Deutsche Bank Results Presentation Deck

Capital metrics

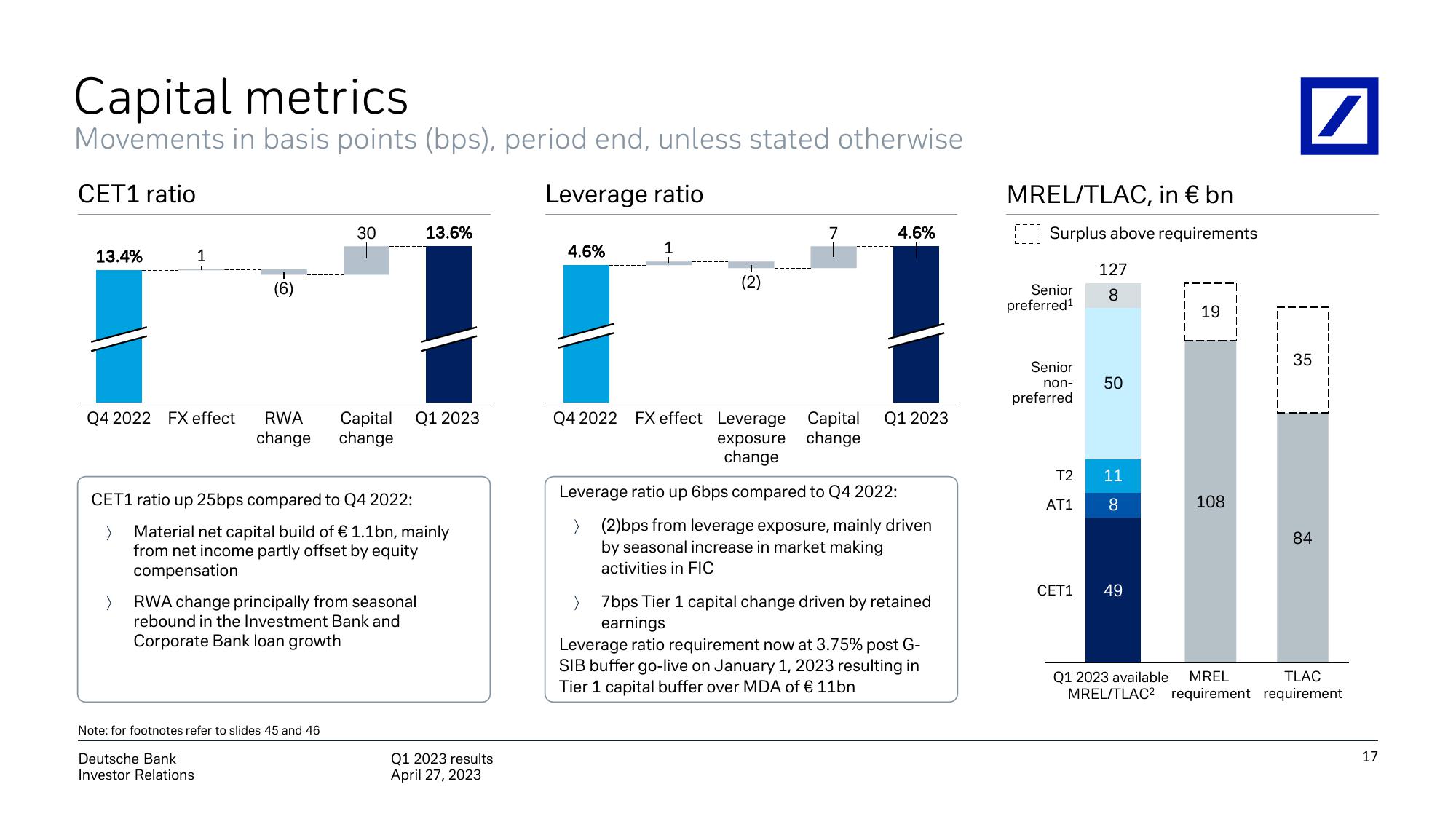

Movements in basis points (bps), period end, unless stated otherwise

CET1 ratio

Leverage ratio

13.4%

Q4 2022 FX effect

1

>

(6)

Deutsche Bank

Investor Relations

30

CET1 ratio up 25bps compared to Q4 2022:

Material net capital build of € 1.1bn, mainly

from net income partly offset by equity

compensation

RWA Capital Q1 2023

change change

RWA change principally from seasonal

rebound in the Investment Bank and

Corporate Bank loan growth

Note: for footnotes refer to slides 45 and 46

13.6%

Q1 2023 results

April 27, 2023

4.6%

1

(2)

Q4 2022 FX effect Leverage

7

Capital

exposure change

change

4.6%

Q1 2023

Leverage ratio up 6bps compared to Q4 2022:

> (2)bps from leverage exposure, mainly driven

by seasonal increase in market making

activities in FIC

7bps Tier 1 capital change driven by retained

earnings

Leverage ratio requirement now at 3.75% post G-

SIB buffer go-live on January 1, 2023 resulting in

Tier 1 capital buffer over MDA of € 11bn

MREL/TLAC, in € bn

Surplus above requirements

Senior

preferred¹1

Senior

non-

preferred

T2

AT1

127

8

50

11

8

CET1 49

19

108

35

84

TLAC

Q1 2023 available MREL

MREL/TLAC² requirement requirement

17View entire presentation