Main Street Capital Investor Day Presentation Deck

Stress Test 2023 Leverage Position

Adjusted to the

High End Target

Leverage

4,609,255

($'s in 000's)

Total Assets

Debt Capital

Revolving Credit Facility

SBIC Debentures

Notes Payable

Total Debt

Total Debt, excl. SBIC

Debentures

Net Asset Value (NAV)

As of March

31, 2023

$ 4,293,255

$ 564,000 $

334,000 $

$ 1,100,000

$ 1,998,000 $

$ 1,664,000

$ 2,172,922

New

Investments

funded by Debt

316,000

$

2.30

0.77

$

300,000 $ 864,000

16,000 $ 350,000

$ 1,100,000

316,000 $ 2,314,000

$

$

1,964,000

2,172,922

2.10

Stress Test

(10% reduction

in Fair Value

$ (460,926) $

0.90

$

$

Proforma after

Stress Impacts

$

$

$

$

(460,926) $

4,148,330

NYSE: MAIN

1,964,000

1.87

MAINST

CAPITAL CORPORATION

1.15

Additional

Equity

Issuances

864,000 $ (105,000) $

350,000

$

1,100,000

$

2,314,000 $ (105,000) $

$

1,711,997 $ 105,000 $

Proforma after

Additional Equity

Issuances

$

4,148,330

759,000

350,000

1,100,000

2,209,000

Asset Coverage Ratio

Debt to Equity Ratio

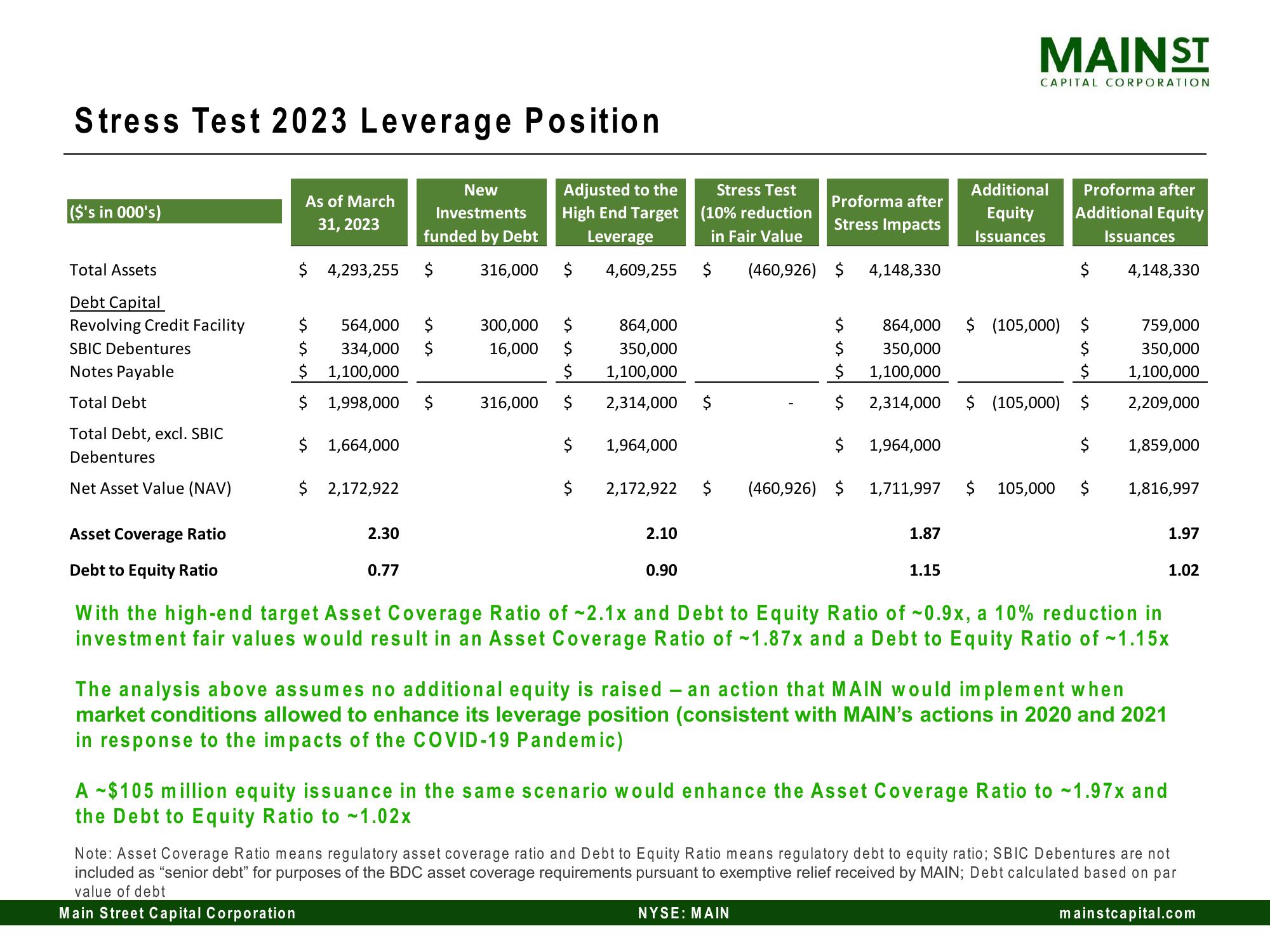

With the high-end target Asset Coverage Ratio of -2.1x and Debt to Equity Ratio of ~0.9x, a 10% reduction in

investment fair values would result in an Asset Coverage Ratio of ~1.87x and a Debt to Equity Ratio of ~1.15x

1,859,000

1,816,997

The analysis above assumes no additional equity is raised - an action that MAIN would implement when

market conditions allowed to enhance its leverage position (consistent with MAIN's actions in 2020 and 2021

in response to the impacts of the COVID-19 Pandemic)

1.97

1.02

A -$105 million equity issuance in the same scenario would enhance the Asset Coverage Ratio to -1.97x and

the Debt to Equity Ratio to -1.02x

Note: Asset Coverage Ratio means regulatory asset coverage ratio and Debt to Equity Ratio means regulatory debt to equity ratio; SBIC Debentures are not

included as "senior debt" for purposes of the BDC asset coverage requirements pursuant to exemptive relief received by MAIN; Debt calculated based on par

value of debt

Main Street Capital Corporation

mainstcapital.comView entire presentation