Netstreit IPO Presentation Deck

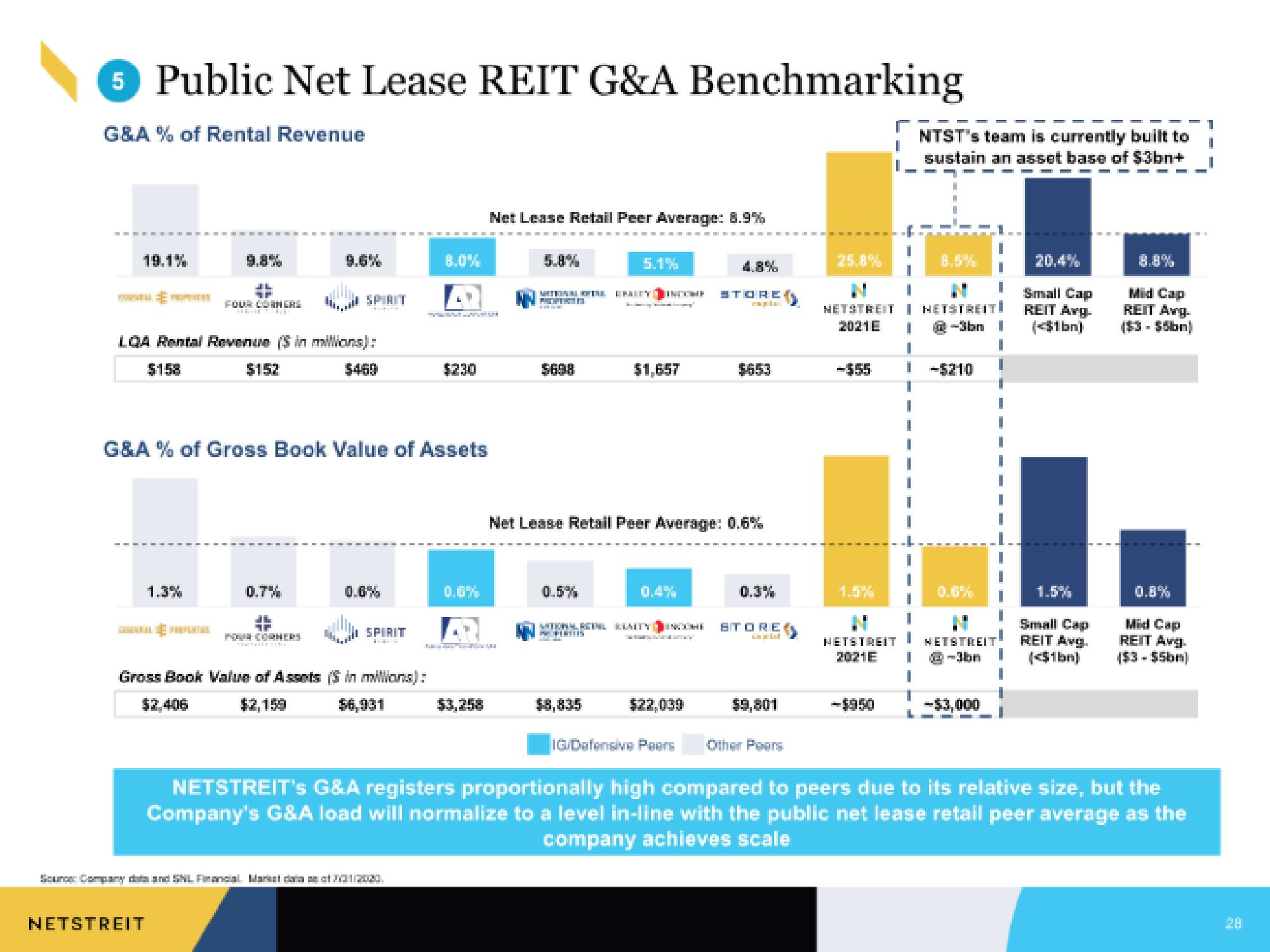

5 Public Net Lease REIT G&A Benchmarking

G&A % of Rental Revenue

19.1%

JL

FOUR CORNERS

TECH STET

LQA Rental Revenue (Sin millions):

$158

$152

$469

1.3%

NETSTREIT

SPIRIT

G&A % of Gross Book Value of Assets

0.7%

EF

FOUR CORNERS

Toalerine

0.6%

SPIRIT

Gross Book Value of Assets (S in mans):

$2,406

$2,159

$6,931

Sour Company data and SNL Financial Market dana 2011(22020.

ALER

$230

0.6%

A

Net Lease Retail Peer Average: 8.9%

$3,258

$698

MTGADE OF KIL ERSITY INETHE STORE

HATIKAN

5.1%

0.5%

$1,657

$8,835

4.8%

Net Lease Retail Peer Average: 0.6%

$653

$22,039

NATIONAL RETNL KLAITY INCOME STORE

PROPERTIES

0.3%

$9,801

IG/Defensive Peers Other Pears

25.8%

NETSTREIT | NETSTREIT!

2021E | @-3bn 1

I

-$55

1.5%

NTST's team is currently built to

sustain an asset base of $3bn+

-$950

I

i -$210

0.6%

NETSTREIT NETSTREIT

2021E I @-3bn

I

-$3,000

Small Cap

REIT Avg-

(<$1bn)

1.5%

Small Cap

REIT Avg.

(<$1bn)

Mid Cap

REIT Avg-

0.8%

Mid Cap

REIT Avg.

($3-$5bm)

NETSTREIT's G&A registers proportionally high compared to peers due to its relative size, but the

Company's G&A load will normalize to a level in-line with the public net lease retail peer average as the

company achieves scaleView entire presentation