Bank of America Investment Banking Pitch Book

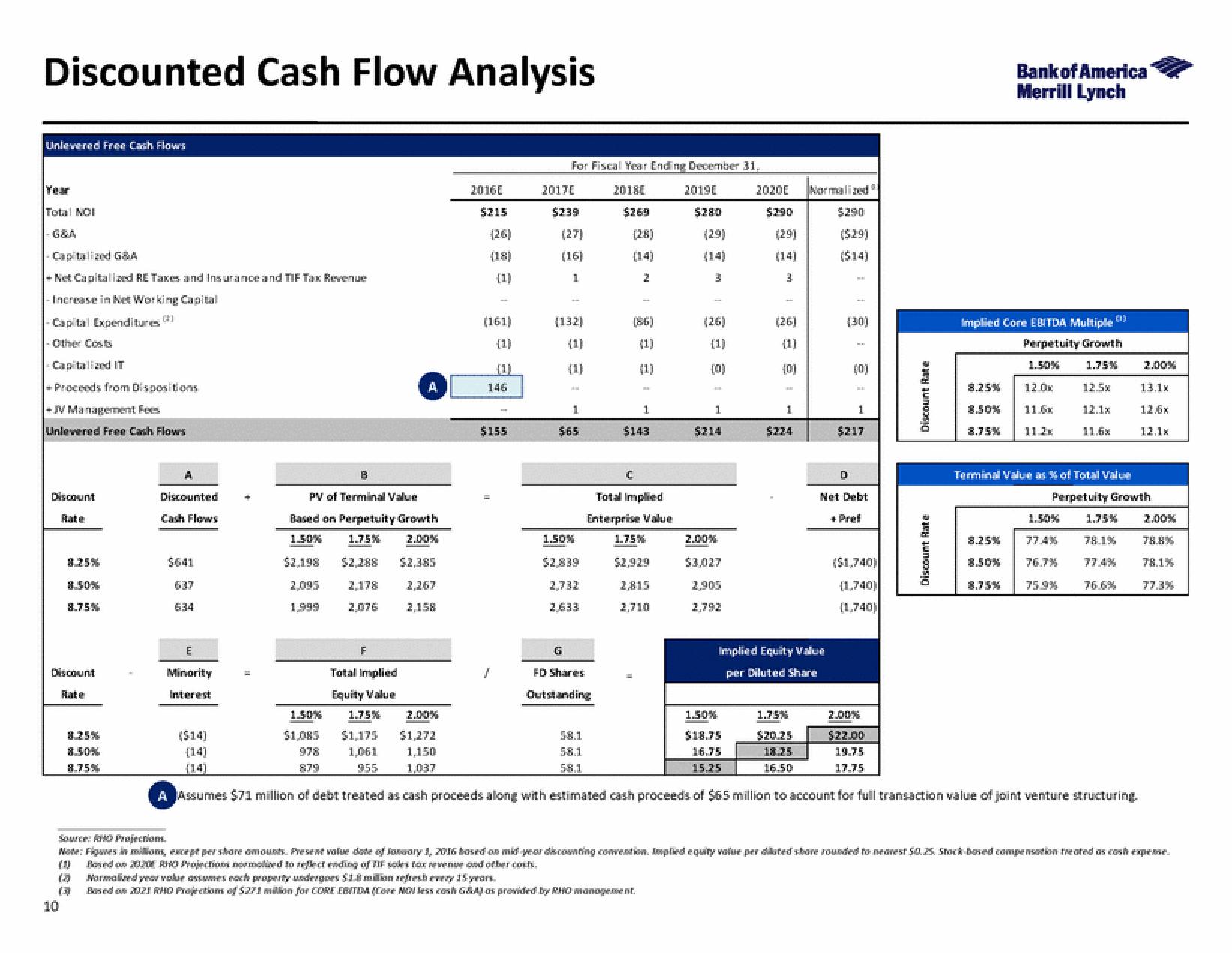

Discounted Cash Flow Analysis

Unlevered Free Cash Flows

Year

Total NOI

Capitalized G&A

+ Net Capitalized RE Taxes and Insurance and TIF Tax Revenue

Increase in Net Working Capital

Capital Expenditures (

Other Costs

Capitalized IT

Proceeds from Dispositions

+JV Management Fees

Unlevered Free Cash Flows

Discount

Rate

8.25%

8.50%

8.75%

Discount

Rate

10

8.25%

8.50%

8.75%

(2)

(3)

A

Discounted

Cash Flows

$641

637

634

E

Minority

Interest

B

PV of Terminal Value

Based on Perpetuity Growth

1.50%

1.75%

2.00%

$2.198 $2,288 $2,385

2,095

2.178

1,999

2,076

F

A

Total Implied

Equity Value

2,267

2,158

2016E

$215

(18)

(161)

(1)

(1)

146

$155

For Fiscal Year Ending December 31.

2018E

$269

2017E

$239

(27)

(16)

1

(132)

Au

1

$65

G

1.50%

$2.839

2,732

2,633

(14)

FD Shares

Outstanding

(86)

(1)

1

$143

C

Total Implied

Enterprise Value

1.75%

$2,929

2,815

2,710

2019E

$280

3

(26)

(1)

(0)

1

$214

2.00%

$3,027

2,792

2020E

$290

1.50%

$18.75

16.75

15.25

(29)

(14)

3

(26)

[1]

[0]

1

$224

Normalized

$290

($29)

($14)

Implied Equity Value

per Diluted Share

1.75%

$20.25

18.25

16.50

(30)

(0)

1

$217

Net Debt

+ Pref

($1,740)

(1,740)

(1,740)

Discount Rate

2.00%

$22.00

19.75

17.75

Discount Rate

8.25%

8.50%

8.75%

Bank of America

Merrill Lynch

Implied Core EBITDA Multiple

Perpetuity Growth

1.50%

1.75%

1253

12.1x

11,6x

8.25%

8.50%

12.0x

11.6x

11.2x

(1)

Terminal Value as % of Total Value

1.50%

77.4%

76.7%

75.9%

($14)

58.1

1.50% 1.75% 2.00%

$1,085 $1,175 $1,272

1,061

955

(14)

(14)

978

879

1,150

1,037

58.1

58.1

A Assumes $71 million of debt treated as cash proceeds along with estimated cash proceeds of $65 million to account for full transaction value of joint venture structuring.

Perpetuity Growth

2.00%

13.1x

12.6x

12.1x

1.75%

78.1%

78.8%

77.4% 78.1%

76.6% 77.3%

Source: RHO Projection.

Note: Figures in millions, except per share amounts. Present value dote of January 1, 2016 based on mid year discounting convention. Implied equity value per diluted share rounded to nearest $0.25. Stock bosed compensation treated as cash exprose.

(10) Based on 2020 RHO Projections normalized to reflect ending of TIF soles fox revenue and other costs.

Normalized year volue assumes each property undergoes $1.8 million refresh every 15 years.

Based on 2021 RHO Projection of $271 million for CORE EBITDA (Core NO! less cash G&A) os provided by RHO management.View entire presentation