Q1 2023 Earnings Presentation

NON-GAAP FINANCIAL PERFORMANCE

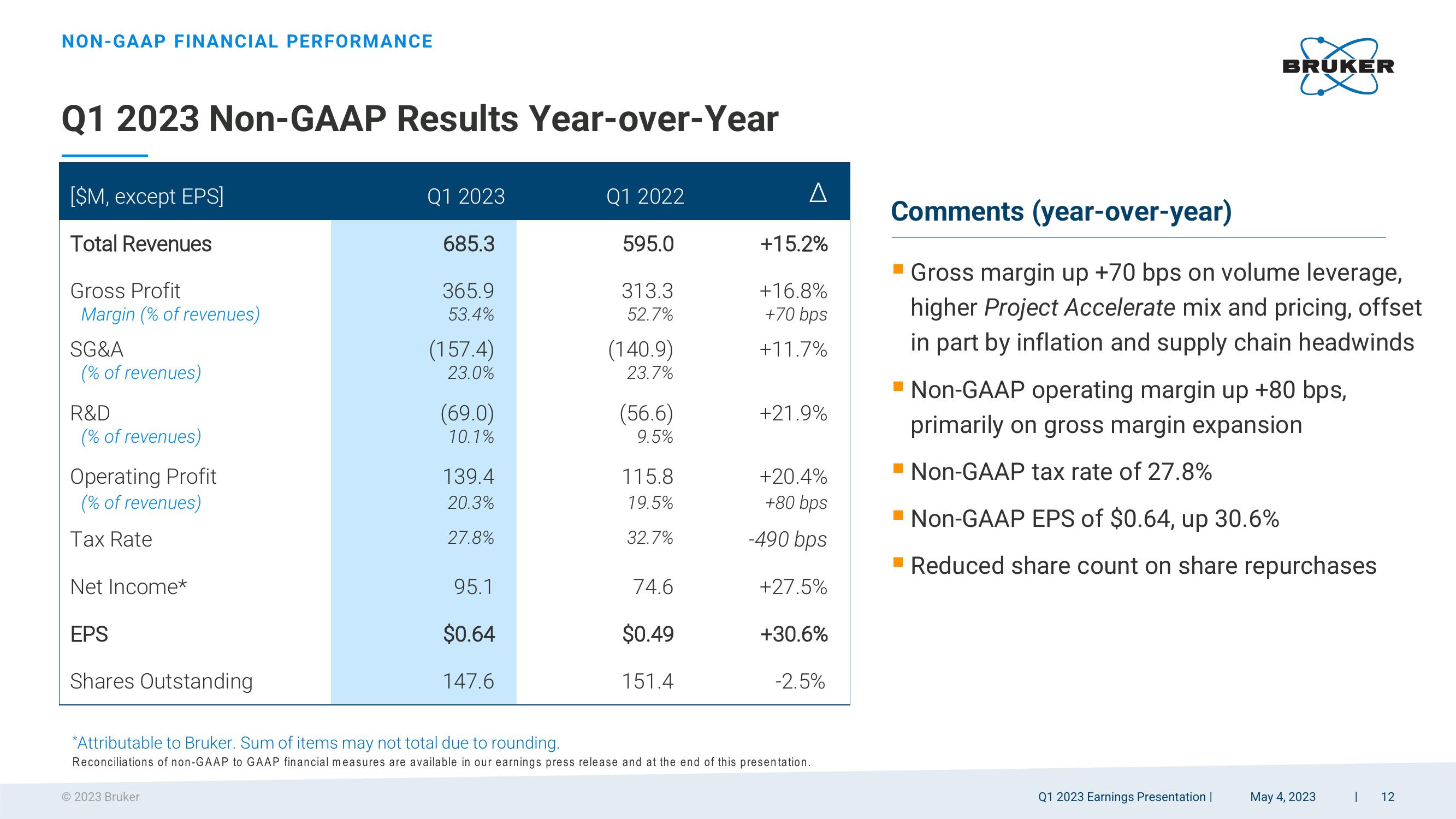

Q1 2023 Non-GAAP Results Year-over-Year

[$M, except EPS]

Total Revenues

Gross Profit

Margin (% of revenues)

SG&A

(% of revenues)

R&D

(% of revenues)

Operating Profit

(% of revenues)

Tax Rate

Net Income*

EPS

Shares Outstanding

Q1 2023

685.3

365.9

53.4%

2023 Bruker

(157.4)

23.0%

(69.0)

10.1%

139.4

20.3%

27.8%

95.1

$0.64

147.6

Q1 2022

595.0

313.3

52.7%

(140.9)

23.7%

(56.6)

9.5%

115.8

19.5%

32.7%

74.6

$0.49

151.4

A

+15.2%

+16.8%

+70 bps

+11.7%

+21.9%

+20.4%

+80 bps

-490 bps

+27.5%

+30.6%

-2.5%

*Attributable to Bruker. Sum of items may not total due to rounding.

Reconciliations of non-GAAP to GAAP financial measures are available in our earnings press release and at the end of this presentation.

BRUKER

Comments (year-over-year)

Gross margin up +70 bps on volume leverage,

higher Project Accelerate mix and pricing, offset

in part by inflation and supply chain headwinds

Non-GAAP operating margin up +80 bps,

primarily on gross margin expansion

Non-GAAP tax rate of 27.8%

Non-GAAP EPS of $0.64, up 30.6%

Reduced share count on share repurchases

Q1 2023 Earnings Presentation |

May 4, 2023

I 12View entire presentation