Benson Hill SPAC Presentation Deck

BENSON HILL

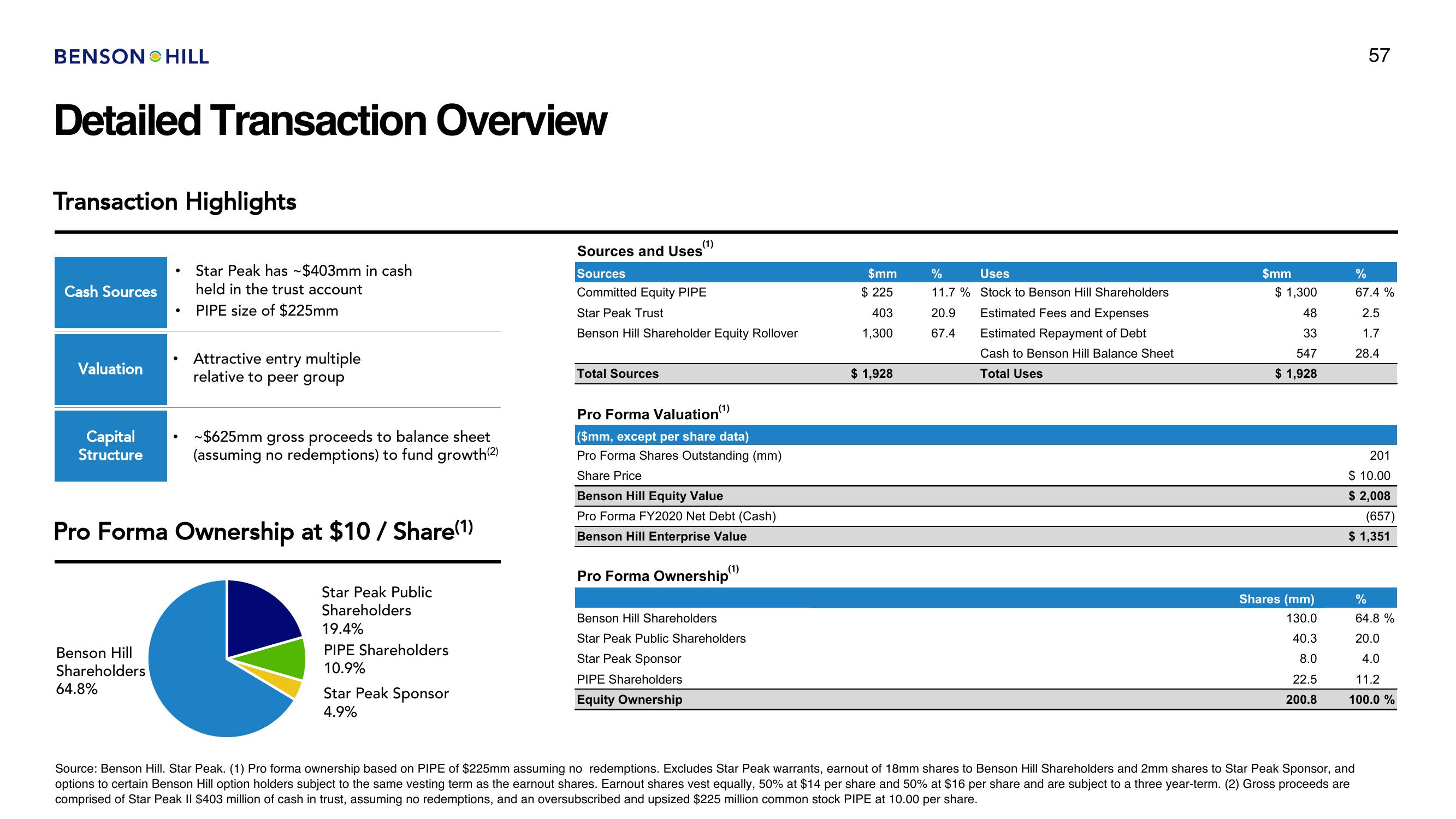

Detailed Transaction Overview

Transaction Highlights

Cash Sources

Valuation

Capital

Structure

●

Benson Hill

Shareholders

64.8%

●

●

Star Peak has ~$403mm in cash

held in the trust account

PIPE size of $225mm

Attractive entry multiple

relative to peer group

~$625mm gross proceeds to balance sheet

(assuming no redemptions) to fund growth(2)

Pro Forma Ownership at $10/Share(¹)

Star Peak Public

Shareholders

19.4%

PIPE Shareholders

10.9%

Star Peak Sponsor

4.9%

(1)

Sources and Uses

Sources

Committed Equity PIPE

Star Peak Trust

Benson Hill Shareholder Equity Rollover

Total Sources

Pro Forma Valuation (¹)

($mm, except per share data)

Pro Forma Shares Outstanding (mm)

Share Price

Benson Hill Equity Value

Pro Forma FY2020 Net Debt (Cash)

Benson Hill Enterprise Value

Pro Forma Ownership

Benson Hill Shareholders

Star Peak Public Shareholders

Star Peak Sponsor

PIPE Shareholders

Equity Ownership

$mm

$225

403

1,300

$ 1,928

Uses

%

11.7% Stock to Benson Hill Shareholders

Estimated Fees and Expenses

20.9

67.4

Estimated Repayment of Debt

Cash to Benson Hill Balance Sheet

Total Uses

$mm

$ 1,300

48

33

547

$ 1,928

Shares (mm)

130.0

40.3

8.0

22.5

200.8

57

%

67.4 %

2.5

1.7

28.4

201

$10.00

$ 2,008

(657)

$ 1,351

Source: Benson Hill. Star Peak. (1) Pro forma ownership based on PIPE of $225mm assuming no redemptions. Excludes Star Peak warrants, earnout of 18mm shares to Benson Hill Shareholders and 2mm shares to Star Peak Sponsor, and

options to certain Benson Hill option holders subject to the same vesting term as the earnout shares. Earnout shares vest equally, 50% at $14 per share and 50% at $16 per share and are subject to a three year-term. (2) Gross proceeds are

comprised of Star Peak II $403 million of cash in trust, assuming no redemptions, and an oversubscribed and upsized $225 million common stock PIPE at 10.00 per share.

%

64.8 %

20.0

4.0

11.2

100.0 %View entire presentation