Evercore Investment Banking Pitch Book

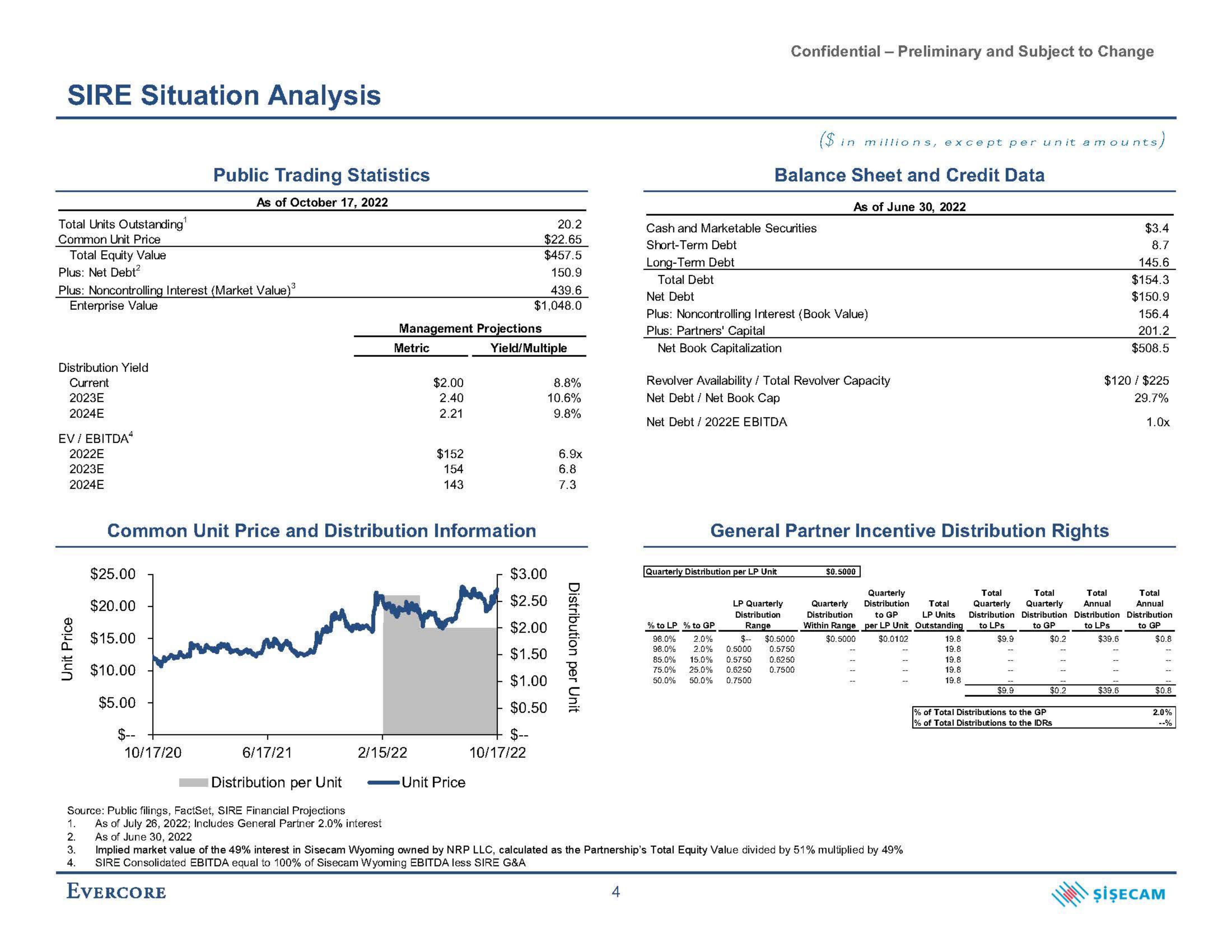

SIRE Situation Analysis

Total Units Outstanding

Common Unit Price

Total Equity Value

Plus: Net Debt²

Plus: Noncontrolling Interest (Market Value)³

Enterprise Value

Distribution Yield

Current

2023E

2024E

EV/EBITDA*

2022E

2023E

2024E

Unit Price

Public Trading Statistics

As of October 17, 2022

$25.00

$20.00

$15.00

$10.00

$5.00

2.

3.

4.

10/17/20

6/17/21

Distribution per Unit

Source: Public filings, FactSet, SIRE Financial Projections

1. As of July 26, 2022; Includes General Partner 2.0% interest

Management Projections

Metric

Common Unit Price and Distribution Information

2/15/22

$2.00

2.40

2.21

$152

154

143

20.2

$22.65

$457.5

150.9

439.6

$1,048.0

Unit Price

Yield/Multiple

8.8%

10.6%

9.8%

$3.00

$2.50

$2.00

$1.50

$1.00

$0.50

$--

10/17/22

6.9x

6.8

7.3

Distribution per Unit

4

Cash and Marketable Securities

Short-Term Debt

Long-Term Debt

Total Debt

Confidential - Preliminary and Subject to Change

Balance Sheet and Credit Data

Net Debt

Plus: Noncontrolling Interest (Book Value)

Plus: Partners' Capital

Net Book Capitalization

Quarterly Distribution per LP Unit

($ in millions, except per unit amounts,

Revolver Availability / Total Revolver Capacity

Net Debt Net Book Cap

Net Debt 2022E EBITDA

LP Quarterly

Distribution

Range

$--

2.0% 0.5000

15.0% 0.5750

75.0% 25.0% 0.6250

50.0% 50.0% 0.7500

% to LP % to GP

98.0% 2.0%

98.0%

85.0%

As of June 30, 2022

General Partner Incentive Distribution Rights

$0.5000

0.5750

0.6250

0.7500

$0.5000

As of June 30, 2022

Implied market value of the 49% interest in Sisecam Wyoming owned by NRP LLC, calculated as the Partnership's Total Equity Value divided by 51% multiplied by 49%

SIRE Consolidated EBITDA equal to 100% of Sisecam Wyoming EBITDA less SIRE G&A

EVERCORE

Quarterly

Quarterly Distribution Total

Distribution to GP LP Units

Within Range per LP Unit Outstanding

$0.5000 $0.0102

19.8

19.8

19.8

19.8

19.8

$9.9

Total

Total

Total

Total

Quarterly Quarterly Annual Annual

Distribution Distribution Distribution Distribution

to LPs

to GP

to LPs

to GP

$9.9

$0.2

$39.6

$0.8

$0.2

$120 $225

29.7%

1.0x

% of Total Distributions to the GP

% of Total Distributions to the IDRS

$3.4

8.7

145.6

$154.3

$150.9

156.4

201.2

$508.5

$39.6

$0.8

2.0%

ŞİŞECAMView entire presentation