Science 37 SPAC

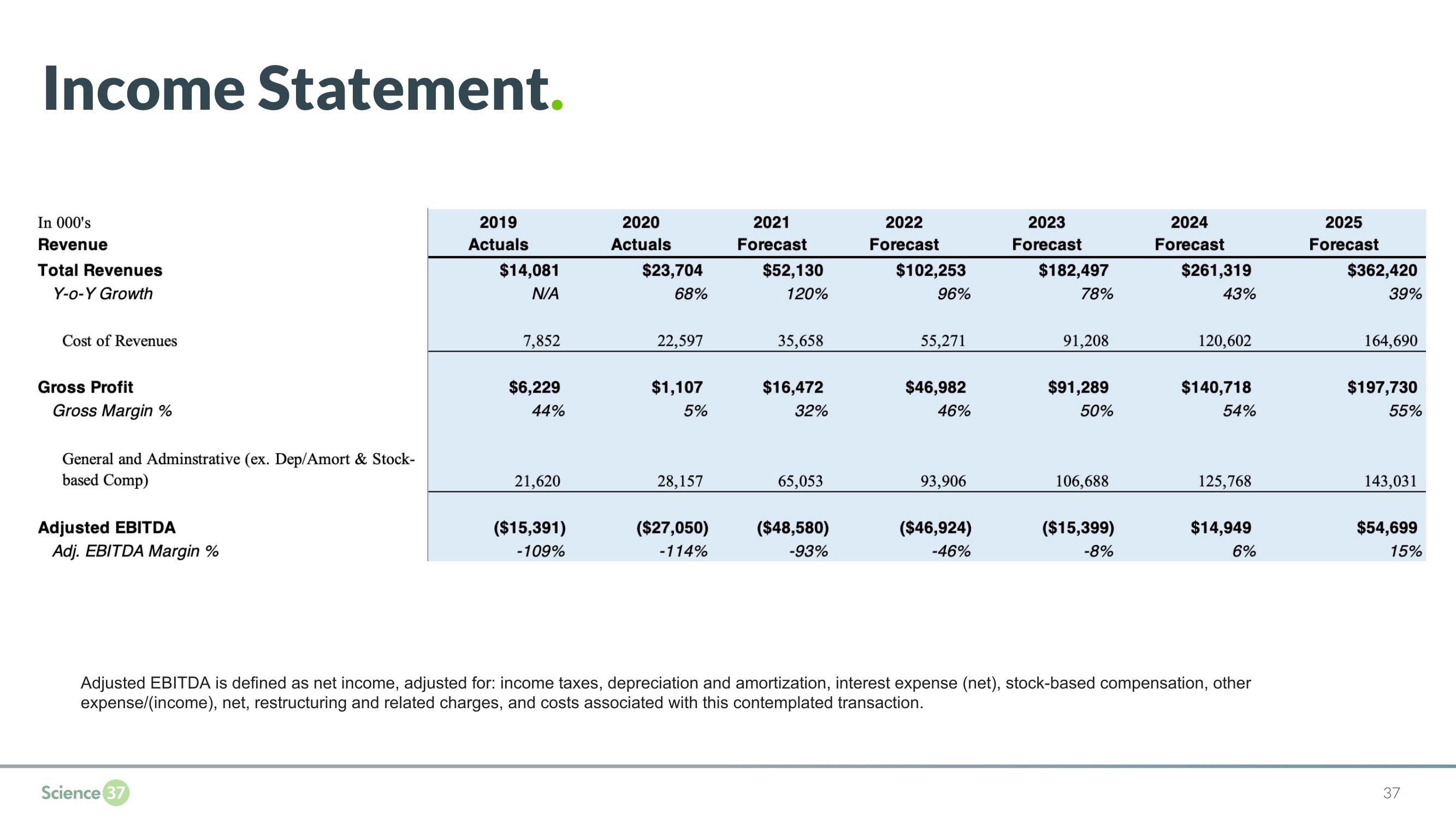

Income Statement.

In 000's

Revenue

Total Revenues

Y-o-Y Growth

Cost of Revenues

Gross Profit

Gross Margin %

General and Adminstrative (ex. Dep/Amort & Stock-

based Comp)

Adjusted EBITDA

Adj. EBITDA Margin %

2019

Actuals

Science 37

$14,081

N/A

7,852

$6,229

44%

21,620

($15,391)

-109%

2020

Actuals

$23,704

68%

22,597

$1,107

5%

28,157

($27,050)

-114%

2021

Forecast

$52,130

120%

35,658

$16,472

32%

65,053

($48,580)

-93%

2022

Forecast

$102,253

96%

55,271

$46,982

46%

93,906

($46,924)

-46%

2023

Forecast

$182,497

78%

91,208

$91,289

50%

106,688

($15,399)

-8%

2024

Forecast

$261,319

43%

120,602

$140,718

54%

125,768

$14,949

6%

Adjusted EBITDA is defined as net income, adjusted for: income taxes, depreciation and amortization, interest expense (net), stock-based compensation, other

expense/(income), net, restructuring and related charges, and costs associated with this contemplated transaction.

2025

Forecast

$362,420

39%

164,690

$197,730

55%

143,031

$54,699

15%

37View entire presentation