Bright Machines SPAC

Revenue Growth

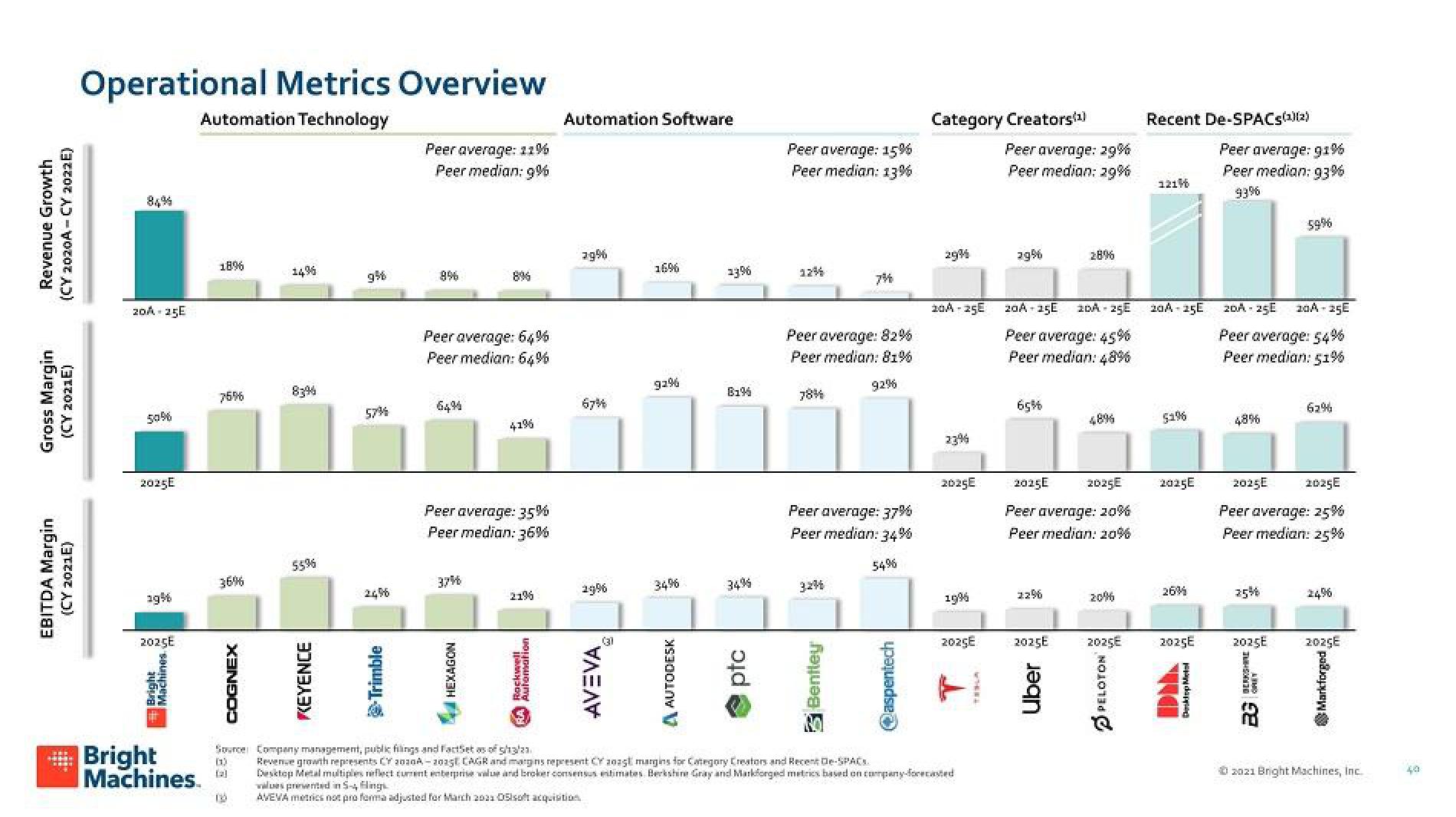

(CY 2020A-CY 2022E)

Gross Margin

(CY 2021E)

EBITDA Margin

(CY 2021E)

Operational Metrics Overview

Automation Technology

20A 25E

50%

2025E

ag%

2025E

Bright

Machines.

Bright

Machines

18%

75%

36%

COGNEX

14%

(1)

(2)

83%

55%

KEYENCE

57%

24%

Trimble

Peer average: 11%

Peer median: 9%

8%

Peer average: 64%

Peer median: 64%

64%

Peer average: 35%

Peer median: 36%

37%

41%

HEXAGON

21%

RA Rockwell on

Automation Software

29%

2996

AVEVA

(31

16%

92%

3496

A AUTODESK

1396

B1%

34%

ptc

Peer average: 15%

Peer median: 13%

12%

Peer average: 82%

Peer median: 81%

92%

78%

7%

Peer average: 37%

Peer median: 34%

54%

32%

3 Bentley

@aspentech

Category Creators(¹)

29%

20A-25E

2025E

19%

2025E

Source Company management, public filings and FactSet as of 5/3/2

Revenue growth represents CY 2020A-2025E CAGR and margins represent CY 20a5l margins for Category Creators and Recent De-SPAC

Desktop Metal multiples reflect current enterprise value and broker consensus estimates Berkshire Gray and Markforged metrics based on company-forecasted

values presented in 5-4 flingi

AVEVA metrics not pro forma adjusted for March 2023 05isoft acquisition

TESLA

Peer average: 29%

Peer median: 29%

29%

20A-25E 20A-25E

Peer average: 45%

Peer median: 48%

65%

22%

2896

2025E 2025E

Peer average: 20%

Peer median: 20%

2025E

Uber

48%

20%

2025E

PELOTON

Recent De-SPACS(¹)(2)

1216

20A-25E

51%

2025E

26%

2025E

Peer average: 91%

Peer median: 93%

93%

20A-25E 20A-25E

Peer average: 54%

Peer median: 51%

48%

25%

59%

2025E

2025E

Peer average: 25%

Peer median: 25%

2025E

BG

62%

2025E

Markforged

Ⓒ2021 Bright Machines, Inc.

40View entire presentation