Pershing Square Activist Presentation Deck

II. Pershing's View of McDonald's

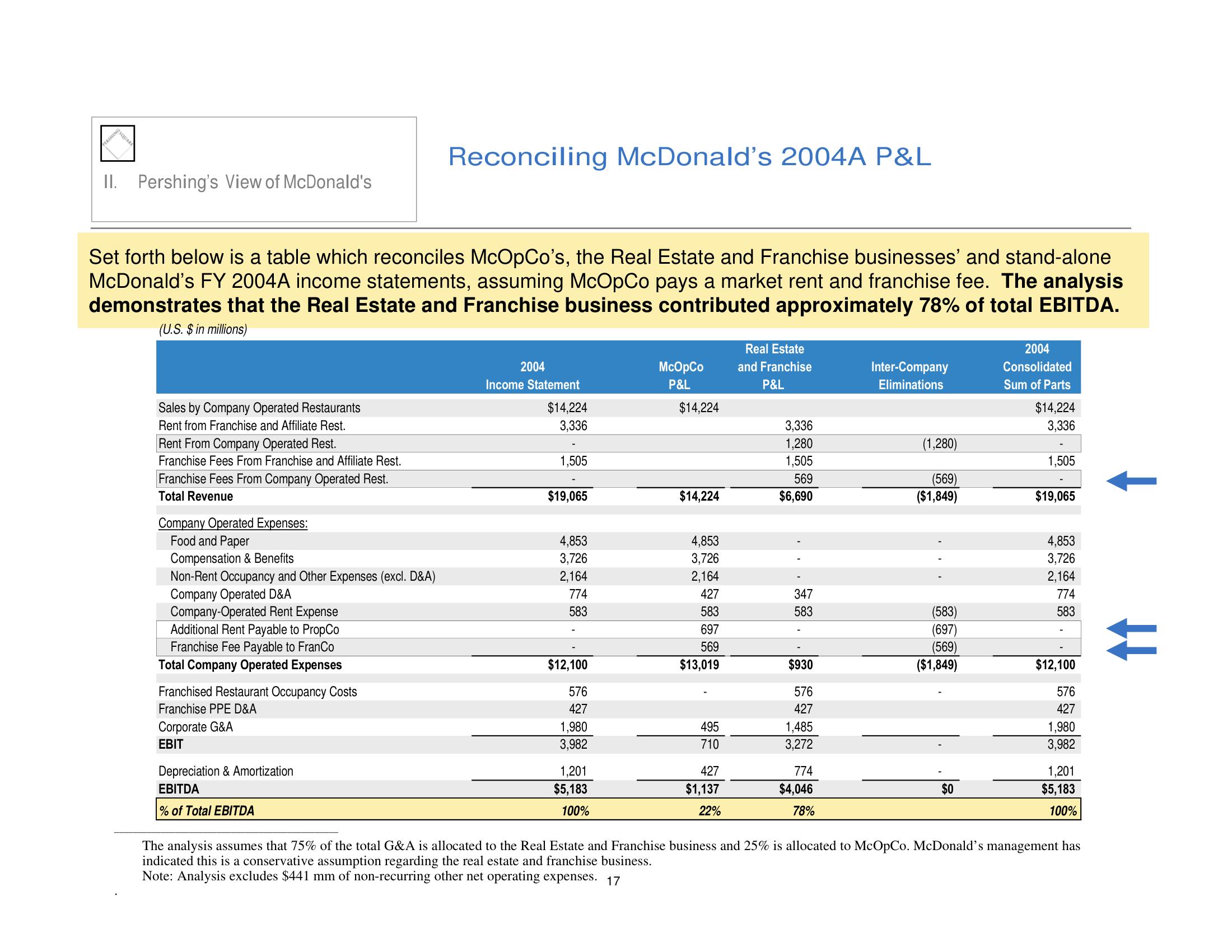

Set forth below is a table which reconciles McOpCo's, the Real Estate and Franchise businesses' and stand-alone

McDonald's FY 2004A income statements, assuming McOpCo pays a market rent and franchise fee. The analysis

demonstrates that the Real Estate and Franchise business contributed approximately 78% of total EBITDA.

(U.S. $ in millions)

Sales by Company Operated Restaurants

Rent from Franchise and Affiliate Rest.

Rent From Company Operated Rest.

Franchise Fees From Franchise and Affiliate Rest.

Franchise Fees From Company Operated Rest.

Total Revenue

Company Operated Expenses:

Food and Paper

Compensation & Benefits

Non-Rent Occupancy and Other Expenses (excl. D&A)

Company Operated D&A

Company-Operated Rent Expense

Additional Rent Payable to PropCo

Franchise Fee Payable to FranCo

Total Company Operated Expenses

Franchised Restaurant Occupancy Costs

Franchise PPE D&A

Corporate G&A

EBIT

Reconciling McDonald's 2004A P&L

Depreciation & Amortization

EBITDA

% of Total EBITDA

2004

Income Statement

$14,224

3,336

1,505

$19,065

4,853

3,726

2,164

774

583

$12,100

576

427

1,980

3,982

1,201

$5,183

100%

Real Estate

McOpCo and Franchise

P&L

P&L

$14,224

$14,224

4,853

3,726

2,164

427

583

697

569

$13,019

'

495

710

427

$1,137

22%

3,336

1,280

1,505

569

$6,690

347

583

$930

576

427

1,485

3,272

774

$4,046

78%

Inter-Company

Eliminations

(1,280)

(569)

($1,849)

(583)

(697)

(569)

($1,849)

$0

2004

Consolidated

Sum of Parts

$14,224

3,336

1,505

$19,065

4,853

3,726

2,164

774

583

$12,100

576

427

1,980

3,982

1,201

$5,183

100%

The analysis assumes that 75% of the total G&A is allocated to the Real Estate and Franchise business and 25% is allocated to McOpCo. McDonald's management has

indicated this is a conservative assumption regarding the real estate and franchise business.

Note: Analysis excludes $441 mm of non-recurring other net operating expenses. 17

↑↑View entire presentation