Credit Suisse Credit Presentation Deck

Deleveraging to significantly reduce funding needs

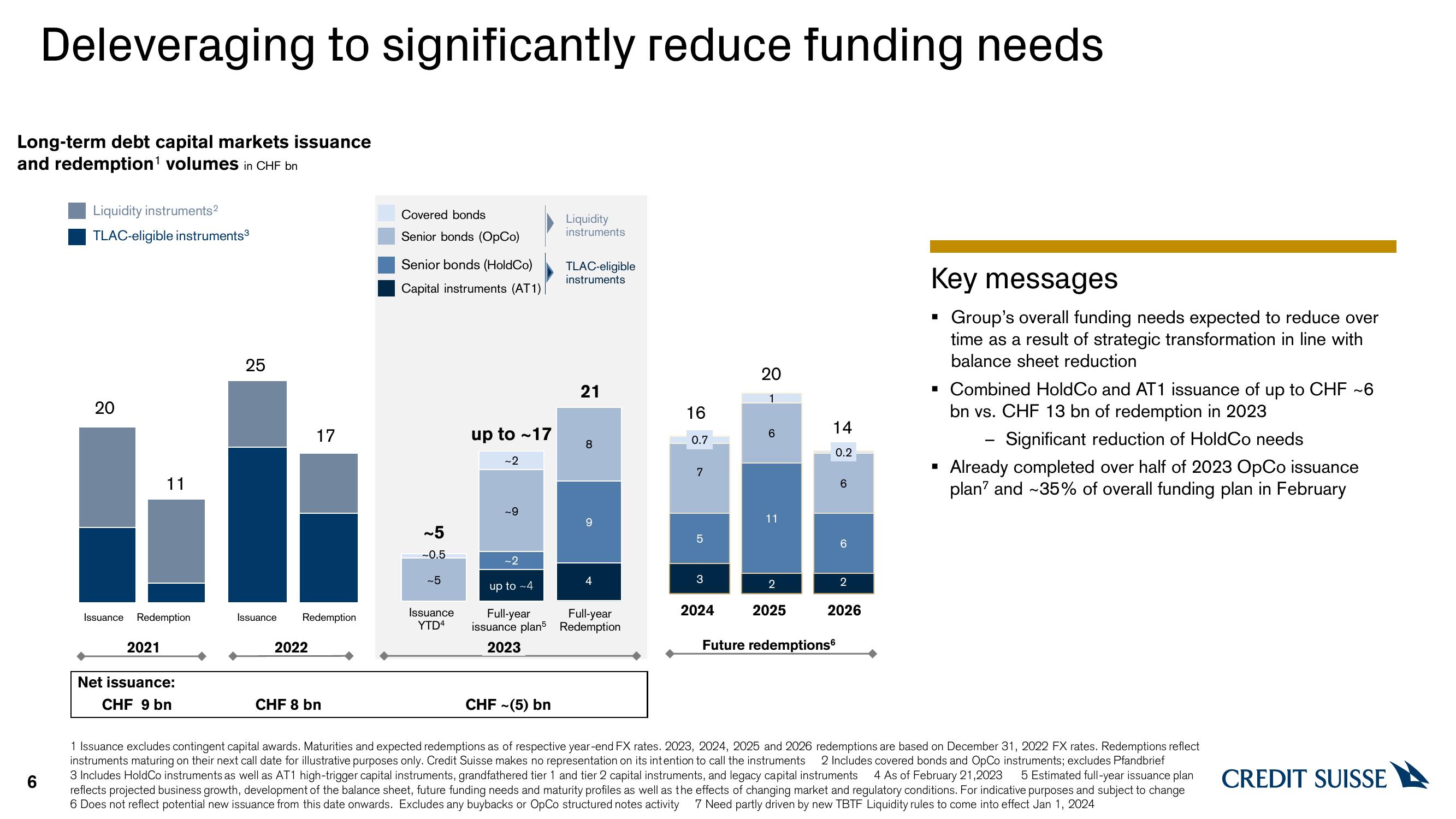

Long-term debt capital markets issuance

and redemption¹ volumes in CHF bn

6

Liquidity instruments²

TLAC-eligible instruments³

20

Issuance

11

Redemption

2021

Net issuance:

CHF 9 bn

25

Issuance

17

Redemption

2022

CHF 8 bn

Covered bonds

Senior bonds (OpCo)

Senior bonds (HoldCo)

Capital instruments (AT1)

~5

~0.5

Issuance

YTD4

up to -17

~2

~2

up to ~4

Liquidity

instruments

CHF ~(5) bn

TLAC-eligible

instruments

21

8

9

4

Full-year Full-year

issuance plan5 Redemption

2023

16

0.7

7

5

3

2024

20

6

11

2

2025

14

0.2

Future redemptions

CO

6

6

2

2026

Key messages

Group's overall funding needs expected to reduce over

time as a result of strategic transformation in line with

balance sheet reduction

■

▪ Combined HoldCo and AT1 issuance of up to CHF ~6

bn vs. CHF 13 bn of redemption in 2023

Significant reduction of HoldCo needs

N

Already completed over half of 2023 OpCo issuance

plan² and ~35% of overall funding plan in February

1 Issuance excludes contingent capital awards. Maturities and expected redemptions as of respective year-end FX rates. 2023, 2024, 2025 and 2026 redemptions are based on December 31, 2022 FX rates. Redemptions reflect

instruments maturing on their next call date for illustrative purposes only. Credit Suisse makes no representation on its intention to call the instruments 2 Includes covered bonds and OpCo instruments; excludes Pfandbrief

3 Includes HoldCo instruments as well as AT1 high-trigger capital instruments, grandfathered tier 1 and tier 2 capital instruments, and legacy capital instruments 4 As of February 21,2023 5 Estimated full-year issuance plan

reflects projected business growth, development of the balance sheet, future funding needs and maturity profiles as well as the effects of changing market and regulatory conditions. For indicative purposes and subject to change

6 Does not reflect potential new issuance from this date onwards. Excludes any buybacks or OpCo structured notes activity 7 Need partly driven by new TBTF Liquidity rules to come into effect Jan 1, 2024

CREDIT SUISSEView entire presentation