Antero Midstream Partners Mergers and Acquisitions Presentation Deck

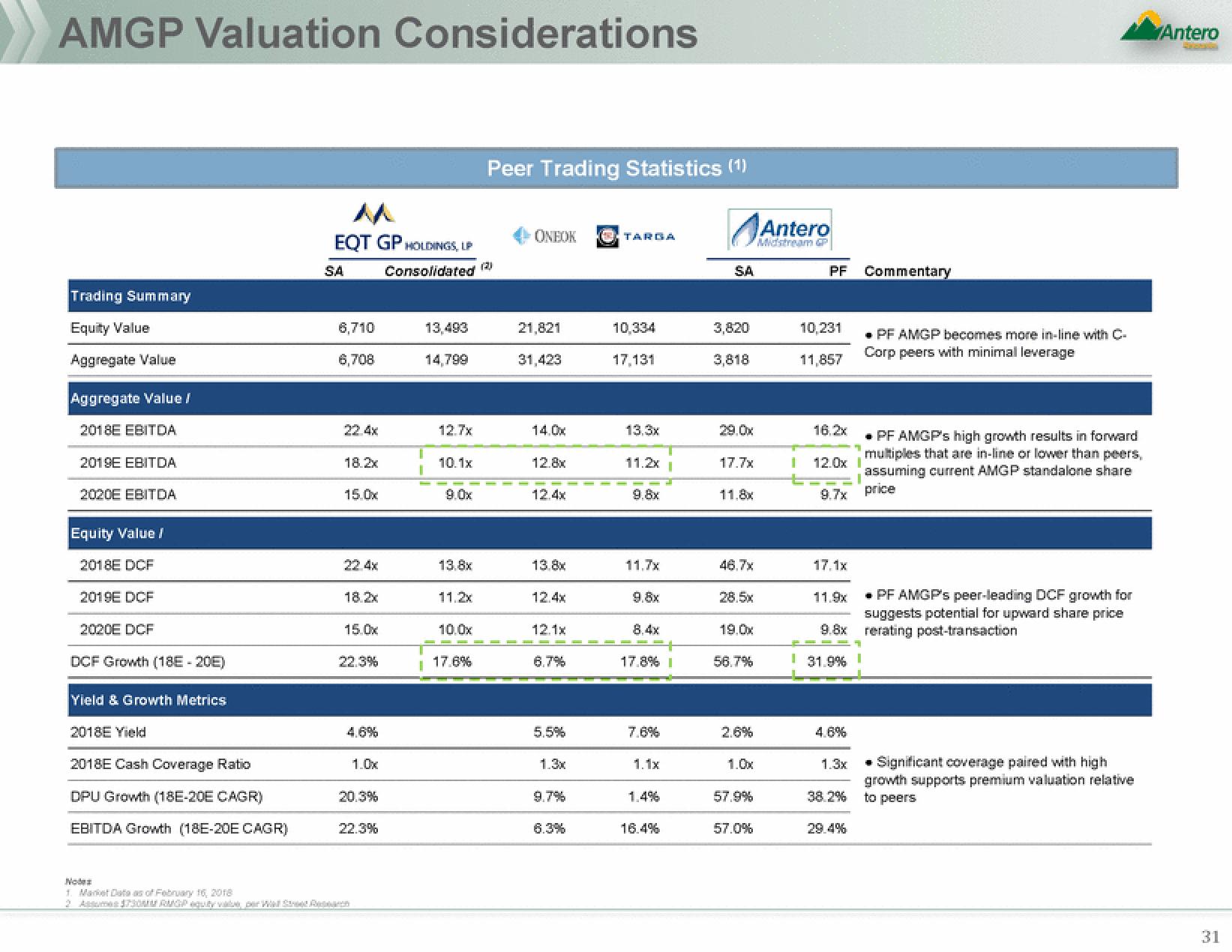

AMGP Valuation Considerations

Trading Summary

Equity Value

Aggregate Value

Aggregate Value /

2018E EBITDA

2019E EBITDA

2020E EBITDA

Equity Value /

2018E DCF

2019E DCF

2020E DCF

DCF Growth (18E-20E)

Yield & Growth Metrics

2018E Yield

2018E Cash Coverage Ratio

DPU Growth (18E-20E CAGR)

EBITDA Growth (18E-20E CAGR)

1. Market Data as of February 16, 2018

M

EQT GP HOLDINGS, LP

SA

6,710

6,708

18.2x

15.0x

22.4x

18.2x

15.0x

22.3%

1.0x

20.3%

22.3%

Consolidated (2)

i

13,493

14,799

12.7x

10.1x

9.0x

13.8x

11.2x

10.0x

Peer Trading Statistics (1)

I 17.6%

ONEOK

21,821

31,423

14.0x

12.8x

12.4x

13.8x

12.4x

12.1x

6.7%

5.5%

1.3x

9.7%

6.3%

TARGA

RGA

10,334

17,131

13.3x

11.2x

9.8x

11.7x

9.8x

8.4x

17.8% I

7.6%

1.1x

1.4%

16.4%

SA

3,820

3,818

29.0x

17.7x

11.8x

46.7x

28.5

19.0x

56.7%

2.6%

1.0x

Antero

Midstream GP

57.9%

57.0%

PF

10,231

11,857

16.2x

1 12.0x

9.7x

17.1x

11.9x

4.6%

* PF AMGP's peer-leading DCF growth for

suggests potential for upward share price

9.8x rerating post-transaction

31.9%

1.3x

38.2%

Commentary

29.4%

PF AMGP becomes more in-line with C-

Corp peers with minimal leverage

* PF AMGP's high growth results in forward

multiples that are in-line or lower than peers,

assuming current AMGP standalone share

price

Significant coverage paired with high

growth supports premium valuation relative

to peers

Antero

31View entire presentation