SmileDirectClub Investor Presentation Deck

●

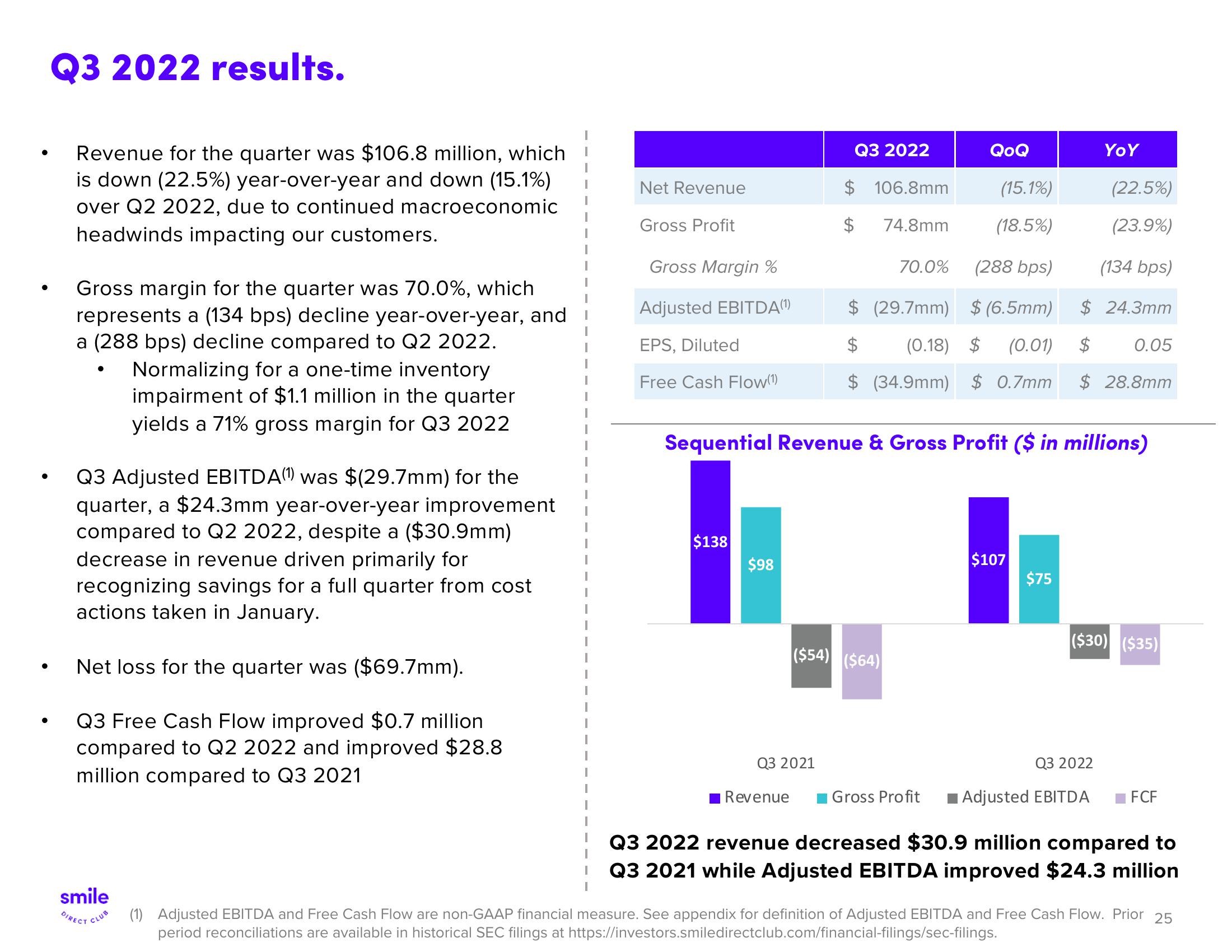

Q3 2022 results.

Revenue for the quarter was $106.8 million, which

is down (22.5%) year-over-year and down (15.1%)

over Q2 2022, due to continued macroeconomic

headwinds impacting our customers.

Gross margin for the quarter was 70.0%, which

represents a (134 bps) decline year-over-year, and

a (288 bps) decline compared to Q2 2022.

●

Q3 Adjusted EBITDA(¹) was $(29.7mm) for the

quarter, a $24.3mm year-over-year improvement

compared to Q2 2022, despite a ($30.9mm)

decrease in revenue driven primarily for

recognizing savings for a full quarter from cost

actions taken in January.

Net loss for the quarter was ($69.7mm).

Q3 Free Cash Flow improved $0.7 million

compared to Q2 2022 and improved $28.8

million compared to Q3 2021

smile

DIRECT

Normalizing for a one-time inventory

impairment of $1.1 million in the quarter

yields a 71% gross margin for Q3 2022

CLUB

Net Revenue

Gross Profit

Gross Margin %

Adjusted EBITDA(¹)

EPS, Diluted

Free Cash Flow(¹)

$138

$98

Q3 2022

$106.8mm

Q3 2021

Revenue

(15.1%)

(18.5%)

(288 bps)

$ (29.7mm) $ (6.5mm)

(0.18) $ (0.01)

$

$ (34.9mm) $ 0.7mm

($54) ($64)

74.8mm

70.0%

QoQ

Sequential Revenue & Gross Profit ($ in millions)

Gross Profit

$107

$75

YOY

(22.5%)

(23.9%)

(134 bps)

$24.3mm

$ 0.05

$28.8mm

Q3 2022

($30) ($35)

■Adjusted EBITDA FCF

Q3 2022 revenue decreased $30.9 million compared to

Q3 2021 while Adjusted EBITDA improved $24.3 million

(1) Adjusted EBITDA and Free Cash Flow are non-GAAP financial measure. See appendix for definition of Adjusted EBITDA and Free Cash Flow. Prior 25

period reconciliations are available in historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.View entire presentation