Hydrafacial Investor Day Presentation Deck

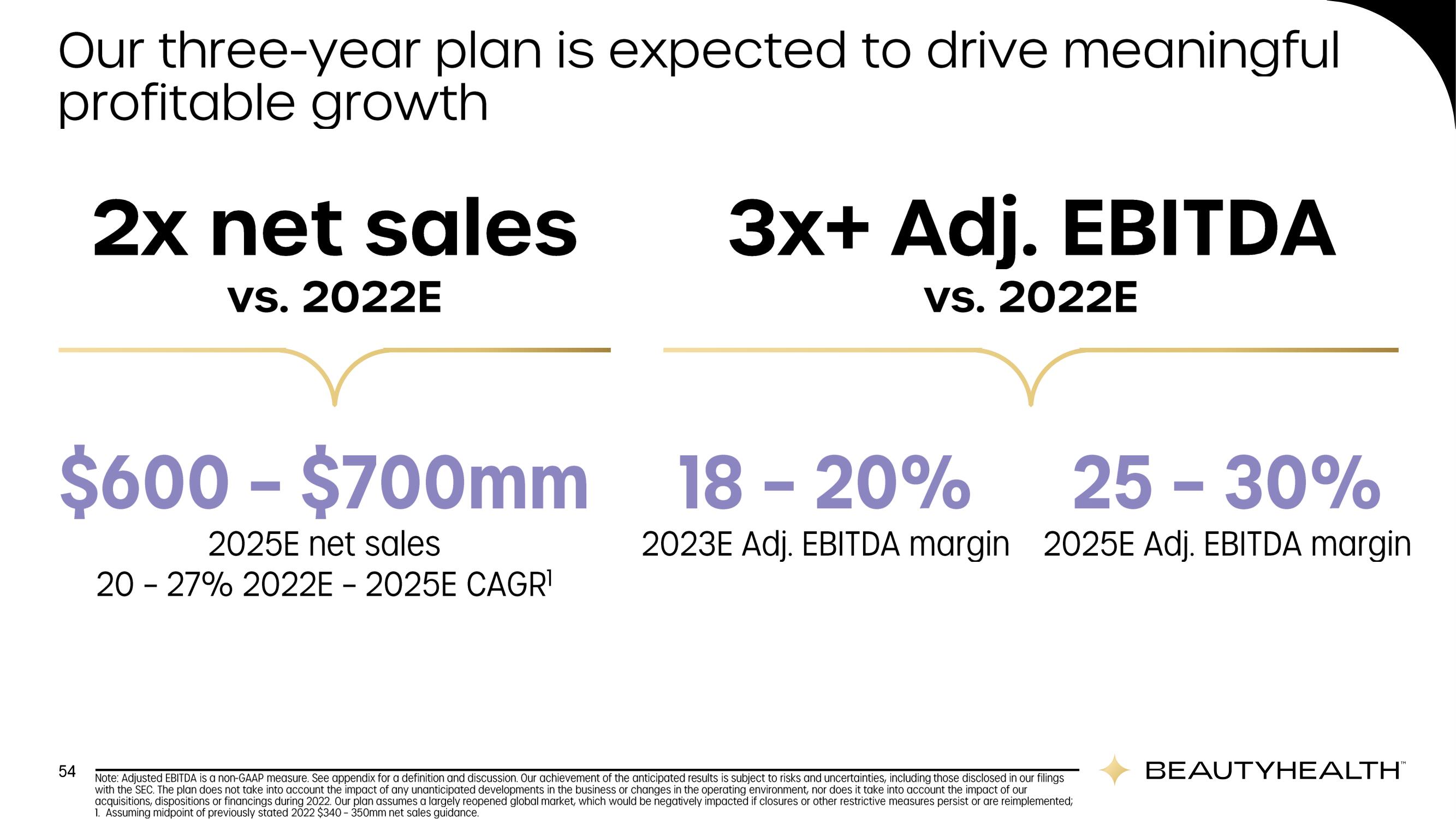

Our three-year plan is expected to drive meaningful

profitable growth

2x net sales

vs. 2022E

54

3x+ Adj. EBITDA

vs. 2022E

$600 - $700mm 18 - 20%

2025E net sales

20-27% 2022E - 2025E CAGR¹

25-30%

2023E Adj. EBITDA margin 2025E Adj. EBITDA margin

Note: Adjusted EBITDA is a non-GAAP measure. See appendix for a definition and discussion. Our achievement of the anticipated results is subject to risks and uncertainties, including those disclosed in our filings

with the SEC. The plan does not take into account the impact of any unanticipated developments in the business or changes in the operating environment, nor does it take into account the impact of our

acquisitions, dispositions or financings during 2022. Our plan assumes a largely reopened global market, which would be negatively impacted if closures or other restrictive measures persist or are reimplemented;

1. Assuming midpoint of previously stated 2022 $340-350mm net sales guidance.

BEAUTYHEALTH™View entire presentation