Solar Industry Update

Executive Summary

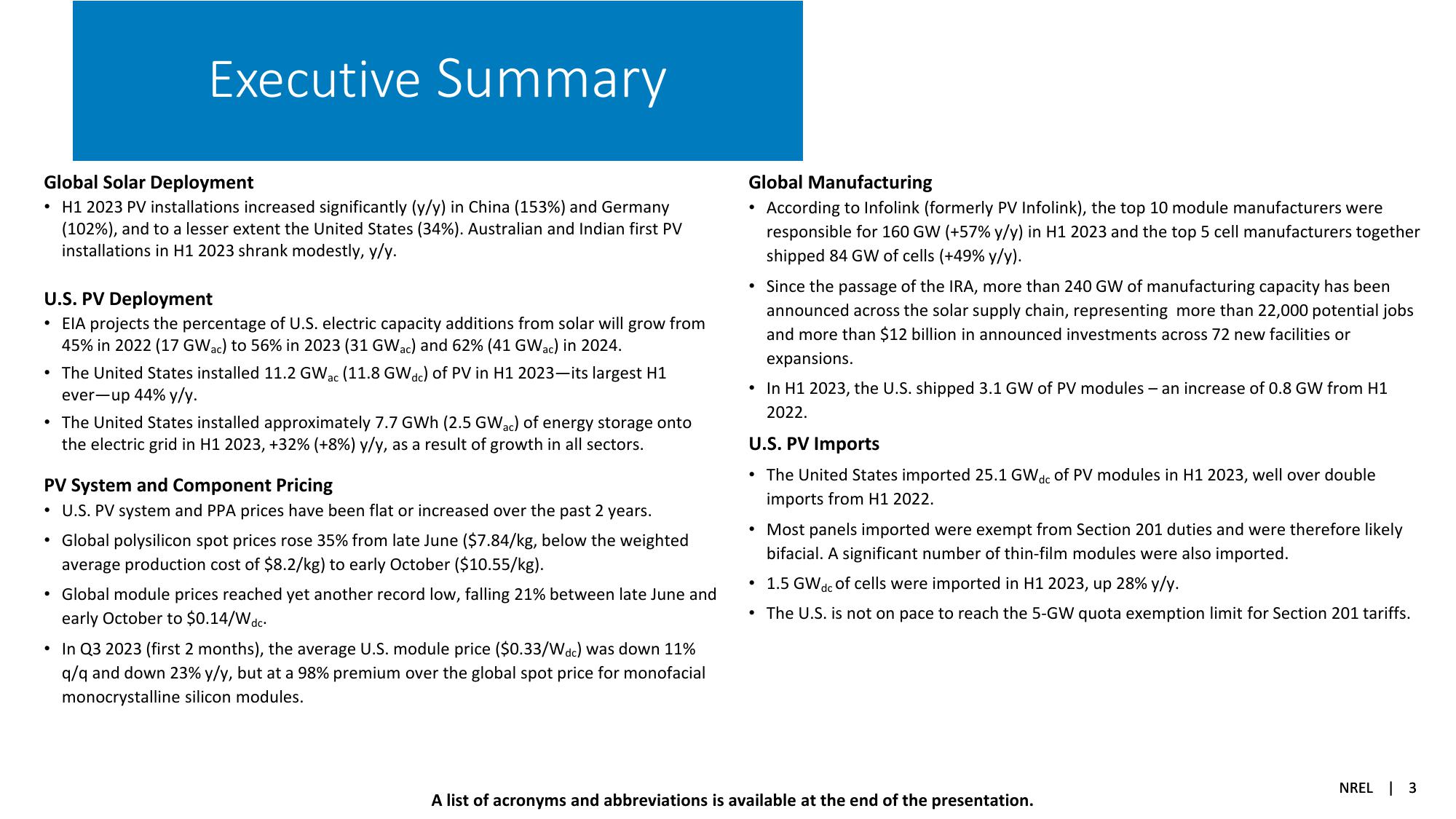

Global Solar Deployment

H1 2023 PV installations increased significantly (y/y) in China (153%) and Germany

(102%), and to a lesser extent the United States (34%). Australian and Indian first PV

installations in H1 2023 shrank modestly, y/y.

U.S. PV Deployment

EIA projects the percentage of U.S. electric capacity additions from solar will grow from

45% in 2022 (17 GWac) to 56% in 2023 (31 GWac) and 62% (41 GWac) in 2024.

• The United States installed 11.2 GWac (11.8 GWdc) of PV in H1 2023-its largest H1

ever-up 44% y/y.

⚫ The United States installed approximately 7.7 GWh (2.5 GW ac) of energy storage onto

the electric grid in H1 2023, +32% (+8%) y/y, as a result of growth in all sectors.

PV System and Component Pricing

• U.S. PV system and PPA prices have been flat or increased over the past 2 years.

.

Global polysilicon spot prices rose 35% from late June ($7.84/kg, below the weighted

average production cost of $8.2/kg) to early October ($10.55/kg).

• Global module prices reached yet another record low, falling 21% between late June and

early October to $0.14/Wdc.

⚫ In Q3 2023 (first 2 months), the average U.S. module price ($0.33/Wdc) was down 11%

q/q and down 23% y/y, but at a 98% premium over the global spot price for monofacial

monocrystalline silicon modules.

Global Manufacturing

According to Infolink (formerly PV Infolink), the top 10 module manufacturers were

responsible for 160 GW (+57% y/y) in H1 2023 and the top 5 cell manufacturers together

shipped 84 GW of cells (+49% y/y).

• Since the passage of the IRA, more than 240 GW of manufacturing capacity has been

announced across the solar supply chain, representing more than 22,000 potential jobs

and more than $12 billion in announced investments across 72 new facilities or

expansions.

• In H1 2023, the U.S. shipped 3.1 GW of PV modules - an increase of 0.8 GW from H1

2022.

U.S. PV Imports

• The United States imported 25.1 GWdc of PV modules in H1 2023, well over double

imports from H1 2022.

• Most panels imported were exempt from Section 201 duties and were therefore likely

bifacial. A significant number of thin-film modules were also imported.

⚫ 1.5 GW dc of cells were imported in H1 2023, up 28% y/y.

• The U.S. is not on pace to reach the 5-GW quota exemption limit for Section 201 tariffs.

A list of acronyms and abbreviations is available at the end of the presentation.

NREL 3View entire presentation