Comcast Results Presentation Deck

Cable: Strong Growth in Adjusted EBITDA and Net Cash Flow

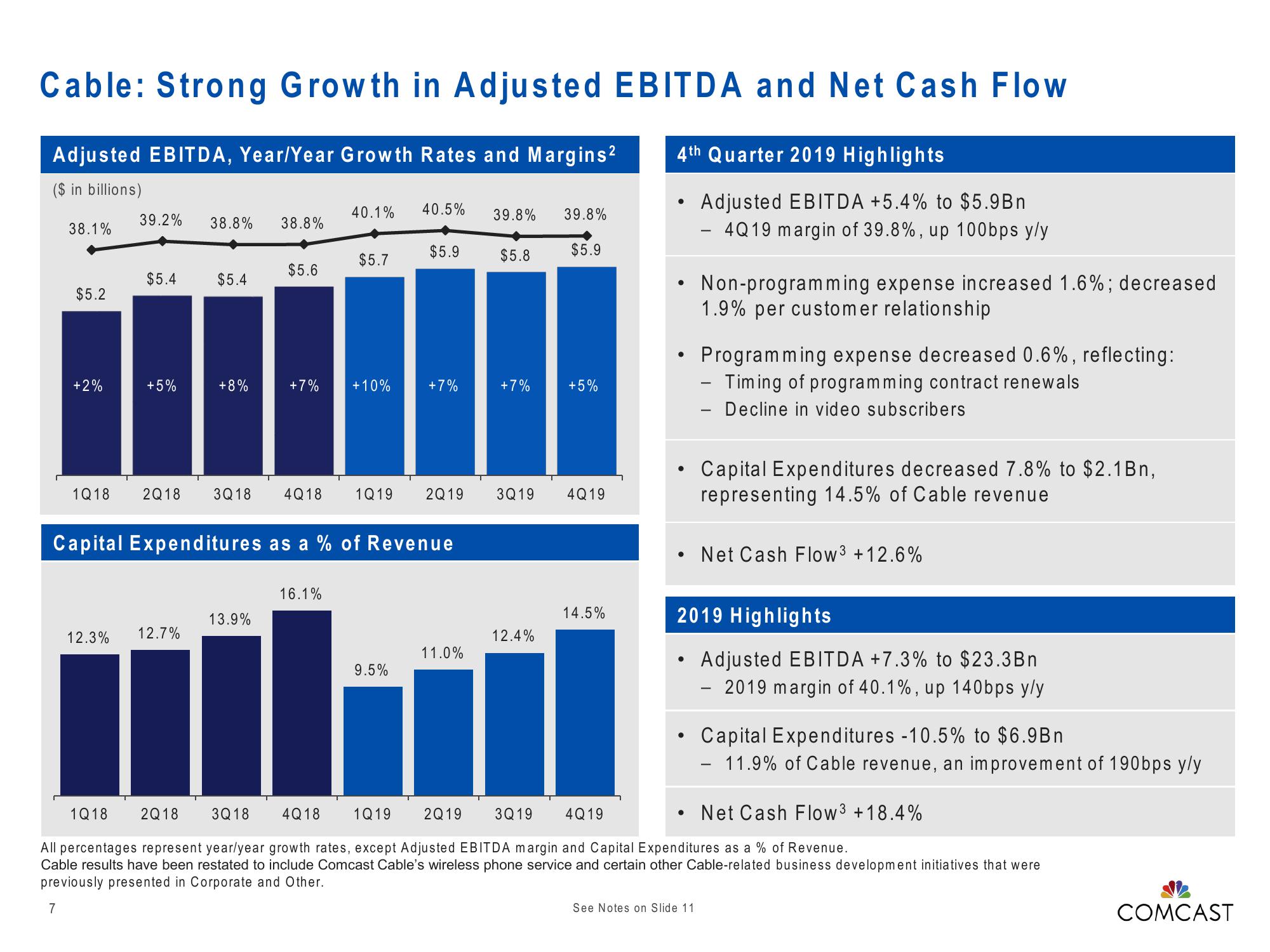

Adjusted EBITDA, Year/Year Growth Rates and Margins²

($ in billions)

38.1%

$5.2

+2%

1Q18

39.2%

$5.4

+5%

38.8% 38.8%

$5.4

12.3% 12.7%

+8%

$5.6

+7%

13.9%

40.1% 40.5%

$5.7

16.1%

+10%

Capital Expenditures as a % of Revenue

$5.9

+7%

2Q18 3Q18 4Q18 1Q19 2Q19 3Q19

9.5%

39.8% 39.8%

$5.9

11.0%

$5.8

+7%

12.4%

+5%

4Q19

14.5%

4th Quarter 2019 Highlights

Adjusted EBITDA +5.4% to $5.9Bn

4Q19 margin of 39.8%, up 100bps y/y

●

●

Non-programming expense increased 1.6%; decreased

1.9% per customer relationship

Programming expense decreased 0.6%, reflecting:

- Timing of programming contract renewals

Decline in video subscribers

See Notes on Slide 11

-

Capital Expenditures decreased 7.8% to $2.1 Bn,

representing 14.5% of Cable revenue

Net Cash Flow³ +12.6%

2019 Highlights

Adjusted EBITDA +7.3% to $23.3Bn

- 2019 margin of 40.1%, up 140bps y/y

Capital Expenditures -10.5% to $6.9Bn

11.9% of Cable revenue, an improvement of 190bps y/y

1Q18

2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19

Net Cash Flow³ +18.4%

All percentages represent year/year growth rates, except Adjusted EBITDA margin and Capital Expenditures as a % of Revenue.

Cable results have been restated to include Comcast Cable's wireless phone service and certain other Cable-related business development initiatives that were

previously presented in Corporate and Other.

7

COMCASTView entire presentation