MoneyLion Results Presentation Deck

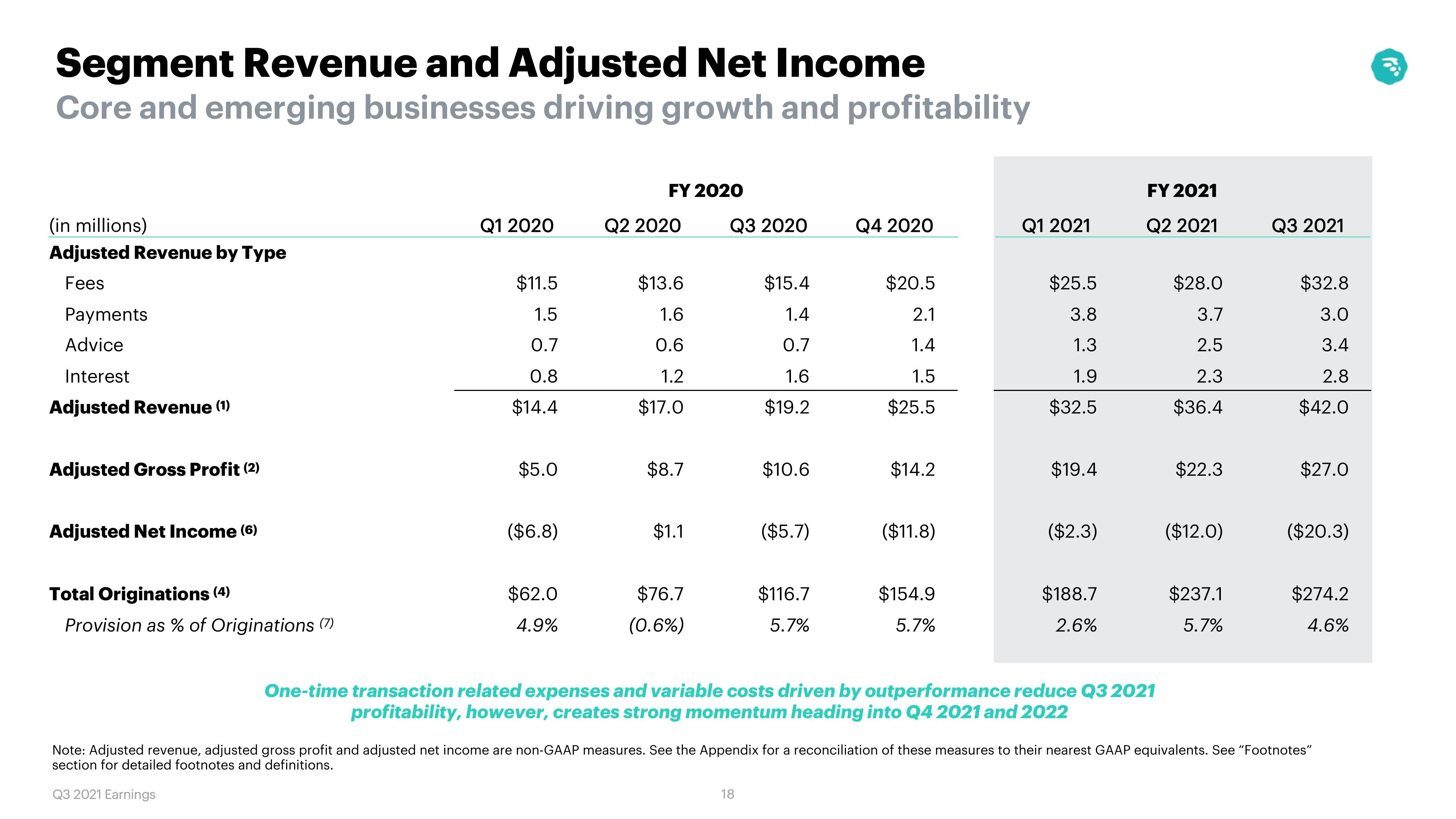

Segment Revenue and Adjusted Net Income

Core and emerging businesses driving growth and profitability

(in millions)

Adjusted Revenue by Type

Fees

Payments

Advice

Interest

Adjusted Revenue (1)

Adjusted Gross Profit (2)

Adjusted Net Income (6)

Total Originations (4)

Provision as % of Originations (7)

Q1 2020

$11.5

1.5

0.7

0.8

$14.4

$5.0

($6.8)

$62.0

4.9%

FY 2020

Q2 2020

$13.6

1.6

0.6

1.2

$17.0

$8.7

$1.1

$76.7

(0.6%)

Q3 2020

$15.4

1.4

0.7

1.6

$19.2

$10.6

18

($5.7)

$116.7

5.7%

Q4 2020

$20.5

2.1

1.4

1.5

$25.5

$14.2

($11.8)

$154.9

5.7%

Q1 2021

$25.5

3.8

1.3

1.9

$32.5

$19.4

($2.3)

$188.7

2.6%

FY 2021

Q2 2021

One-time transaction related expenses and variable costs driven by outperformance reduce Q3 2021

profitability, however, creates strong momentum heading into Q4 2021 and 2022

$28.0

3.7

2.5

2.3

$36.4

$22.3

($12.0)

$237.1

5.7%

Q3 2021

$32.8

3.0

3.4

2.8

$42.0

$27.0

($20.3)

$274.2

4.6%

Note: Adjusted revenue, adjusted gross profit and adjusted net income are non-GAAP measures. See the Appendix for a reconciliation of these measures to their nearest GAAP equivalents. See "Footnotes"

section for detailed footnotes and definitions.

Q3 2021 Earnings

1⁰⁰View entire presentation