Tradeweb Investor Presentation Deck

4. TANGIBLE GROWTH OPPORTUNITIES

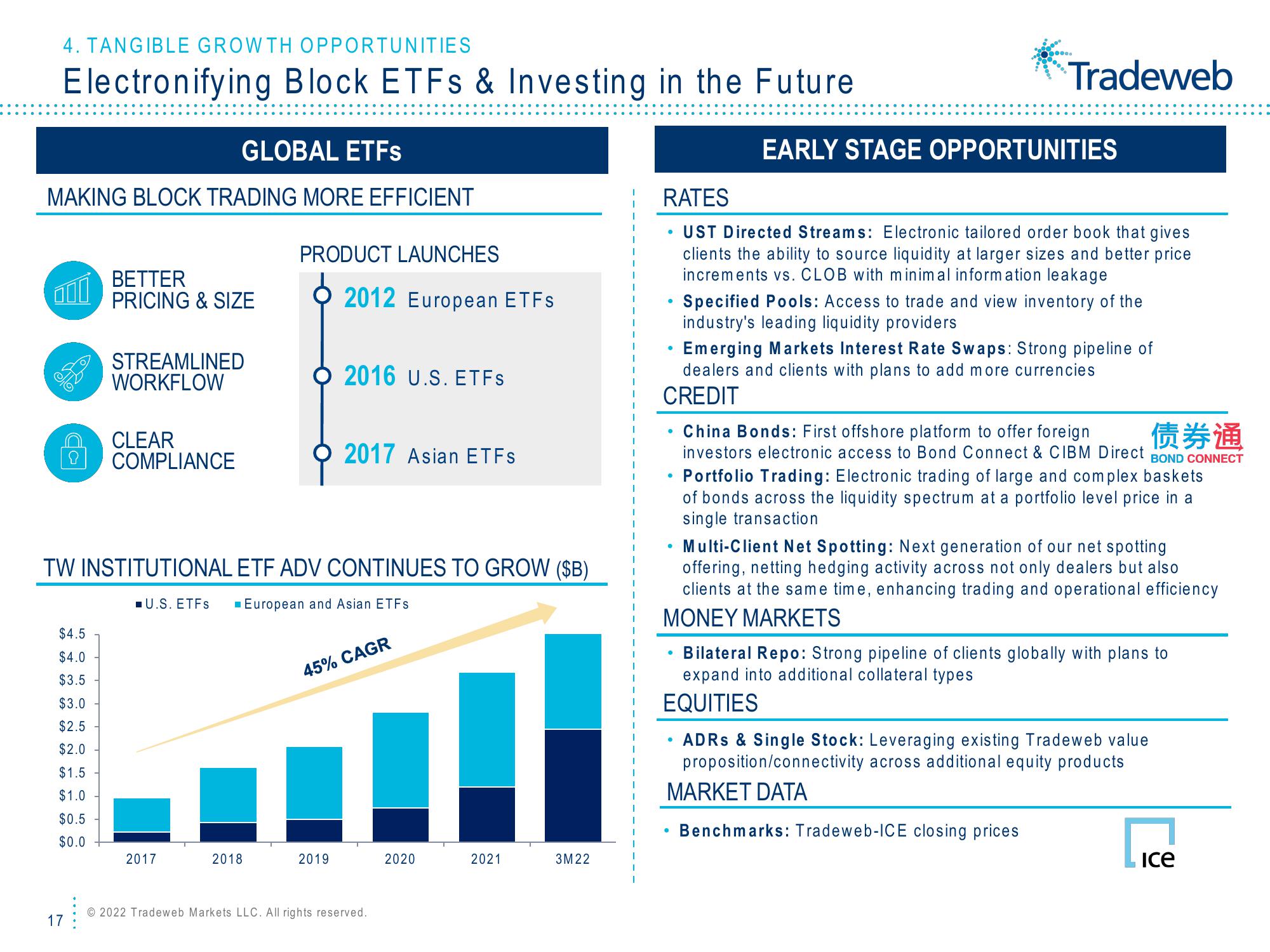

Electronifying Block ETFs & Investing in the Future

MAKING BLOCK TRADING MORE EFFICIENT

$4.5

$4.0

$3.5

$3.0

$2.5

$2.0

$1.5

$1.0

$0.5

$0.0

17

GLOBAL ETFs

BETTER

PRICING & SIZE

STREAMLINED

WORKFLOW

CLEAR

COMPLIANCE

2017

PRODUCT LAUNCHES

TW INSTITUTIONAL ETF ADV CONTINUES TO GROW ($B)

■U.S. ETFs ■ European and Asian ETFs

2018

2012 European ETFs

O 2016 U.S. ETFs

2017 Asian ETFs

2019

45% CAGR

Ⓒ2022 Tradeweb Markets LLC. All rights reserved.

2020

2021

3M22

●

●

RATES

UST Directed Streams: Electronic tailored order book that gives

clients the ability to source liquidity at larger sizes and better price

increments vs. CLOB with minimal information leakage

●

....

Tradeweb

EARLY STAGE OPPORTUNITIES

Emerging Markets Interest Rate Swaps: Strong pipeline of

dealers and clients with plans to add more currencies

CREDIT

●

Specified Pools: Access to trade and view inventory of the

industry's leading liquidity providers

●

Multi-Client Net Spotting: Next generation of our net spotting

offering, netting hedging activity across not only dealers but also

clients at the same time, enhancing trading and operational efficiency

MONEY MARKETS

债券通

China Bonds: First offshore platform to offer foreign

investors electronic access to Bond Connect & CIBM Direct BOND CONNECT

Portfolio Trading: Electronic trading of large and complex baskets

of bonds across the liquidity spectrum at a portfolio level price in a

single transaction

Bilateral Repo: Strong pipeline of clients globally with plans to

expand into additional collateral types

EQUITIES

ADRS & Single Stock: Leveraging existing Tradeweb value

proposition/connectivity across additional equity products

MARKET DATA

Benchmarks: Tradeweb-ICE closing pricesView entire presentation