Yelp Investor Presentation Deck

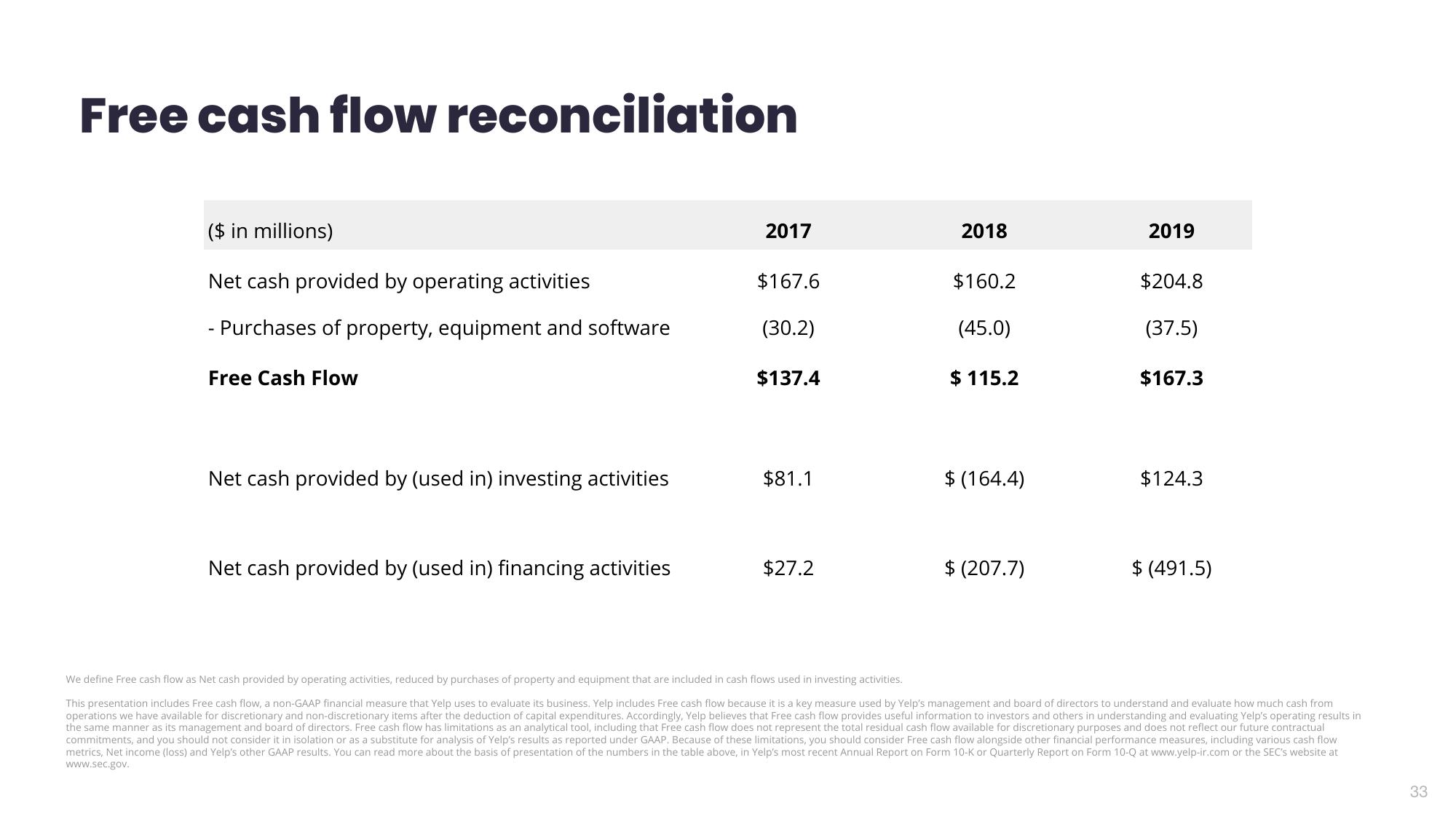

Free cash flow reconciliation

($ in millions)

Net cash provided by operating activities

- Purchases of property, equipment and software

Free Cash Flow

Net cash provided by (used in) investing activities

Net cash provided by (used in) financing activities

2017

$167.6

(30.2)

$137.4

$81.1

$27.2

2018

$160.2

(45.0)

$ 115.2

$ (164.4)

$ (207.7)

2019

$204.8

(37.5)

$167.3

$124.3

$ (491.5)

We define Free cash flow as Net cash provided by operating activities, reduced by purchases of property and equipment that are included in cash flows used in investing activities.

This presentation includes Free cash flow, a non-GAAP financial measure that Yelp uses to evaluate its business. Yelp includes Free cash flow because it is a key measure used by Yelp's management and board of directors to understand and evaluate how much cash from

operations we have available for discretionary and non-discretionary items after the deduction of capital expenditures. Accordingly, Yelp believes that Free cash flow provides useful information to investors and others in understanding and evaluating Yelp's operating results in

the same manner as its management and board of directors. Free cash flow has limitations as an analytical tool, including that Free cash flow does not represent the total residual cash flow available for discretionary purposes and does not reflect our future contractual

commitments, and you should not consider it in isolation or as a substitute for analysis of Yelp's results as reported under GAAP. Because of these limitations, you should consider Free cash flow alongside other financial performance measures, including various cash flow.

metrics, Net income (loss) and Yelp's other GAAP results. You can read more about the basis of presentation of the numbers in the table above, in Yelp's most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q at www.yelp-ir.com or the SEC's website at

www.sec.gov.

33View entire presentation