Blackwells Capital Activist Presentation Deck

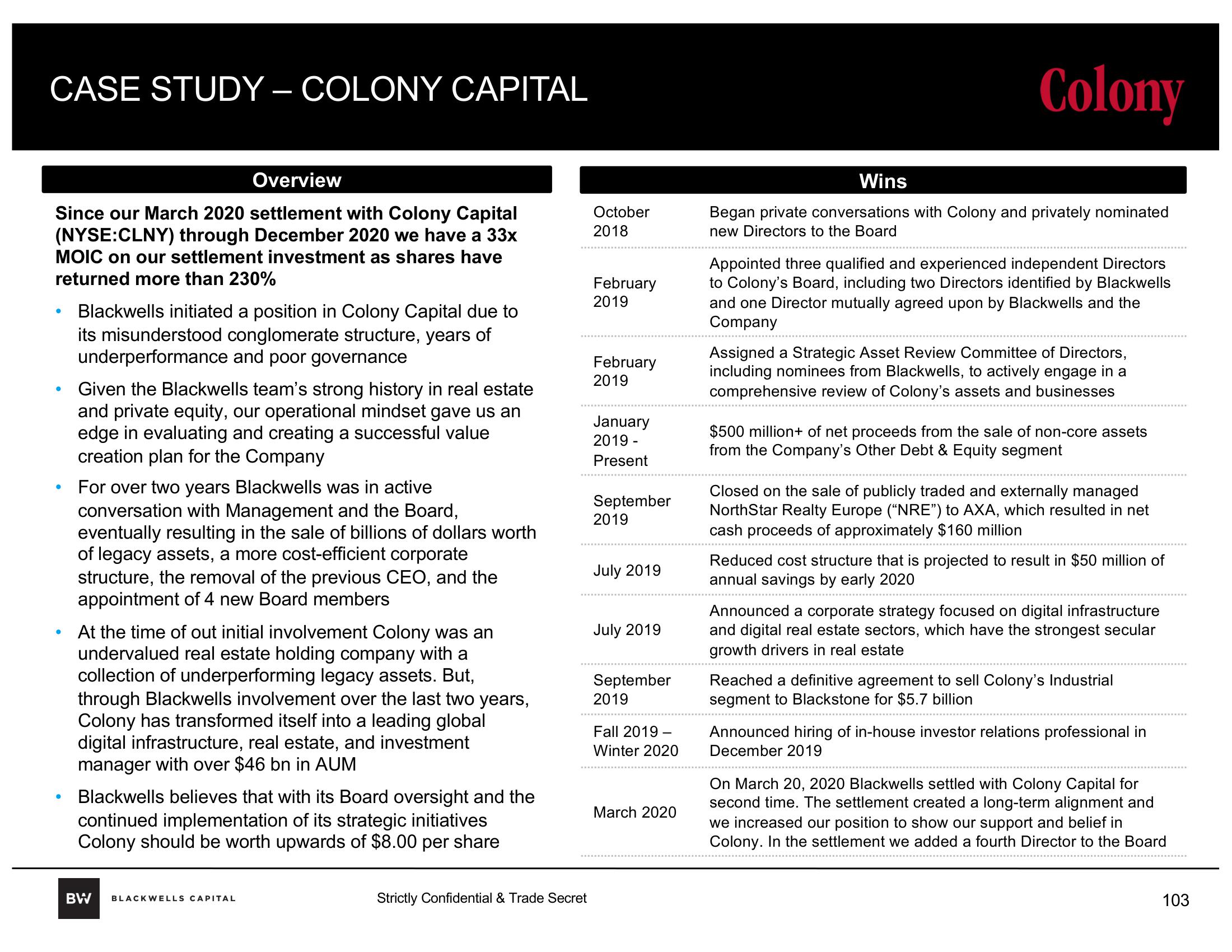

CASE STUDY - COLONY CAPITAL

Overview

Since our March 2020 settlement with Colony Capital

(NYSE:CLNY) through December 2020 we have a 33x

MOIC on our settlement investment as shares have

returned more than 230%

Blackwells initiated a position in Colony Capital due to

its misunderstood conglomerate structure, years of

underperformance and poor governance

Given the Blackwells team's strong history in real estate

and private equity, our operational mindset gave us an

edge in evaluating and creating a successful value

creation plan for the Company

For over two years Blackwells was in active

conversation with Management and the Board,

eventually resulting in the sale of billions of dollars worth

of legacy assets, a more cost-efficient corporate

structure, the removal of the previous CEO, and the

appointment of 4 new Board members

At the time of out initial involvement Colony was an

undervalued real estate holding company with a

collection of underperforming legacy assets. But,

through Blackwells involvement over the last two years,

Colony has transformed itself into a leading global

digital infrastructure, real estate, and investment

manager with over $46 bn in AUM

Blackwells believes that with its Board oversight and the

continued implementation of its strategic initiatives

Colony should be worth upwards of $8.00 per share

BW BLACKWELLS CAPITAL

Strictly Confidential & Trade Secret

October

2018

February

2019

February

2019

January

2019 -

Present

September

2019

July 2019

July 2019

September

2019

Fall 2019-

Winter 2020

March 2020

Colony

Wins

Began private conversations with Colony and privately nominated

new Directors to the Board

Appointed three qualified and experienced independent Directors

to Colony's Board, including two Directors identified by Blackwells

and one Director mutually agreed upon by Blackwells and the

Company

Assigned a Strategic Asset Review Committee of Directors,

including nominees from Blackwells, to actively engage in a

comprehensive review of Colony's assets and businesses

$500 million+ of net proceeds from the sale of non-core assets

from the Company's Other Debt & Equity segment

Closed on the sale of publicly traded and externally managed

NorthStar Realty Europe ("NRE") to AXA, which resulted in net

cash proceeds of approximately $160 million

Reduced cost structure that is projected to result in $50 million of

annual savings by early 2020

Announced a corporate strategy focused on digital infrastructure

and digital real estate sectors, which have the strongest secular

growth drivers in real estate

Reached a definitive agreement to sell Colony's Industrial

segment to Blackstone for $5.7 billion

Announced hiring of in-house investor relations professional in

December 2019

On March 20, 2020 Blackwells settled with Colony Capital for

second time. The settlement created a long-term alignment and

we increased our position to show our support and belief in

Colony. In the settlement we added a fourth Director to the Board

103View entire presentation