Silicon Valley Bank Results Presentation Deck

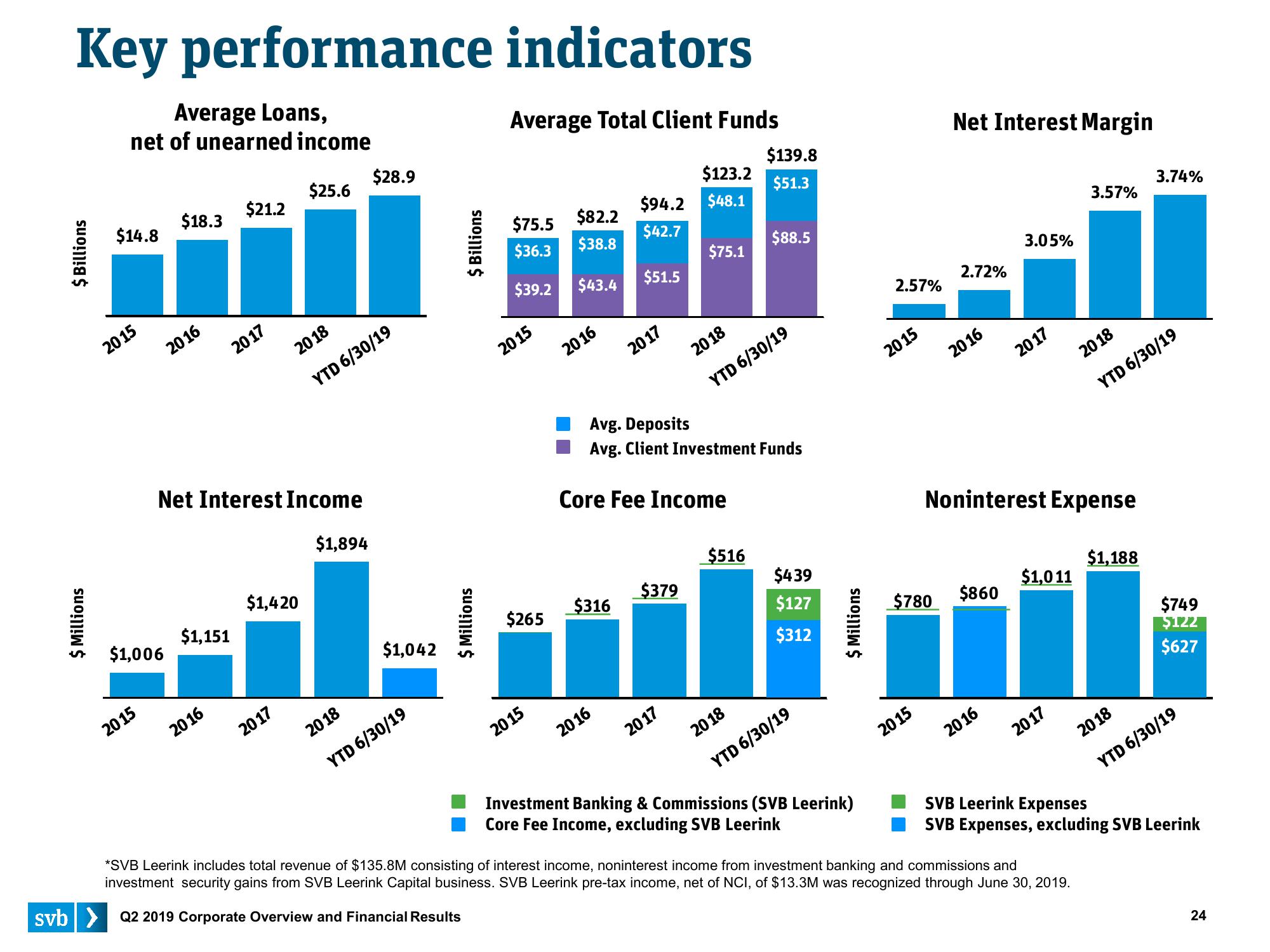

Key performance indicators

Average Loans,

Average Total Client Funds

net of unearned income

$ Billion

5 Millions

I$

$14.8

2015

$1,006

2015

$18.3

2016

$21.2

2017

$1,151

2016

Net Interest Income

$1,894

$25.6

$1,420

2017

2018

YTD 6/30/19

$28.9

$1,042

2018

YTD 6/30/19

Billions

$

$ Millions

$82.2

$75.5

$36.3

$38.8

$39.2 $43.4

2015

$265

2015

2016

$316

$123.2

$48.1

$94.2

$42.7

$51.5

2016

2017

Core Fee Income

$75.1

Avg. Deposits

Avg. Client Investment Funds

$379

2017

$139.8

$51.3

2018

YTD 6/30/19

$88.5

$516

$439

$127

$312

2018

YTD 6/30/19

5 Millions

$

Investment Banking & Commissions (SVB Leerink)

Core Fee Income, excluding SVB Leerink

2.57%

2015

$780

2015

Net Interest Margin

2.72%

2016

$860

3.05%

2016

2017

Noninterest Expense

$1,011

2017

3.57%

*SVB Leerink includes total revenue of $135.8M consisting of interest income, noninterest income from investment banking and commissions and

investment security gains from SVB Leerink Capital business. SVB Leerink pre-tax income, net of NCI, of $13.3M was recognized through June 30, 2019.

svb> Q2 2019 Corporate Overview and Financial Results

2018

YTD 6/30/19

3.74%

$1,188

$749

$122

$627

2018

YTD 6/30/19

SVB Leerink Expenses

SVB Expenses, excluding SVB Leerink

24View entire presentation