MP Materials Results Presentation Deck

14

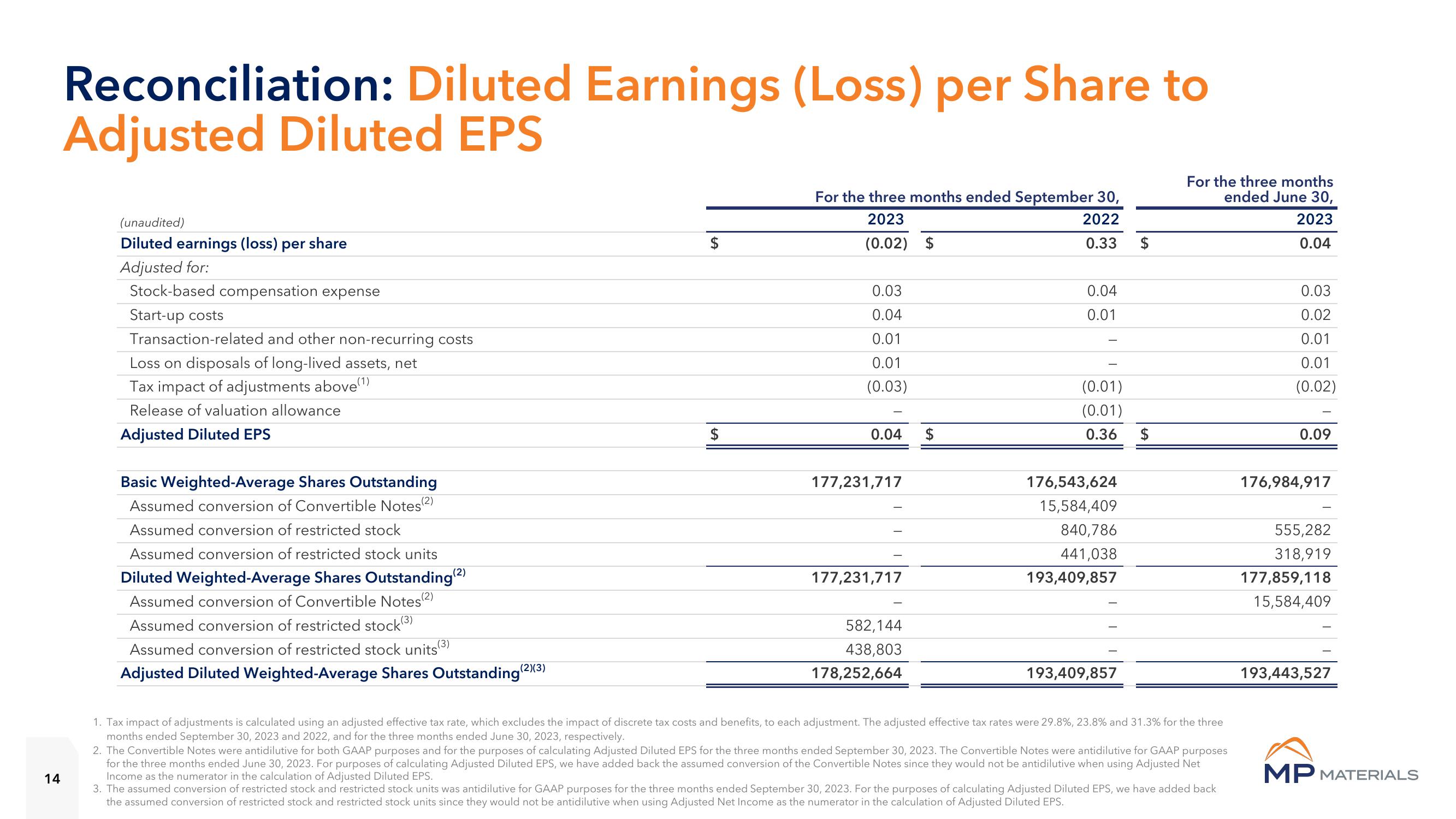

Reconciliation: Diluted Earnings (Loss) per Share to

Adjusted Diluted EPS

(unaudited)

Diluted earnings (loss) per share

Adjusted for:

Stock-based compensation expense

Start-up costs

Transaction-related and other non-recurring costs

Loss on disposals of long-lived assets, net

Tax impact of adjustments above(1)

Release of valuation allowance

Adjusted Diluted EPS

(2)

Basic Weighted-Average Shares Outstanding

Assumed conversion of Convertible Notes (2)

Assumed conversion of restricted stock

Assumed conversion of restricted stock units

Diluted Weighted-Average Shares Outstanding (2

Assumed conversion of Convertible Notes(2)

Assumed conversion of restricted stock(3)

Assumed conversion of restricted stock units

Adjusted Diluted Weighted-Average Shares Outstanding ¹²

(3)

(2)(3)

$

$

For the three months ended September 30,

2022

2023

(0.02) $

0.33

0.03

0.04

0.01

0.01

(0.03)

0.04

177,231,717

177,231,717

582,144

438,803

178,252,664

$

0.04

0.01

(0.01)

(0.01)

0.36

176,543,624

15,584,409

840,786

441,038

193,409,857

193,409,857

$

For the three months

ended June 30,

2023

0.04

1. Tax impact of adjustments is calculated using an adjusted effective tax rate, which excludes the impact of discrete tax costs and benefits, to each adjustment. The adjusted effective tax rates were 29.8%, 23.8% and 31.3% for the three

months ended September 30, 2023 and 2022, and for the three months ended June 30, 2023, respectively.

2. The Convertible Notes were antidilutive for both GAAP purposes and for the purposes of calculating Adjusted Diluted EPS for the three months ended September 30, 2023. The Convertible Notes were antidilutive for GAAP purposes

for the three months ended June 30, 2023. For purposes of calculating Adjusted Diluted EPS, we have added back the assumed conversion of the Convertible Notes since they would not be antidilutive when using Adjusted Net

Income as the numerator in the calculation of Adjusted Diluted EPS.

3. The assumed conversion of restricted stock and restricted stock units was antidilutive for GAAP purposes for the three months ended September 30, 2023. For the purposes of calculating Adjusted Diluted EPS, we have added back

the assumed conversion of restricted stock and restricted stock units since they would not be antidilutive when using Adjusted Net Income as the numerator in the calculation of Adjusted Diluted EPS.

0.03

0.02

0.01

0.01

(0.02)

0.09

176,984,917

555,282

318,919

177,859,118

15,584,409

193,443,527

MP MATERIALSView entire presentation