Uber Mergers and Acquisitions Presentation Deck

Strategic Rationale 02

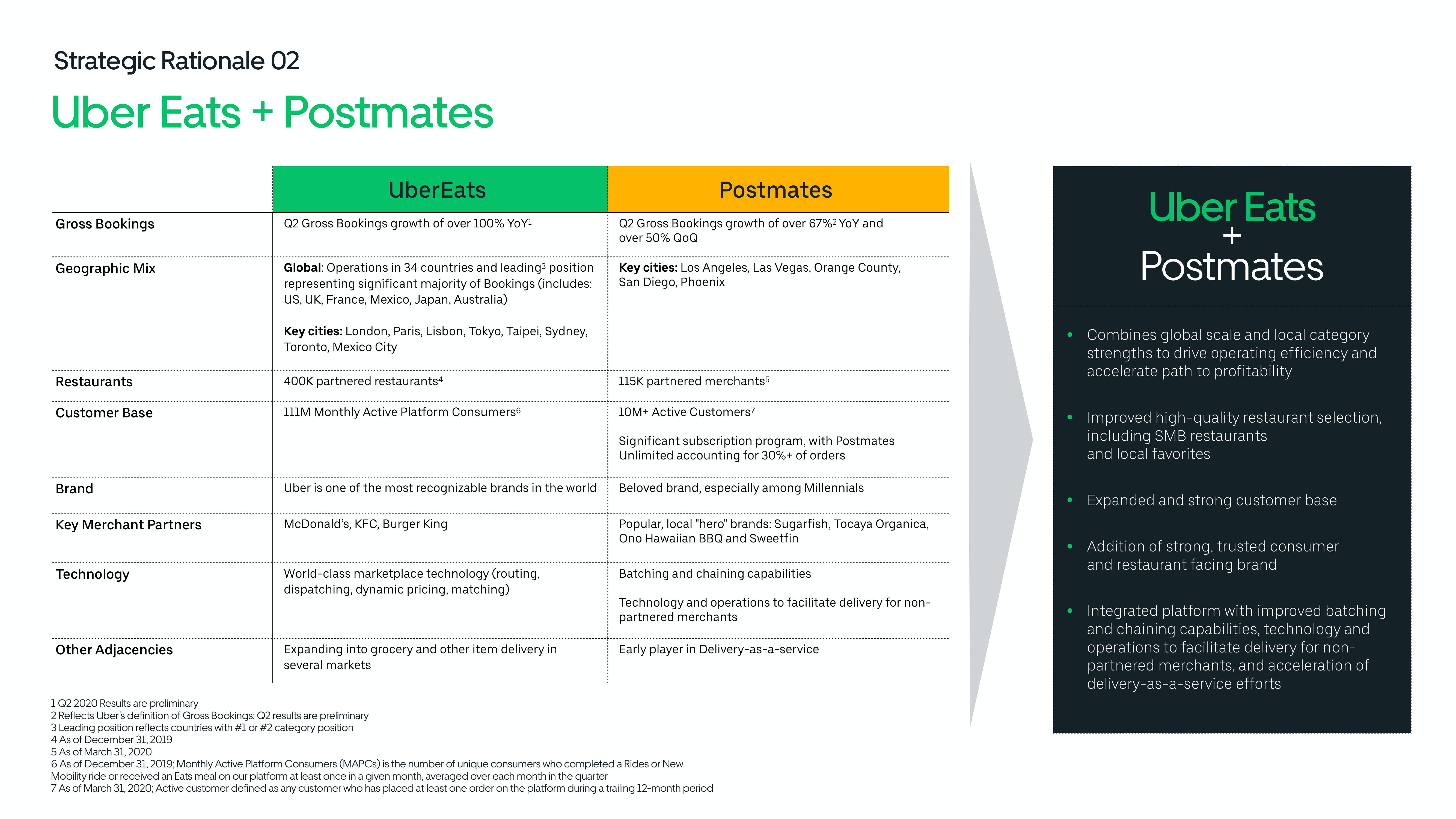

Uber Eats + Postmates

Gross Bookings

Geographic Mix

Restaurants

Customer Base

Brand

Key Merchant Partners

Technology

Other Adjacencies

UberEats

Q2 Gross Bookings growth of over 100% YoY¹

Global: Operations in 34 countries and leading³ position

representing significant majority of Bookings (includes:

US, UK, France, Mexico, Japan, Australia)

Key cities: London, Paris, Lisbon, Tokyo, Taipei, Sydney,

Toronto, Mexico City

400K partnered restaurants4

111M Monthly Active Platform Consumers

Uber is one of the most recognizable brands in the world

McDonald's, KFC, Burger King

World-class marketplace technology (routing,

dispatching, dynamic pricing, matching)

Expanding into grocery and other item delivery in

several markets

1 Q2 2020 Results are preliminary

2 Reflects Uber's definition of Gross Bookings; Q2 results are preliminary

3 Leading position reflects countries with #1 or #2 category position

4 As of December 31, 2019

Postmates

Q2 Gross Bookings growth of over 67%² YoY and

over 50% QOQ

Key cities: Los Angeles, Las Vegas, Orange County,

San Diego, Phoenix

115K partnered merchants5

10M+ Active Customers7

Significant subscription program, with Postmates

Unlimited accounting for 30%+ of orders

Beloved brand, especially among Millennials

Popular, local "hero" brands: Sugarfish, Tocaya Organica,

Ono Hawaiian BBQ and Sweetfin

Batching and chaining capabilities

Technology and operations to facilitate delivery for non-

partnered merchants

Early player in Delivery-as-a-service

5 As of March 31, 2020

6 As of December 31, 2019; Monthly Active Platform Consumers (MAPCS) is the number of unique consumers who completed a Rides or New

Mobility ride or received an Eats meal on our platform at least once in a given month, averaged over each month in the quarter

7 As of March 31, 2020; Active customer defined as any customer who has placed at least one order on the platform during a trailing 12-month period

Uber Eats

+

Postmates

• Combines global scale and local category

strengths to drive operating efficiency and

accelerate path to profitability

Improved high-quality restaurant selection,

including SMB restaurants

and local favorites

Expanded and strong customer base

• Addition of strong, trusted consumer

and restaurant facing brand

Integrated platform with improved batching

and chaining capabilities, technology and

operations to facilitate delivery for non-

partnered merchants, and acceleration of

delivery-as-a-service effortsView entire presentation