Ashtead Group Results Presentation Deck

ROBUST AND FLEXIBLE DEBT STRUCTURE

$5,000m

$4,000m

$3,000m

$2,000m

$1,000m

$m

$5,000m

$4,000m

$3,000m

$2,000m

$1,000m

13

$m

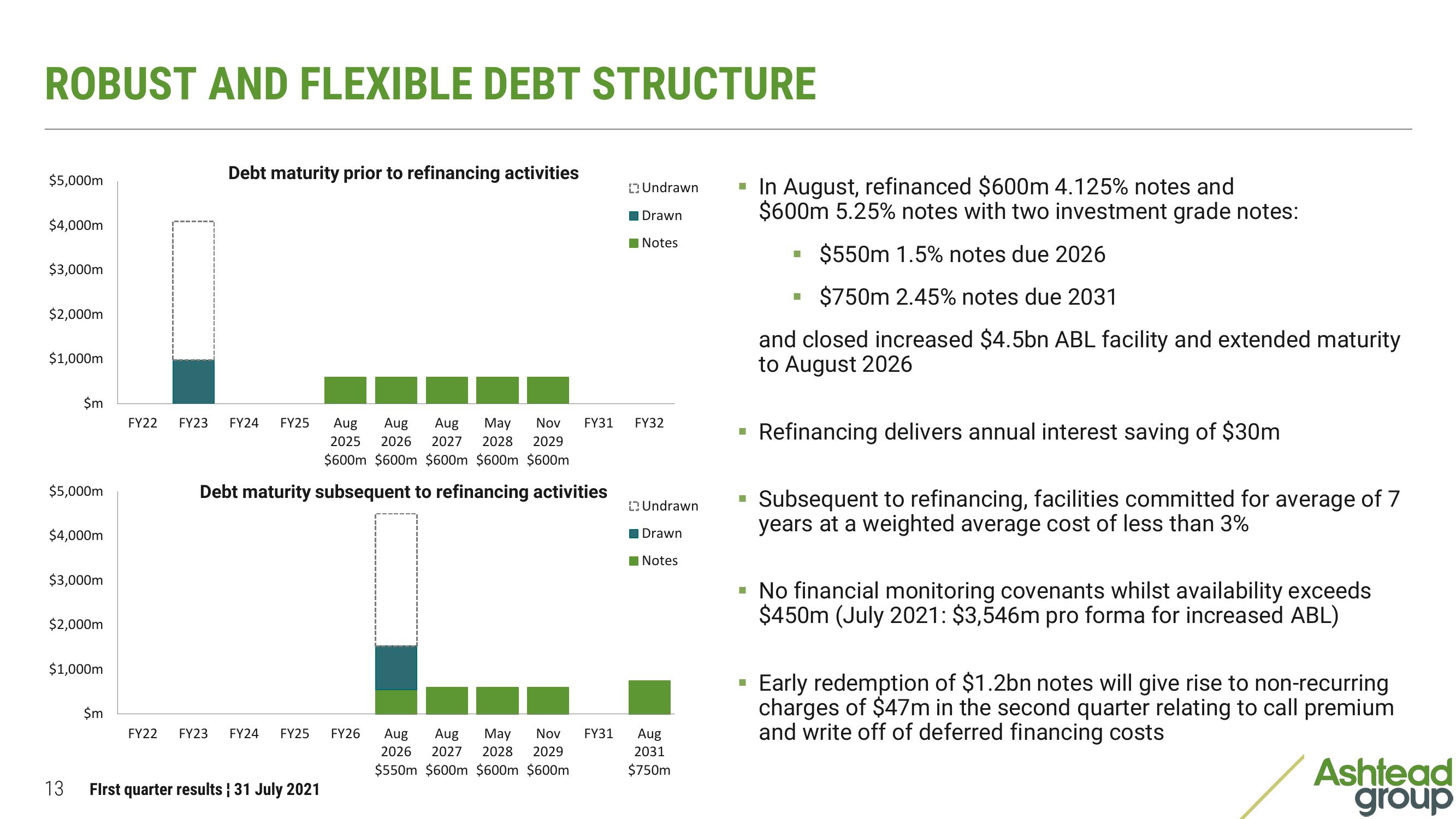

Debt maturity prior to refinancing activities

FY22 FY23 FY24 FY25

Aug Aug Aug May Nov FY31 FY32

2025 2026 2027 2028 2029

$600m $600m $600m $600m $600m

Debt maturity subsequent to refinancing activities

FY22 FY23 FY24 FY25 FY26

First quarter results | 31 July 2021

Aug Aug May Nov

2026 2027 2028 2029

$550m $600m $600m $600m

Undrawn

Drawn

Notes

FY31

Undrawn

Drawn

Notes

Aug

2031

$750m

▪ In August, refinanced $600m 4.125% notes and

$600m 5.25% notes with two investment grade notes:

$550m 1.5% notes due 2026

$750m 2.45% notes due 2031

and closed increased $4.5bn ABL facility and extended maturity

to August 2026

I

Refinancing delivers annual interest saving of $30m

■

Subsequent to refinancing, facilities committed for average of 7

years at a weighted average cost of less than 3%

▪ No financial monitoring covenants whilst availability exceeds

$450m (July 2021: $3,546m pro forma for increased ABL)

Early redemption of $1.2bn notes will give rise to non-recurring

charges of $47m in the second quarter relating to call premium

and write off of deferred financing costs

Ashtead

groupView entire presentation