Melrose Results Presentation Deck

Melrose track record: managing successfully in a crisis

Melrose

Buy

Improve

Sell

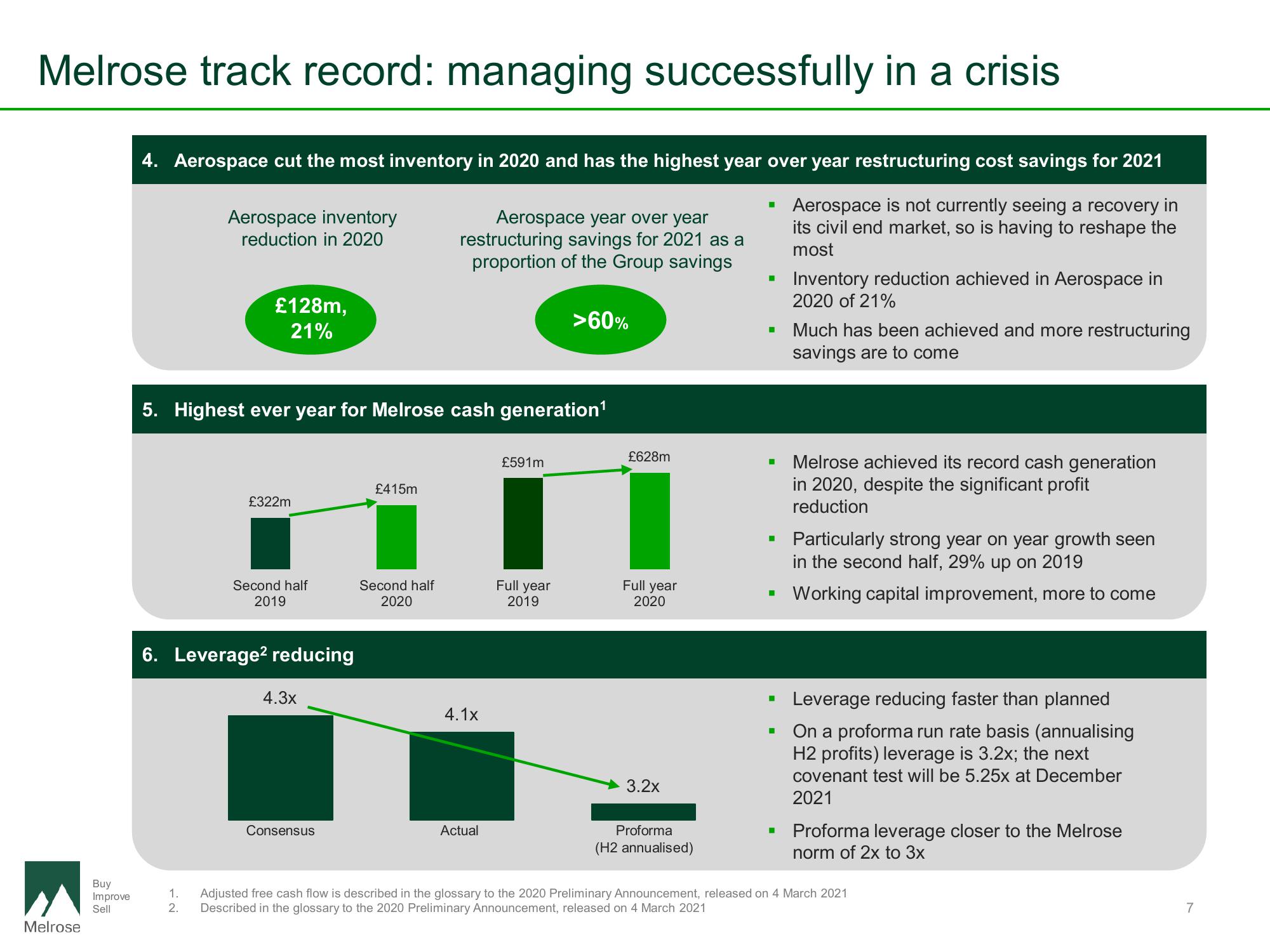

4. Aerospace cut the most inventory in 2020 and has the highest year over year restructuring cost savings for 2021

Aerospace is not currently seeing a recovery in

its civil end market, so is having to reshape the

most

Aerospace inventory

reduction in 2020

£128m,

21%

1.

2.

5. Highest ever year for Melrose cash generation¹

£322m

Second half

2019

6. Leverage² reducing

4.3x

Consensus

£415m

Aerospace year over year

restructuring savings for 2021 as a

proportion of the Group savings

Second half

2020

4.1x

Actual

£591m

>60%

Full year

2019

£628m

Full year

2020

3.2x

Proforma

(H2 annualised)

■

■

■

■

■

■

■

■

Inventory reduction achieved in Aerospace in

2020 of 21%

Much has been achieved and more restructuring

savings are to come

Melrose achieved its record cash generation

in 2020, despite the significant profit

reduction

Particularly strong year on year growth seen

in the second half, 29% up on 2019

Working capital improvement, more to come

Leverage reducing faster than planned

On a proforma run rate basis (annualising

H2 profits) leverage is 3.2x; the next

covenant test will be 5.25x at December

2021

Proforma leverage closer to the Melrose

norm of 2x to 3x

Adjusted free cash flow is described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

Described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

7View entire presentation