Markforged Results Presentation Deck

Financial Summary

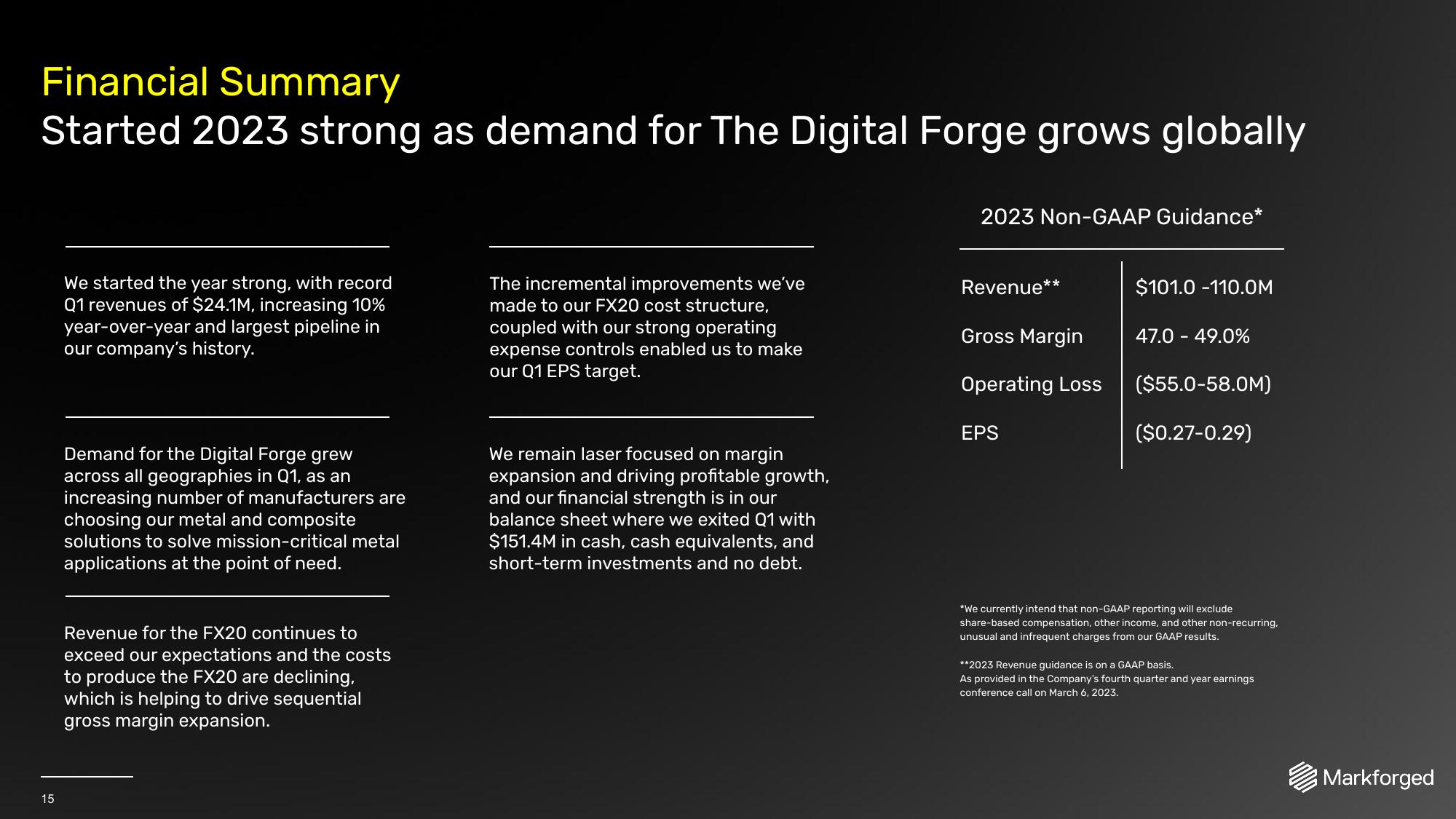

Started 2023 strong as demand for The Digital Forge grows globally

15

We started the year strong, with record

Q1 revenues of $24.1M, increasing 10%

year-over-year and largest pipeline in

our company's history.

Demand for the Digital Forge grew

across all geographies in Q1, as an

increasing number of manufacturers are

choosing our metal and composite

solutions to solve mission-critical metal

applications at the point of need.

Revenue for the FX20 continues to

exceed our expectations and the costs

to produce the FX20 are declining,

which is helping to drive sequential

gross margin expansion.

The incremental improvements we've

made to our FX20 cost structure,

coupled with our strong operating

expense controls enabled us to make

our Q1 EPS target.

We remain laser focused on margin

expansion and driving profitable growth,

and our financial strength is in our

balance sheet where we exited 01 with

$151.4M in cash, cash equivalents, and

short-term investments and no debt.

2023 Non-GAAP Guidance*

Revenue**

Gross Margin

Operating Loss

EPS

$101.0 -110.0M

47.0 - 49.0%

($55.0-58.0M)

($0.27-0.29)

*We currently intend that non-GAAP reporting will exclude

share-based compensation, other income, and other non-recurring.

unusual and infrequent charges from our GAAP results.

**2023 Revenue guidance is on a GAAP basis.

As provided in the Company's fourth quarter and year earnings

conference call on March 6, 2023.

MarkforgedView entire presentation