Azerion Results Presentation Deck

Strategy delivery

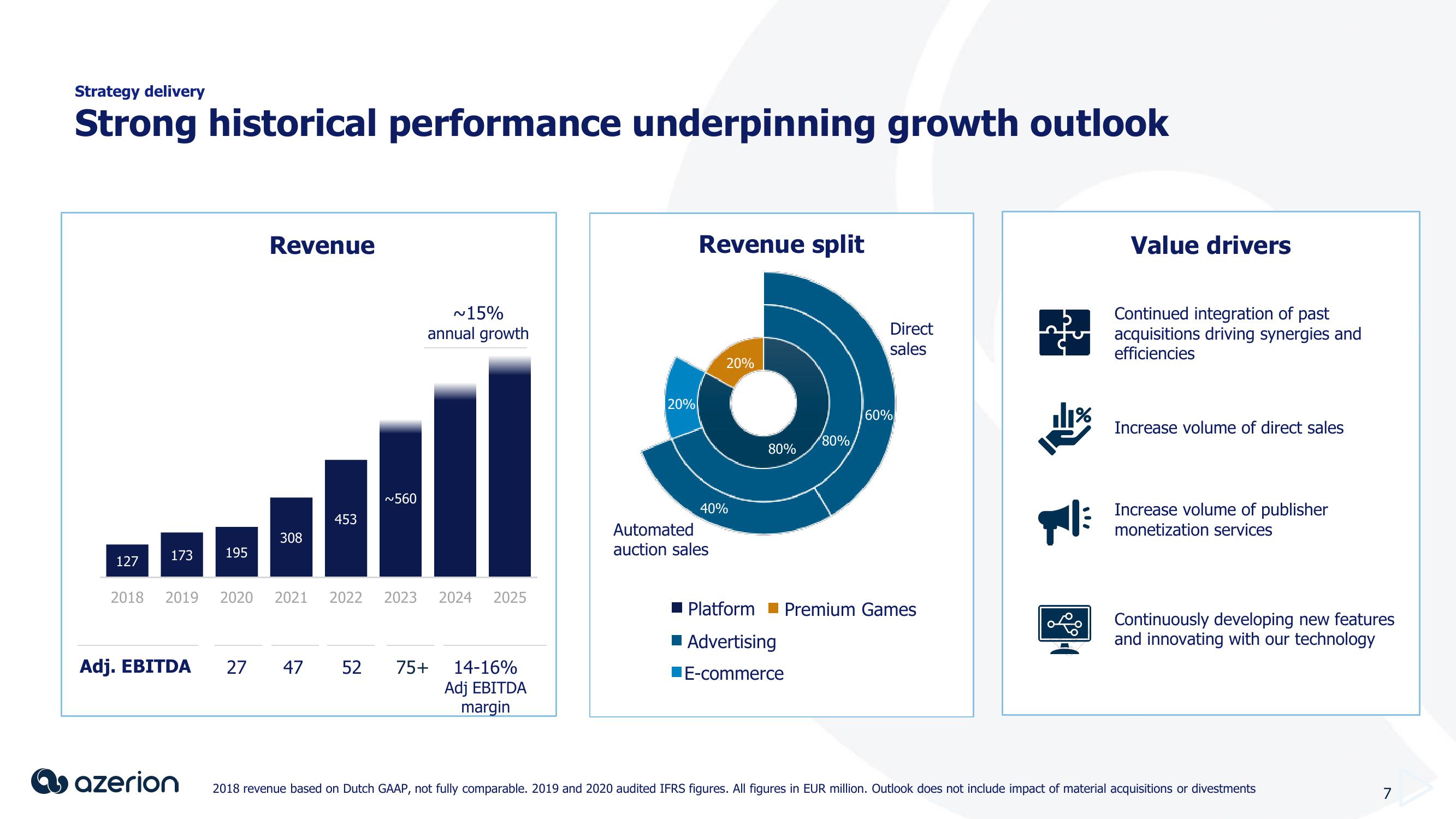

Strong historical performance underpinning growth outlook

127

173

all

~560

453

308

2022 2023 2024 2025

2018 2019

Adj. EBITDA

azerion

Revenue

195

~15%

annual growth

2020 2021

27 47 52 75+ 14-16%

Adj EBITDA

margin

20%

Revenue split

40%

Automated

auction sales

20%

80%

Platform

Advertising

E-commerce

'80%

Direct

sales

60%

Premium Games

11%

Value drivers

Continued integration of past

acquisitions driving synergies and

efficiencies

Increase volume of direct sales

Increase volume of publisher

monetization services

Continuously developing new features

and innovating with our technology

2018 revenue based on Dutch GAAP, not fully comparable. 2019 and 2020 audited IFRS figures. All figures in EUR million. Outlook does not include impact of material acquisitions or divestments

7View entire presentation