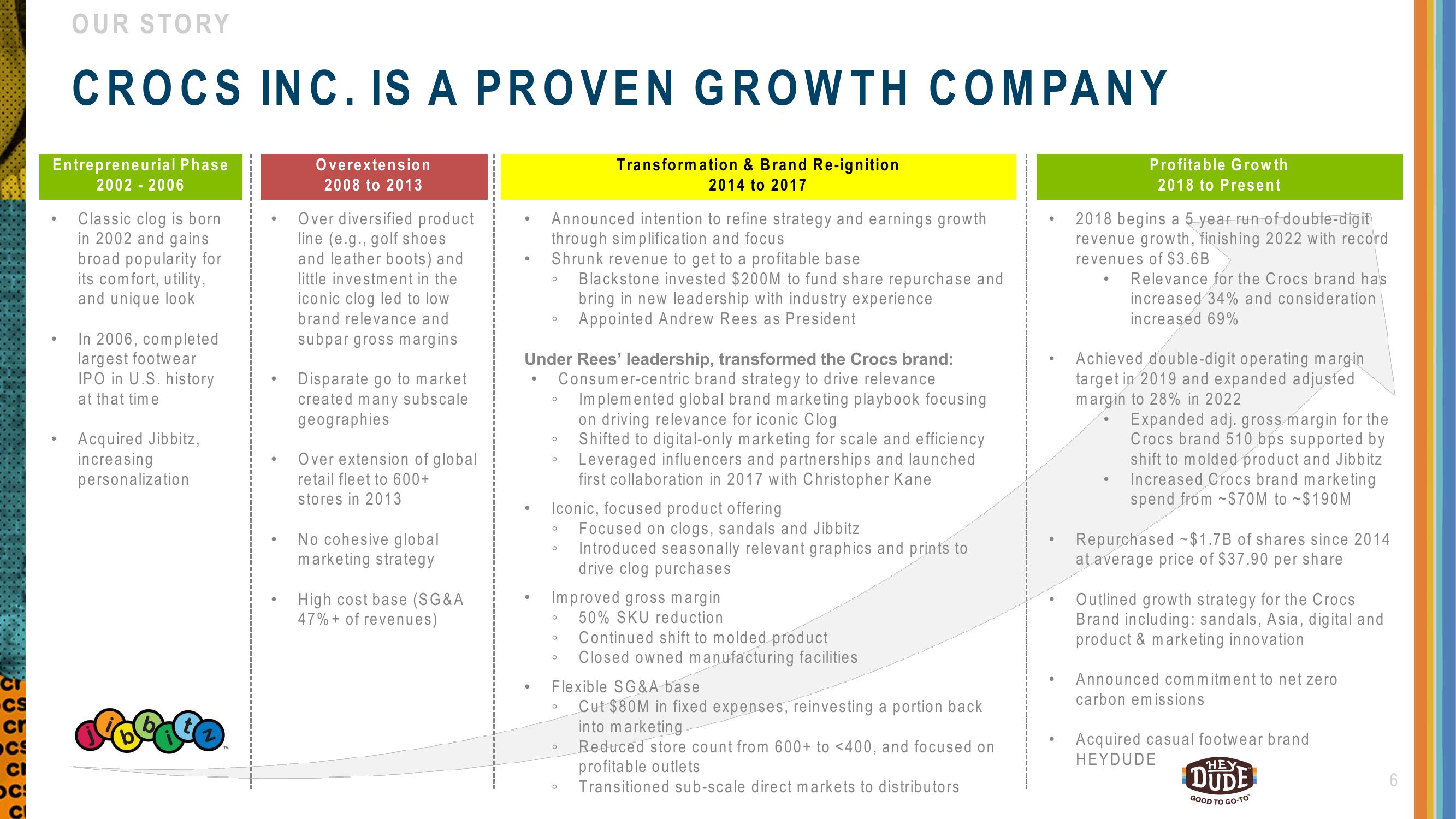

OUR STORY

CROCS INC. IS A PROVEN GROWTH COMPANY

Entrepreneurial Phase

2002 - 2006

Classic clog is born

in 2002 and gains

broad popularity for

its comfort, utility,

and unique look

In 2006, completed

largest footwear

IPO in U.S. history

at that time

Acquired Jibbitz,

increasing

personalization

764140

Overextension

2008 to 2013

Over diversified product

line (e.g., golf shoes

and leather boots) and

little investment in the

iconic clog led to low

brand relevance and

subpar gross margins

Disparate go to market

created many subscale

geographies

Over extension of global

retail fleet to 600+

stores in 2013

No cohesive global

marketing strategy

High cost base (SG&A

47% of revenues)

●

●

●

●

Announced intention to refine strategy and earnings growth

through simplification and focus

Shrunk revenue to get to a profitable base

O

O

Under Rees' leadership, transformed the Crocs brand:

Consumer-centric brand strategy to drive relevance

Implemented global brand marketing playbook focusing

on driving relevance for iconic Clog

Shifted to digital-only marketing for scale and efficiency

Leveraged influencers and partnerships and launched

first collaboration in 2017 with Christopher Kane

O

O

O

O

Iconic, focused product offering

Focused on clogs, sandals and Jibbitz

Introduced seasonally relevant graphics and prints to

drive clog purchases

O

Transformation & Brand Re-ignition

2014 to 2017

O

Improved gross margin

50% SKU reduction

O

Blackstone invested $200M to fund share repurchase and

bring in new leadership with industry experience

Appointed Andrew Rees as President

O

O

Continued shift to molded product

Closed owned manufacturing facilities

Flexible SG&A base

Cut $80M in fixed expenses, reinvesting a portion back

into marketing

Reduced store count from 600+ to <400, and focused on

profitable outlets

Transitioned sub-scale direct markets to distributors

●

●

●

Profitable Growth

2018 to Present

2018 begins a 5 year run of double-digit

revenue growth, finishing 2022 with record

revenues of $3.6B

●

Relevance for the Crocs brand has

increased 34% and consideration

increased 69%

Achieved double-digit operating margin

target in 2019 and expanded adjusted

margin to 28% in 2022

Expanded adj. gross margin for the

Crocs brand 510 bps supported by

shift to molded product and Jibbitz

Increased Crocs brand marketing

spend from $70M to ~$190M

Repurchased ~$1.7B of shares since 2014

at average price of $37.90 per share

Outlined growth strategy for the Crocs

Brand including: sandals, Asia, digital and

product & marketing innovation

Announced commitment to net zero

carbon emissions

Acquired casual footwear brand

HEYDUDE

DUDE

GOOD TO GO-TOView entire presentation