Kimco and Weingarten Strategic Merger investor presentaton

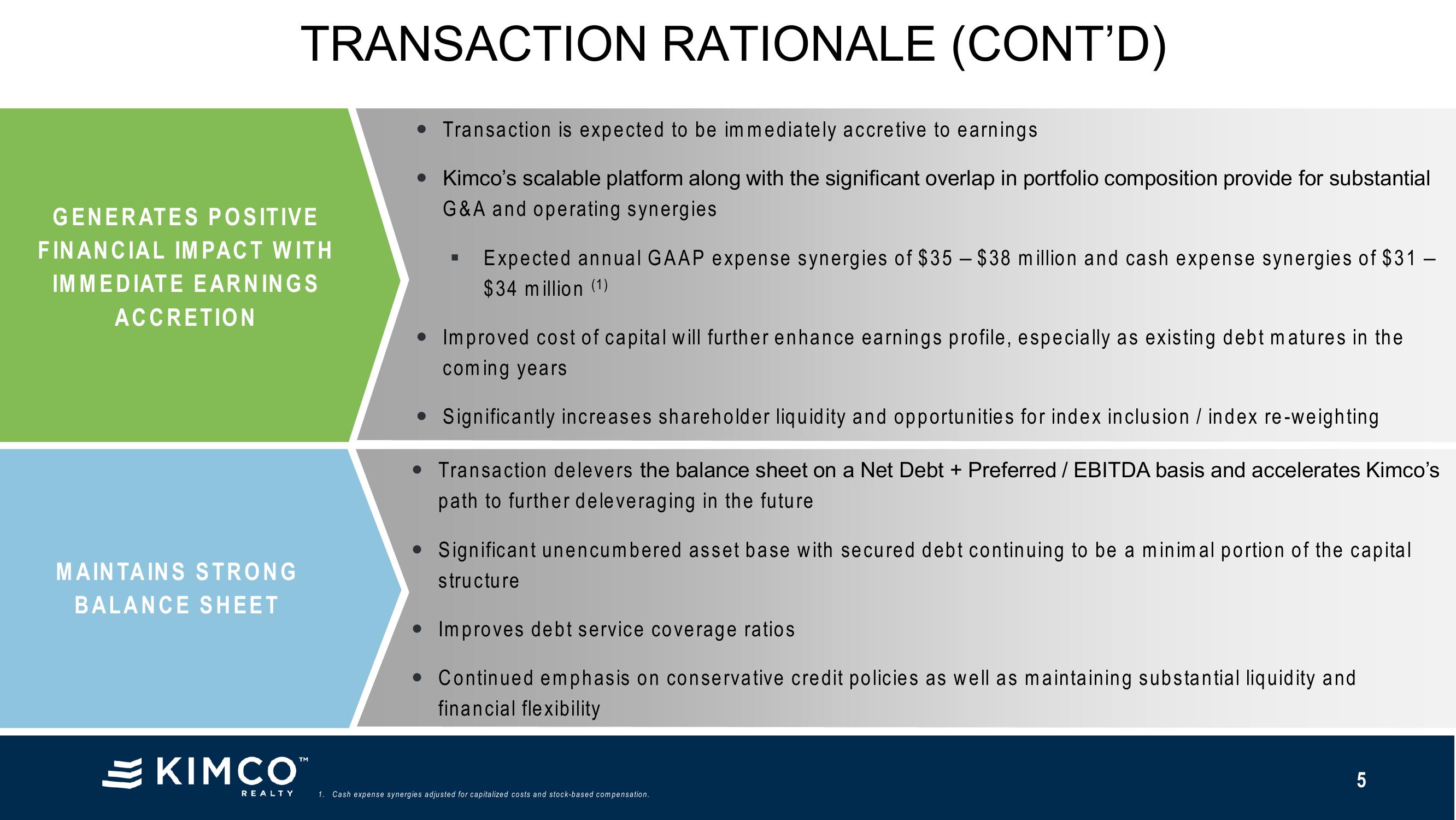

GENERATES POSITIVE

FINANCIAL IMPACT WITH

IMMEDIATE EARNINGS

ACCRETION

MAINTAINS STRONG

BALANCE SHEET

TRANSACTION RATIONALE (CONT'D)

KIMCO™

REALTY

• Transaction is expected to be immediately accretive to earnings

• Kimco's scalable platform along with the significant overlap in portfolio composition provide for substantial

G&A and operating synergies

■

Expected annual GAAP expense synergies of $35 - $38 million and cash expense synergies of $31-

$34 million (1)

• Improved cost of capital will further enhance earnings profile, especially as existing debt matures in the

coming years

• Significantly increases shareholder liquidity and opportunities for index inclusion / index re-weighting.

• Transaction de levers the balance sheet on a Net Debt + Preferred / EBITDA basis and accelerates Kimco's

path to further de leveraging in the future.

• Significant unencumbered asset base with secured debt continuing to be a minimal portion of the capital

structure

• Improves debt service coverage ratios

●

• Continued emphasis on conservative credit policies as well as maintaining substantial liquidity and

financial flexibility

1. Cash expense synergies adjusted for capitalized costs and stock-based compensation.

5View entire presentation