Lumen Mergers and Acquisitions Presentation Deck

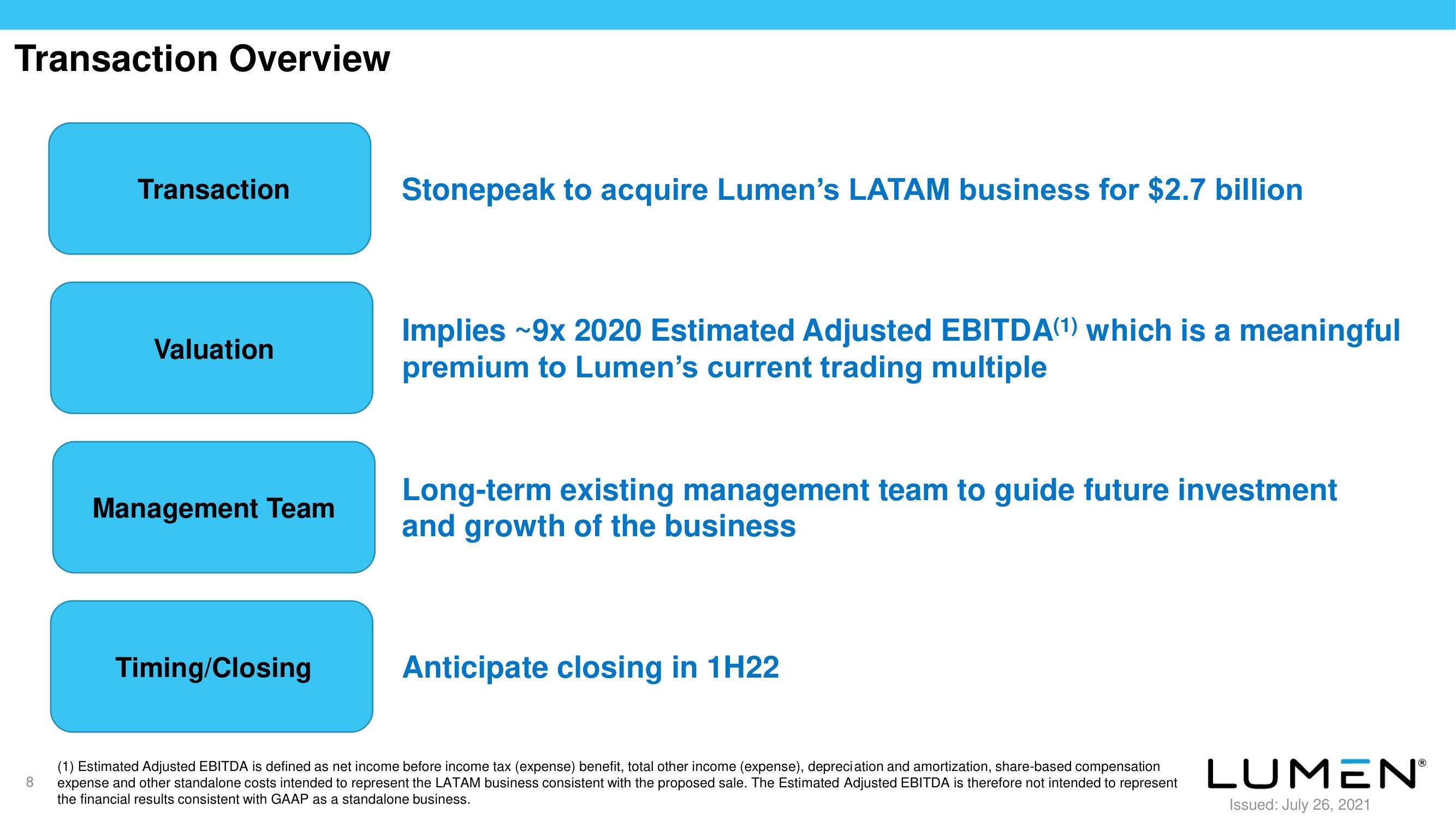

Transaction Overview

8

Transaction

Valuation

Management Team

Timing/Closing

Stonepeak to acquire Lumen's LATAM business for $2.7 billion

Implies ~9x 2020 Estimated Adjusted EBITDA(1) which is a meaningful

premium to Lumen's current trading multiple

Long-term existing management team to guide future investment

and growth of the business

Anticipate closing in 1H22

(1) Estimated Adjusted EBITDA is defined as net income before income tax (expense) benefit, total other income (expense), depreciation and amortization, share-based compensation

expense and other standalone costs intended to represent the LATAM business consistent with the proposed sale. The Estimated Adjusted EBITDA is therefore not intended to represent

the financial results consistent with GAAP as a standalone business.

LUMENⓇ

Issued: July 26, 2021View entire presentation